“There is a transition from an electricity grid, to a network,” explained Sam Wilkinson, Associate Director for Solar and Energy Storage at IHS Markit, from the stage at the SNEC Conference in Shanghai earlier this year. He noted that the transition from a unidirectional to a bi-directional grid, with generation assets dispersed throughout the network, would require a fundamental change in the electricity system. One in which IT, self learning algorithms, and high-speed communication, computational, and analytical tools will be both an enabler and a driver. And what’s more, it’s not just at the grid level that this paradigm-shifting trend can be seen. “There is a huge amount of intelligence being added to solar,” continued Wilkinson – in everything from AC modules and smart modules through to tracker systems. And that’s even before string inverters and battery storage get involved.

Digitalization has been a buzzword within PV for some years, but in many ways 2018 is shaping up to be the year in which it truly comes of age. While China may be considered by some as not representing the cutting edge of PV, but rather the mass production end of the market, at SNEC 2018 digitalization and its effects, and the Internet of things (IoT) in particular, were an unavoidable and high-profile addition to proceedings. Jifan Gao, Trina Solar’s Chairperson and CEO since 1998, also took up the baton for the impacts and opportunities presented by the digital world in his 2018 SNEC address. Heralding “smart solar” as the pathway down which his company will travel. TrinaIOT was the badge given by Gao to the data collection, processing, and control services that will span right across the solar downstream ecosystem – from power production, to storage, distribution, and sales. Software, hardware, and cloud-based services were coupled into the TrinaIOT platform, that sits alongside the TrinaPro optimized utility-scale PV offering.

Not all new under the sun

While software solutions in the solar realm are buzzing today, there have been very early adopters in the field. Valentin Software was founded 30 years ago and introduced its PV*Sol software 20 years ago. “At this time, nobody thought that PV would play a very big role [in the energy system],” explains Steffen Lindemann, the Managing Director at the solar design company. PV*Sol is claimed to be a highly accurate small and medium-sized PV design software, incorporating a wide range of suppliers into its sophisticated power output model. The platform is also widely adopted in educational contexts, as students can learn the effects of shading and system faults in a highly detailed manner, to discover patterns that are typical for these type of events.

Two decades down the road after PV*Sol’s introduction, and technological development has not gone unnoticed at Valentin Software. Granularity in terms of its output modeling has gone from hours to minutes, to increase accuracy of the analysis. To move to seconds is possible, says Lindemann, although the value of such a high level of detail is not yet immediately apparent. Additionally, 3D capabilities have been added to the PV*Sol platform, to track shading effects on the system. But with all the development and higher granularity, Lindemann also explains that user-friendliness is paramount, and that technology has to orient itself to what the customers need and are willing to use.

Another important chapter for Valentin Software is the load and energy yield data, as these can provide crucial insights that are necessary for grid integration. “For example, we currently have a project in Turkey and the main goal is to investigate how PV energy can be best integrated into grids. Our software provides some aspects of that in terms of energy yields. We conducted training for universities there and they were very interested to see how a PV plant behaves on the grid – without actually building the plant itself,” Lindemann explains.

Increased complexity

The solar offering itself has become more complex, as the product and technologies have evolved. Bifacial technology, another of 2018’s hot trends, presents an example of how this can provide a challenge to software and digital service providers. The additional complexity that bifacial technology introduces when modeling the expected power output from a PV power plant has proven a tricky challenge to the leading providers of software providers such as PVsyst.

The complexity comes primarily from the variation in ground albedo or reflectivity – the major determining factor in the level of rear-side energy production from a bifacial PV plant. This is further complicated with the addition of trackers, with the level of complexity proving too much for PVsyst’s developers – and external experts from labs such as NREL – at least at this stage.

Without power output modeling that can be relied on by investors, trackers and bifacial technology will prove difficult to finance. Investors are necessarily hesitant to put their money behind a project in which output is uncertain. However, with numerous projects underway in many parts of the world, it is likely this modeling challenge will be overcome. But it speaks to the fundamental importance of some of the digital tools in the PV and wider energy sector today.

Utility activity

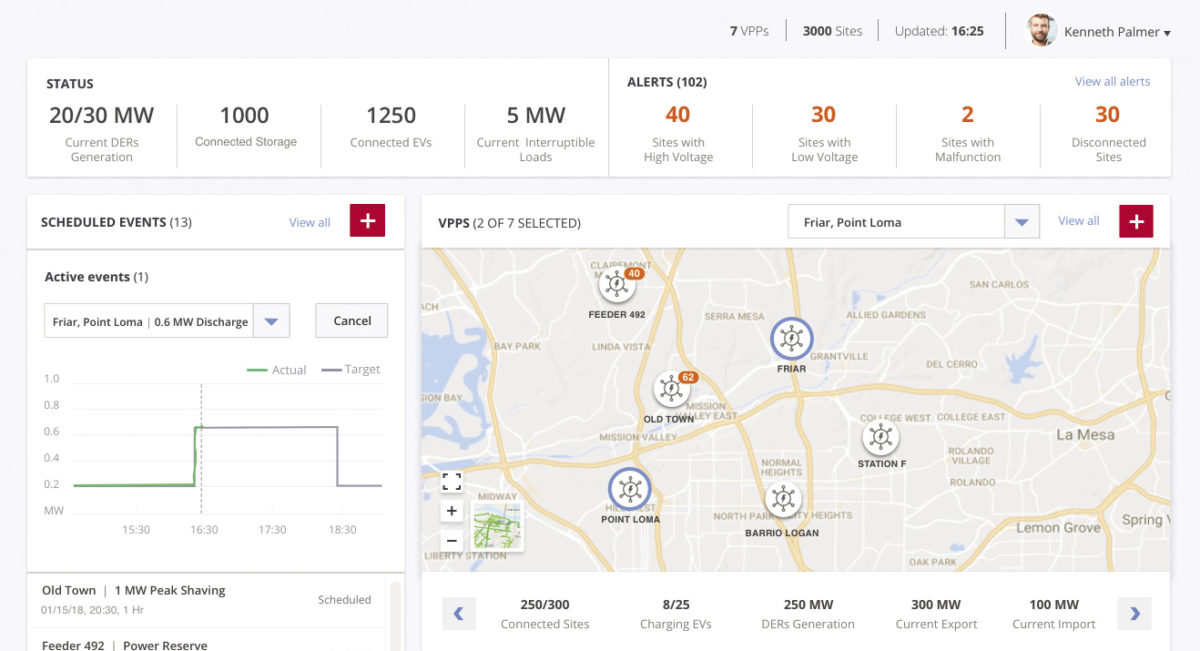

The utility business is increasingly transforming into a software-enabled service platform, where customers are finding all sorts of products, starting with the design of a solar rooftop, virtual power plant, and energy trading offerings, as well as digital O&M tools, right through to energy management of buildings and smart grid operations. Behind all these services stands either the paradigm to reduce costs or create new revenue streams as the traditional ones slowly decline.

The key word here is ‘beyond the meter,’ as electricity companies used to call their customers’ ‘meter points.’ We see this paradigm shift whereby the delivery of energy is just one piece of the utility portfolio. Moreover, many of the services that power companies now offer let customers interact with their electricity production and consumption.

German utility spin-off innogy recently announced that it is working on developing an IoT ecosystem that allows customers to optimize energy consumption as needed. The utility seeks partners to build on the digital interface that allows customers to connect their appliances and devices to the IoT system provided by innogy. Voice-activated home assistants such as Amazon’s Echo or Google Home are actively integrated into a household’s home energy system, with the utility as the enabler of this software solution. That electric vehicle (EV) adoption could be a revenue stream for a utility might have been unthinkable a few years back, but through the value of big data collection and processing, utilities are also finding ways to capitalize on e-mobility. Innogy recently unveiled a software platform that allows it to make predictions on the use of EVs in a region.

The solution serves a dual purpose: The growing number of EVs could potentially prompt a challenge to grid operators as additional loads have to be managed, in all likelihood, through grid expansion. But rather than using the scattergun approach to indiscriminately make these grid infrastructure adjustments, innogy says it can make predictions on the number of EVs a specific postal code is likely to acquire. Based on this information distribution, grid operators can make infrastructure adjustments in a targeted, and more cost- effective, way.

Dutch grid operator Alliander provides a similar service through its Andes solution. The Andes platform sources socio- economic data and integrates them into comprehensive models for future consumption and distributed generation models, giving grid operators the possibility to provide a bespoke distribution grid upgrade, minimizing the cost of the asset to what is necessary.

Enabling the end user

End users too are having their experience and participation in the electricity sector enhanced through software solutions. And solar+storage lies at the heart of this movement. Gone are the days when the entire interaction with electricity consisted of switching lights on and off. Today, buying a solar+storage system almost inevitably comes with an app that lets customers monitor the system’s performance in real time and track monthly performance and how much value has been generated. SolarEdge and GoodWe are just two of many examples of power electronics manufacturers delivering their products in combination with system monitoring apps.

Electrical storage systems today are also software-laden pieces of equipment. Son- nen, Moixa, and Senec solar batteries process data to optimize self-consumption and revenue generation for the owner. Moixa for example, says its system would buy electricity at off-peak tariffs, and store it for later consumption, to avoid more expensive peak-tariff energy. Aside from economic benefits for the end customer, this of course also enables a form of peak-shaving that if performed at scale could add to grid resilience.

Don’t forget the blockchain

Blockchain-based energy trading platforms are emerging in some markets. While blockchain-based cryptocurrencies have long entertained newspaper tech columns, last year banks did not seem too keen on the idea. Blockchain-based energy trading, on the other hand, does not force independent power producers and utilities out of the market – rather E.on, Enel, innogy, and TEPCO are all using the technology now.

Peer-to-peer energy trading will evolve in step with regulatory frameworks, but example use cases and pilot programs are becoming more common. The reason for these reduced headwinds might be that, like so many other digital tools, peer-to-peer energy trading could pay off as an advantage for grid operators. Trading excess energy with other consumers could reduce the need for large-scale transmission and make use of existing assets, rather than making them redundant as the prospect of grid defection would.

Solar has come to capitalize on the various opportunities digital technology presents – in step with many other sectors. Utilities too are awake to the power and value creation potential of digital solutions to existing and emerging challenges – as all the while the value of the data being harvested in the process increases. Research and accountancy firm BDO released a report in November 2017 stipulating that the global market for data analytics in the energy sector increased more than tenfold in just one year. Reportedly, the market had a size of around $500 million by the beginning of 2017 and reached over $3.5 billion by Q2 of the same year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.