Taiwan’s new government, elected in 2016, has been actively promoting the development of new energy, with the aim of phasing out nuclear energy in 2025, and increasing the share of renewable energy to 20%.

By then, PV project capacity will need to reach 20 GW, while offshore wind power should reach 5.5 GW. However, by mid-2018, just 11.2% and 0.1% of these goals had been met, respectively. As such, there is a way to go if they are to be achieved in the next seven and a half years.

By then, PV project capacity will need to reach 20 GW, while offshore wind power should reach 5.5 GW. However, by mid-2018, just 11.2% and 0.1% of these goals had been met, respectively. As such, there is a way to go if they are to be achieved in the next seven and a half years.

Path to clean energy

To boost development, the government has introduced a number of measures, including releasing land for PV projects, and introducing new policies. Under these changes, Taiwan’s grid-connected PV capacity grew by 470 MW in the first half of 2018 – a new record high – thus taking cumulative capacity to 2.24 GW.

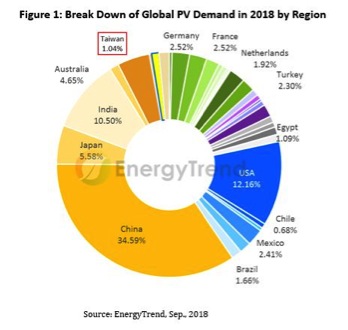

Further ground-mounted power plants have also been developed since then, and total 2018 demand is now expected to reach between 820 and 950 MW. This will represent a share of over 1% in the global PV market, for the first time.

However, if Taiwan’s 20 GW PV target is to be achieved by 2025, it needs to expand domestic PV demand at a CAGR of 303% between 2018 and 2025. This means, between 2018 and 2025, it must add 18 GW of new PV capacity.

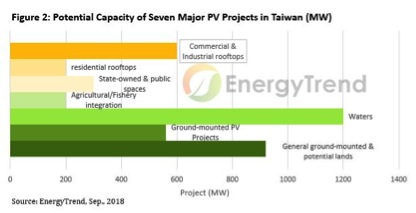

Building ground-mounted power plants is the key to increasing capacity; however, current land resources suitable for ground-mounted power plants are all remote areas with no power grids or transmission lines.

To improve the situation, the government released 2,385 hectares of subsided farmland in 2015 and 2017 for the development of PV projects (see figure 2), and has passed the planning and building of power grids and transmission lines to the Taiwan Power Company. This year, meanwhile, it has made land available for projects with a total capacity of 3.98 GW.

To improve the situation, the government released 2,385 hectares of subsided farmland in 2015 and 2017 for the development of PV projects (see figure 2), and has passed the planning and building of power grids and transmission lines to the Taiwan Power Company. This year, meanwhile, it has made land available for projects with a total capacity of 3.98 GW.

However, considering the current available land resources, just 6.2 GW will be reached by 2020, in the best case scenario, which is short of its mid-term goal of 6.5 GW. Floating PV systems could contribute another 1.2 GW of capacity.

In addition to releasing land, the government devised the “Solar PV Two-year Promotion Plan”. It aimed to increase grid-connected PV capacity by 1.52 GW between July 2016 and June 2018, however, just 1.3 GW of capacity was added.

Taiwan also applies Feed-in Tariffs (FITs). While FIT prices have been decreasing since 2010, the government began granting a 15% FIT bonus for PV projects located in northern Taiwan, and a 6% bonus for projects using high efficiency modules recognized by VPC in 2016. Meanwhile, FIT rates for floating PV systems were introduced in 2017.

Although the Taiwan Government has been actively promoting the development of new energy with supportive policies, shortage of land remains the key obstacle. Indeed, the land released so far by the government is not enough to fulfill the goal of 20 GW of cumulative by 2025. The support of the public – in terms of land use, as well as the planning of transmission lines and the power grid – will thus play a decisive role in Taiwan’s energy transformation.

Domestic manufacturing

Taiwan is the second largest PV cell maker in the world, but has limited capacity for PV module production.

However, as domestic demand increases, many companies have entered module manufacturing, including Taiwan-based Neo Solar Power, Gintech and Solartech Energy (note these three will be merged into URE soon), TSMMC (a joint venture of Motech and Gigasolar), as well as international manufacturer, Canadian Solar, which took over Inventec’s module factory.

However, as domestic demand increases, many companies have entered module manufacturing, including Taiwan-based Neo Solar Power, Gintech and Solartech Energy (note these three will be merged into URE soon), TSMMC (a joint venture of Motech and Gigasolar), as well as international manufacturer, Canadian Solar, which took over Inventec’s module factory.

For the Taiwan-based companies, which have been greatly influenced by the fierce competition with Chinese companies, there is now a chance to reform.

The former will greatly rely on domestic demand, especially in the initial stage of their businesses. These companies will need to establish themselves in the local PV industry, before they could enter the global market.

EnergyTrend, solar energy division of TrendForce, covers multiple green energy research sectors, including solar energy, consumer/power lithium batteries, and electric cars. Our photovoltaic market intelligence services include solar price updates, market trend reports, and comprehensive analysis of subsidy policies around the globe that lead to precise market installation demand forecasts. To learn more, please visit www.energytrend.com

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.