It is difficult to be a leader. Of all the companies in the solar industry, Enphase has had one of the most challenging paths to get to where it is today, and is still impressing the industry and observers with its innovation and technology.

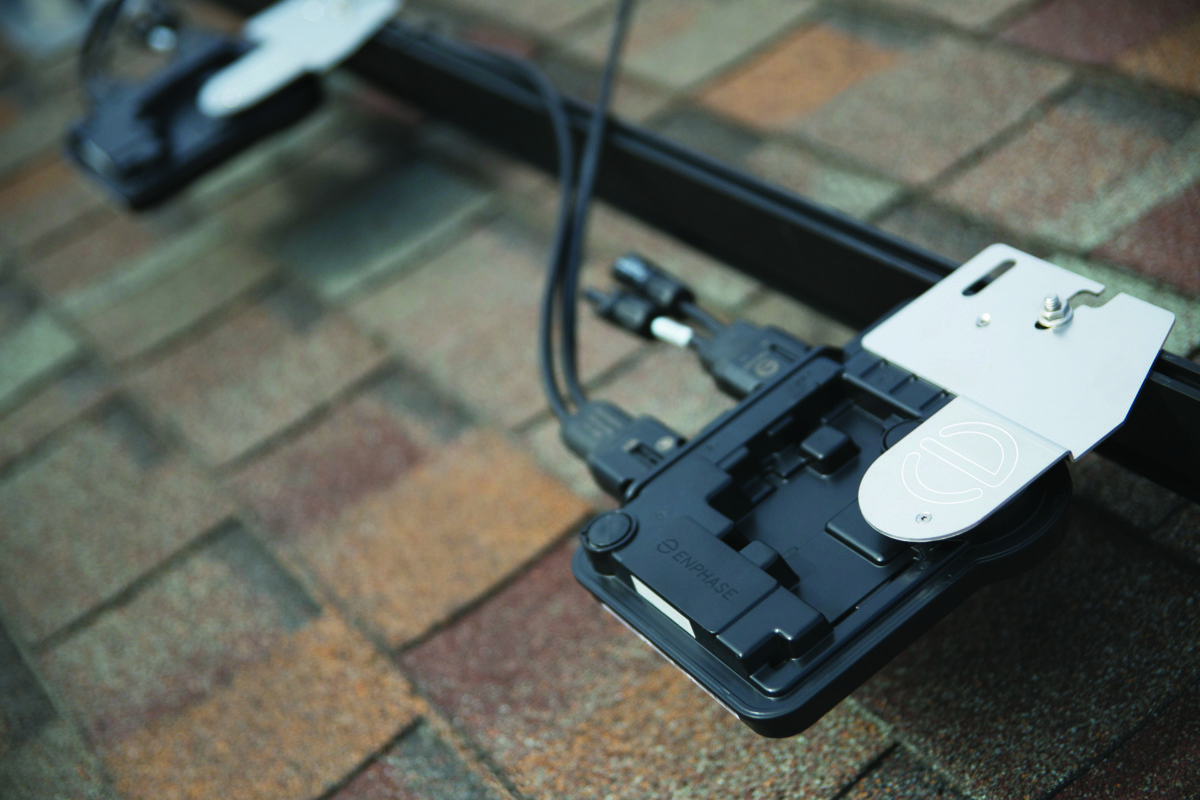

While Enphase’s microinverters have provided clear benefits to some rooftop solar installations and were widely deployed in the residential sector, for several years the company has struggled in this sector to compete with SolarEdge, whose products offered similar benefits at lower costs.

This existential threat led to a dramatic internal re-organization of the company, and over the past two years Enphase has swapped out executives, cut costs, slashed staff and reorganized its priorities, while still continuing to emphasize innovation.

The resulting turnaround has been nothing short of dramatic, and even before new CEO Badri Kothandaraman joined the company last fall, Enphase was working steadily back towards profitability. Operating margins have grown from their nadir at -40% in the first quarter of 2017 to -0.7% in the second quarter of 2018, with sequential increases in all but one quarter.

However, this sudden change has attracted detractors, including Louisiana-based short seller Prescience Point Capital Management, which a month ago accused the company of inflating its results by “manipulative and potentially improper” accounting practices.

Yesterday, Enphase attempted to put concerns to rest about its the company and its accounting, and additionally presented a wealth of information about its products at its Analyst Day. And while there were no obvious revelations presented about the company’s treatment of its quarterly results, following this Roth Capital has reiterated its “buy” position on the stock at $6.50 per share, well above what Enphase is trading at.

Much of what has wowed Roth and other observers is Enphase’s technology progress. The investment firm called the new IQ8 microinverter a “game changer”, stating that the company sees this product – which can enable a house-level microgrid – as potentially disruptive of the utility business model.

Roth also noted that it appreciates management’s financial strategy, most notably Chief Financial Officer Eric Branderiz’ mantra of “don’t run out of cash”. This strategy is certainly being actualized on, with Enphase pricing a $60 million private placement of bonds the day prior. This will further boost the $58.5 million that Enphase was sitting on at the end of Q2, which should put to rest concerns about liquidity.

And while the investment banking firm notes that only a modest amount of new information was released at the Analyst Day, it says that it expects more growth from the company as Enphase delivers on the promises made.

Enphase still faces headwinds from the latest round of proposed Section 301 tariffs, which includes inverters. The Trump Administration is considering raising these tariffs from 10% to 25%, which has clearly caused consternation at Enphase. On the call, CEO Kothandaraman complained that “I hear 10% of tariffs one day – I hear 25% of tariffs the other day.”

The result of this is that Enphase is seeking another contract manufacturer for its products outside of China. Roth expects this to lag the imposition of any tariffs by a few quarters, which could cause more short term pain to the struggling company.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.