Despite the lack of current renewables support in the U.K., two good news stories have emerged in the past week.

In an announcement today, energy tech company, Limejump says it has received approval from energy regulator, OFGEM to enter the balancing mechanism market with its virtual power plant (VPP), thus allowing both renewable and distributed energy generators to compete with the country’s major power players, in what it says is a £1 billion a year market, for the first time.

Limejump’s technology connects distributed storage or generation assets, such as batteries, solar and wind, using big data analytics, trading ability and machine learning, so they “act as if they were one large power station.”

According to the statement, “Connecting to a communication platform developed by Siemens, Limejump is able to provide National Grid with a single, flexible energy source that helps balance the energy system.”

Erik Nygard, CEO comments, “This move means that a farmer with a solar installation or a supermarket with excess energy from its cooling units will be on the same footing as a giant power station. Just as importantly, our move increases competition, enabling a cleaner, more sustainable energy future that benefits both the environment and the end consumer.”

Overall, Limejump says it manages a global battery portfolio totaling 150 MW and a “large amount” of renewables assets. The company could not be immediately reached for further details.

Capacity market review

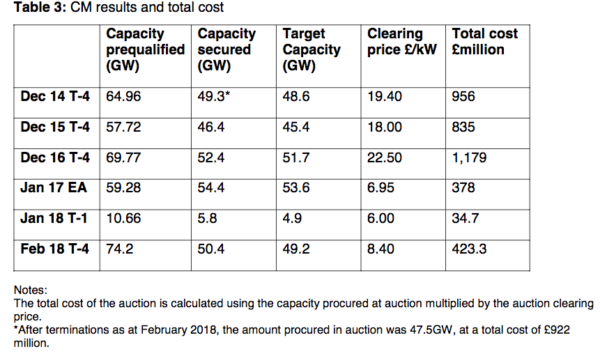

With its five year review of the capacity market (CM) due, the U.K. Government has issued a call for evidence on both the performance of the CM, and arising issues and opportunities. Previous feedback highlighted the need to consider subsidy-free renewables.

Introduced in the U.K. in 2014, as part of the Government’s Electricity Market Reform package, the CM is intended to ensure enough is invested in secure, cost effective electricity supplies, which complement the country’s decarbonization agenda.

Annual competitive auctions are held, either one, or four, years ahead of the delivery year, under which successful bidders are awarded agreements to either generate electricity at time of system stress, or to reduce demand (in the case of demand side response (DSR) providers). They are then paid a clearing price (£/kWh) for the capacity they have committed to providing.

As per the guidelines initially set out, the CM mechanism is reviewed every five years, in order to assess, among other issues, its relevance and new opportunities.

Image: UK Department for Business, Energy and Industrial Strategy

The next review is now open, with the government calling for evidence from stakeholders between August 8 and October 1. The conclusions will be included in a report, to be submitted to Parliament by next summer.

Based on previous stakeholder feedback, two key issues this consultation seeks to address are: whether and how subsidy-free renewables could be included; and changes to interconnector de-rating factors.

On the first point, the government writes, “As part of this, we will need to: look at how to de-rate these technologies; review whether the existing penalty regime is sufficient to address the risks of non-dispatchable technology and effectively encourage secondary trading, and; consider how to enable participation of hybrid capacity (e.g. renewables linked to storage).”

Out of a total of 36 questions posed in the consultation document, a number relate to renewables and storage. These include: How could we go about allowing augmentation of batteries?; Should wind and solar be allowed to participate in the Capacity Market? Why?; What factors need to be considered to enable renewables to participate in the Capacity Market whilst ensuring security of supply?; What factors need to be considered when developing the de-rating methodology for wind and solar?; and What lessons can be learnt from the participation of renewables in other overseas capacity markets?

According to a report issued by Aurora Energy Research, Capacity Market 2018: Results, implications and potential policy reforms, “Renewable generators could actively participate in the CM in the future, with well-designed policy changes reducing total CM payments by £600m between 2025 – 2035.”

Explaining why renewables, specifically solar and wind, have not been previously included, the government writes, “The CM’s eligibility framework does not currently provide a route for some types of renewable capacity, specifically wind and solar, to participate in the auctions. Up until recently it was expected that such technologies would already benefit from low-carbon support schemes such as Contracts for Difference (CfD) or the Renewables Obligation (RO) and so be excluded from the CM. Moreover, until recent evidence which may suggest the contrary, it was considered that solar was not capable of providing any contribution to security of supply.”

It continues, “However, the costs of new wind and solar have fallen more quickly than anticipated, and we understand that a limited number of new on-shore wind and solar projects are reaching the point where they may soon be viable without subsidy. Ofgem received three formal requests from industry to change the CM framework to allow participation in future auctions.”

It goes on, very cautiously, to say that there is a case for wind and “potentially” solar to be included in the auctions, although they raise unique challenges that must be addressed. The questions above, seek solutions to these.

Subsidy-free

The U.K. has notoriously withdrawn what was once strong support for renewables in recent years, going so far as to ignore it in many of its budget announcements.

Last month, meanwhile, it floated the idea of closing both generation and export tariffs for renewables on March 31, 2019, and days later, announced the nation’s first shale-gas fracking licence, prompting outrage from various green energy stakeholders.

Despite the lack of support, however, 2017 saw the U.K. take a marked step forward towards renewables and away from coal and gas. In the Digest of United Kingdom Energy Statistics 2018, the government document showed that while fossil fuels were still clearly the leading source of electricity generation in the country last year, at 80.1%, their grip is loosening, with renewables increasingly picking up the slack.

Meanwhile, last September, Anesco completed the U.K.’s first subsidy-free solar PV project, the 10 MW Clayhill Solar Farm, which is co-located with a 6 MW battery storage unit.

Many believe there is a long path to tread, however, before subsidy-free solar is a reality on the island.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.