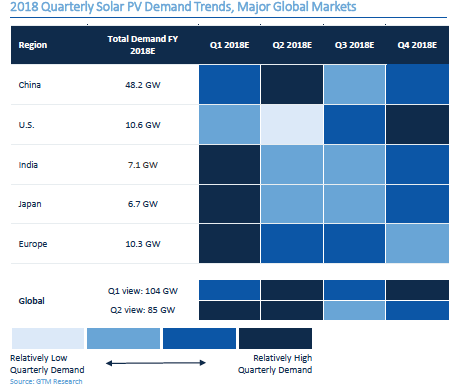

In line with other analysts, GTM Research states that China’s PV policy changes, announced at the end of May, will “severely impact” global PV demand in the short term, although a rebound is expected in Q4 and 2019.

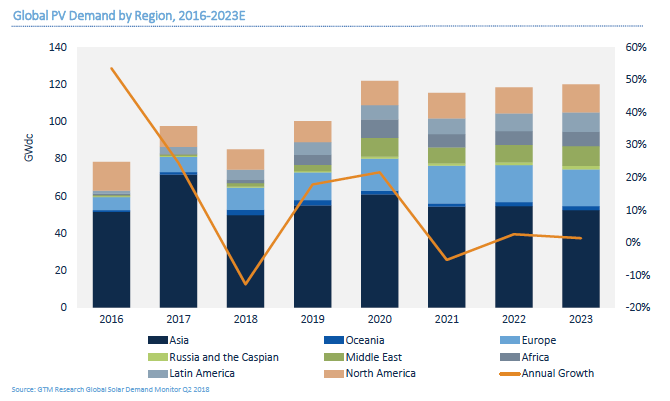

Overall, it sees global demand in 2018 falling to 85.2 GW of new installs versus its previous prediction of 103.5 GW, and down from the just under 100 GW installed in 2017. By 2020, this should have again grown, to reach a record >120 GW.

This compares to TrendForce, which in June said it expects to see global installs of 92-95 GW this year; IHS Markit, which revised its expectations down from 113 GW to 105 GW; and SolarPower Europe, which expects to see 102 rather than 107 GW this year. It must be noted, however, that the latter two have not released updated figures since China’s policy changes.

While Q3 2018 is set to experience the lowest PV demand globally since 2015, Q4 will record an uptick, continues GTM Research, as China begins to recover, and the U.S. achieves the highest quarterly installations of the year.

In North America and Europe, it continues, “relatively stable” demand is anticipated, with growth of 16% and 12%, respectively, this year.

Looking more closely at Europe, the analysts say the market is strengthening, due to efforts to reach its 2020 EU energy targets and the new aim of securing 32% renewable energy supply by 2030. “… in a lower module price environment, more markets are likely to reach the tipping point where the economics of unsubsidized PV make sense within our forecast horizon,” they continue.

This year, the Middle East will comprise 3% of global PV capacity. This is set to grow to 9% by 2023 on the back of growth in Saudi Arabia and the UAE, which will represent 50% of the region’s installed capacity.

By 2023, Latin America is forecast to account for 7% of global installs, with Mexico, Brazil and Chile comprising 81% of the region’s installed capacity.

In China, meanwhile, GTM Research sees demand reaching just 28.8 GW this year – lower than TrendForce’s forecasts of 31.6 GW – as opposed to 48.2 GW, with the country expected to install 141 GW between now and 2022, compared to the originally estimated 206 GW.

“Annual installations of 20-25 GW will be the new normal for China, rather than 30-40 GW,” write the analysts, who add that the country could see auctions and “possibly” subsidy-free solar as its key PV drivers going forward.

Benefits

The benefits of the rapidly falling module prices – of between 29-36% by the end of 2018 – occurring on the back of the policy changes, will be seen first in 2020 in terms of demand, posits GTM Research, as developers are motivated to delay module procurement; something that BloombergNEF also recently relayed to pv magazine.

Module costs comprise between 19-57% of total project costs, depending on region, says GTM Research. As such, Asian markets will be the biggest winners of the decreased prices.

The analysts point to India, as an example where module costs comprise 57% of overall project costs. “A~30% decline in module costs would result in a total capex reduction of over 17%,” they say.

This, combined with new guidelines on extensions to grid connection timelines for tendered projects, could see more competitive tariffs in auctions, although the uncertainty around the recently imposed safeguard duties will put a dampener on the benefits. This is also true in the U.S., where import tariffs are also in place.

Large utility-scale PV pipelines in markets like India, the U.S., Australia, Vietnam, Taiwan and Egypt, will be more competitive in light of the market developments, states the research company, while in regions without subsidies or competitive bidding, including Spain, Portugal, Italy and the U.K., PPA or merchant agreements will become more realistic.

In a session on Investing in Europe’s PV Future, held at this year's Intersolar Europe event, and hosted by BNEF, four panelists discussed the European power purchase agreement (PPA) market, how it is growing, and how it is the key value driver to unsubsidized solar. While the continent is still not offering PPAs longer than 10 – 15 years, yet, the long-term PPA market is growing, said Frederico Giannandrea, Partner, Head of Foresight Southern Europe, Foresight Group, Italy.

Changing auction landscape

Another benefit of the falling module prices will reach the markets where recent auctions have seen “aggressive” bids for utility-scale projects, like in Saudi Arabia, Mexico and Chile. These projects “now look more likely to make acceptable returns,” says GTM Research.

Among its 10 predictions for solar PV going forward, it says bid prices will continue to fall, with prices lower than $0.02 likely in both emerging and established markets. “By 2022, awarded prices as low as $14/MWh will be old news,“ say the analysts. Despite this, they say global average bid price declines will slow in 2018-2019, as cost declines catch up.

They add that joint ventures, consortia and merger & acquisition activity will see more participants in large tenders, and at an earlier stage in the process.

Not only this, but GTM Research predicts that auctions will become increasingly technology neutral. “Additional upside for solar could come from markets where it competes with wind in technology-neutral auctions. Examples include Germany and Greece, though volumes awarded through auctions of this kind are currently relatively low,” it writes.

Meanwhile domestic content requirements (DCRs) and paired manufacturing with independent power producer tenders (IPP) will “proliferate”. Pairing solar with storage is another trend anticipated by GTM Research and this, together with the aforementioned changes, will see increased auction block sizes.

Overall, GTM Research asserts that 2018 will be the biggest year on record for competitively procured PV.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.