Record-breaking years seem to have become business as usual in the PV industry, and 2017 was no exception with global installations for the year brushing the 100 GW mark. Demand for new installations surpassed the expectations of most analysts, meaning supply conditions were tight across the supply chain, with prices even rising at some points during the year.

These conditions played into the hands of the biggest silicon module manufacturers, who after being rocked by oversupply conditions in 2016, were able to take advantage of stable prices and strong demand to improve their position, and plan major capacity expansions.

“The module market in 2017 worked to suppliers’ advantage,” comments Jade Jones, Senior Analyst, Solar Markets at GTM Research. “Strong demand in the China region, as well as Southeast Asian supply tightness due to the Section 201 threat [from the U.S.], allowed suppliers to capture healthy margins.”

The top 10

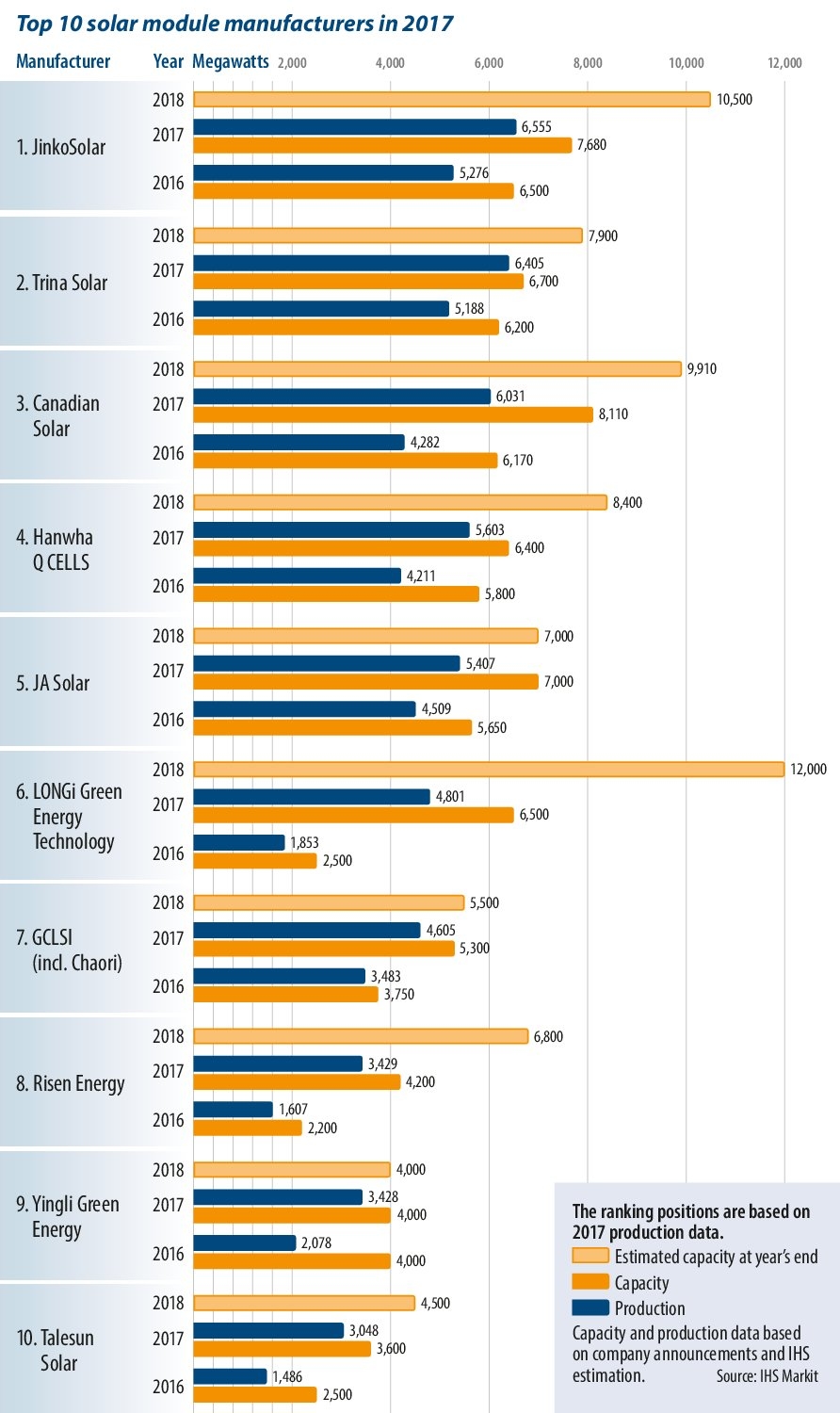

JinkoSolar maintained its place as the largest module manufacturer in 2017, producing just over 6.5 GW, an increase of more than 1 GW on the previous year. In spite of this increase, the company’s gross profit fell 22.7%, from CNY 3.87 billion ($583 million) to CNY 2.99 billion ($451 million). JinkoSolar cited lower module prices and higher material costs as the main reasons for this. “Our gross margin was 11.3% for the year, compared to 18.1% in 2016, partially as a result of increased collaboration with OEM partners to meet surging market demand, especially in the first half of 2017, and higher raw material costs,” states JinkoSolar CEO, Kangping Chen, commenting on the company’s 2017 financial results.

For the most part, 2017 was a stable year for the largest five manufacturers. While Jinko and other top-tier manufacturers were able to absorb these lower margins without too much trouble, there were casualties at the other end of the table. Yingli Green Energy hung on in ninth place, managing to ship more than 3 GW in full year 2017. In spite of this, the company posted a net loss of $510 million, and total liabilities of $3.2 billion. While it has persuaded many of these creditors to wait for the time being, Yingli’s 2017 financial reporting came with a notice stating, “Given the Company’s financial position, substantial doubt exists as to the Company’s ability to continue as a going concern.”

Technology trends

Having entered the ranking in ninth place last year, Longi Solar was able to climb all the way to fifth. As the company only produces mono c-Si products, this could be seen as a sign of market preference for the technology, which has quickly gained market share in recent years. Mono c-Si is strongly preferred in China’s Top Runner Program, and economies of scale achieved through this have allowed mono manufacturers to close the price gap.

“Mono’s market share will approach 50% this year,” says Corrine Lin. “But since the price gap between multi and mono is still too large, some non-Chinese demand has returned to mono c-Si modules recently.”

Also on the technology front in 2017, manufacturers focused on reducing cell-to-module losses. This meant that half-cut cell technology achieved a particularly fast ramp-up. And other module level innovations are still waiting in the wings, such as bifacial; five, six, or multi-busbar modules; as well as shingled modules.

“Although most of these technologies have been known for years, it has not been until recently that they have started to become mainstream and evolve into mass production,” says Karl Melkonyan. “In the next three years, both bifacial and half-cell modules have a chance to gain a significant share of the total module market, combined with new cell technologies, like passivated emitter rear contact (PERC) or n-type technologies including heterojunction (HJT) and interdigitated back contact (IBC).

And there is no sign of PV manufacturers’ push for higher efficiency solar modules ending any time soon. “Demand for higher efficiency products keeps increasing year-over-year despite the relatively higher manufacturing costs and prices of high efficiency modules,” continues Melkonyan. “In addition to policy drivers, such as the Chinese Top Runner Program, high efficiency products are also required for most of the residential and small commercial segments in premium markets such as Japan, the United States, as well as many European countries.”

The driving force

China, of course, is the leading player here both in terms of supply and demand. “In 2017 China reached its peak in global market share accounting for around 53%,” explains Karl Melkonyan, Senior Analyst, Solar Demand at IHS Markit. “Module manufacturers continued expansions in the country, bringing online nearly 10 GW of additional capacity during 2017.”

The 2017 installation boom in China led to supply shortages further up the supply chain, which in turn kept prices stable and capacities expanding. “In 2017, demand in China was much higher than module manufacturers anticipated, so there were a lot of capacity additions announced across the entire supply chain,” explains independent analyst Corrine Lin. “Chinese manufacturers were not ready for this boom. In Q2 and Q3 there were shortages further up the supply chain in polysilicon, wafer, and other module materials.”

Chinese installations were led by a rush to meet the June 30 cut-off date to receive the 2017 FIT rates. Unlike the previous year, when the same cut-off date caused a drop off in demand, and a major oversupply situation, 2017 installations continued into the second half of the year. China’s distributed generation segment also received a major kick-start in 2017, growing 255% over the previous year to install around 15 GW in the first three quarters alone, according to figures from Asia Europe Clean Energy Associates (AECEA).

Despite the tight supply conditions, China’s manufacturers were able to keep pace with this increase in demand, “During Q1 to Q3 2017, China achieved exceptionally high growth rates in terms of production output along its upstream supply chain. “According to the China PV Industry Association, module output increased 43%,” states AECEA’s September 2017 briefing paper. “[This suggests] that approximately 80% of domestic module output stays within China.”

USA

Though demand from China is the biggest factor in global module supply-demand stability, major events in other markets still played a significant role. The threat of tariffs served to shape demand in the U.S. over the year.

Since January 2018, a 30% tariff has been placed on crystalline silicon PV imports to the U.S., with a 2.5 GW exemption for cell imports. Anticipating this announcement, project developers began hoarding modules in the second half of 2017, further compounding the already tight supply conditions.

This exemption for cell imports has already spurred the announcement of several new module facilities in the U.S., and still leaves room for more. “The current 2.5 GW quota in place is enough for the current domestic suppliers without internal cell capacity,” explains Jade Jones. “It also leaves room for U.S. producers to expand module capacity or for foreign firms to build small module fabs in the next four years, with imported cells typically around 500 MW per year.”

Hanwha Q Cells recently announced plans for a 1.6 GW module facility in Georgia, to open in 2019 – which would be the largest such facility in the U.S. Earlier in the year, JinkoSolar announced that it would be opening a new 400 MW factory in Jacksonville, Florida; LG Electronics has plans for a 500 MW high efficiency line in Alabama; and several expansions have been announced by domestic U.S. producers including Mission Solar and SolarTech Universal. pv magazine estimates that around 4 GW of new module capacity has been announced for the U.S. since January.

“The 201 tariffs have had a couple of main effects: There has been more investment in U.S. manufacturing, mostly by foreign companies. Most of this investment wouldn’t have been possible without the threat or the imposition of tariffs,” says Jones.

Jones also points out that the recent acquisition of SolarWorld USA by SunPower likely would not have happened without the tariff announcement, and that, although module prices in 2018 are tumbling in the wake of China’s May 31 announcement, trade tariffs will prevent the U.S. seeing such low prices. “The Section 201 tariffs have given a lifeline to SolarWorld USA, one of the Section 201 petitioners. The company was acquired by SunPower, conveniently after SolarWorld backed SunPower’s IBC product exemption from 201 tariffs. They also place a fundamental floor on how low module prices can fall in the U.S. Module prices will fall in response to industry oversupply, but prices in the U.S. will continue to be the highest in the world.”

India

Though now firmly established as a solar world leader, and set to overtake the U.S. to become the world’s second-largest market in the near future – IHS Markit forecasts India to be responsible for 11% of solar demand by 2021, from its current level of 8% – India has remained well behind the East Asia region in terms of manufacturing.

“There was some capacity growth in India, from small additions (e.g. BHEL’s 200 MW cell and module ramp) to larger gigawatt expansions like that of Adani,” continues Jade Jones. “While many major Chinese suppliers have previously expressed interest in expanding manufacturing in the region, most held off in 2017.”

Given its huge appetite for solar, and the recent trade issues that have slowed its growth somewhat, most analysts expect Indian module manufacturing to ramp up over the coming years. This will most likely be led by the established Chinese manufacturers spreading their activities further afield.

“India’s domestic production capacity is not enough, and the market has had problems with trade war,” says Corrine Lin. “I think building a module manufacturing group is important. Chinese manufacturers will want to open factories, or start further cooperation with local producers.”

Indian manufacturer Adani announced plans to increase its capacity from 1.2 to

2 GW earlier this year, and leading mono c-Si producer Longi announced plans in early 2018 for 2 GW of new manufacturing capacity in India.

“Longi is making modest capacity investments in select markets to hedge against the risks of trade protectionism, while remaining focused on the Chinese domestic market,” stated Wenxue Li, President of Longi Solar, announcing the plan for production in India. “According to preliminary estimates, the new expansion will support $380 million in annual sales and roughly $19 million in net profit every year.”

Taiwan

Though they still have some advantages in terms of their reputation for quality, Taiwan’s cell and module makers have struggled to keep up with the price reductions achieved over in mainland China.

Previously a major exporter of high efficiency cells, Taiwanese companies have had to change strategy in order to survive. This change is evidenced in the upcoming merger between three of Taiwan’s largest PV manufacturers, Neo Solar Power, Gintech, and Solartech, to form a new company under the name United Renewable Energy Company (UREC).

This new company, along with other Taiwanese manufacturers, is expected to focus on its own domestic market, where significant solar ambitions combined with a lack of suitable land for project development likely mean high efficiency modules can be sold at higher prices. “The establishment of UREC will allow Taiwan’s solar cell industry to get rid of its role as foundries and further urge the green energy industry to root and grow strongly in Taiwan,” reads an October press release announcing the planned merger.

(The chart with this article was updated on 23.07.18 to correct an error on Risen's estimated 2018 capacity)

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Thanks for the article. I was looking for this information. thank you very much. Always a good content.

Brazil is becoming a good country to invest in solar energy. I’m getting excited. thanks for the article

Would like to inquery about the brand “ PV Foundery” which is from Singapore.

Thanks!

Very interesting article, any latest information on the subject.