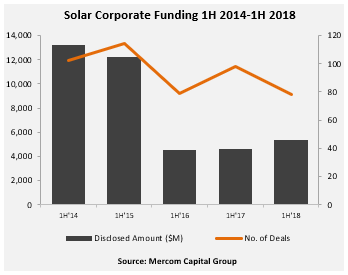

After a massive 65% quarter-on-quarter drop from Q4 2017, solar funding began to bounce back in Q2 2018, resulting in US$5.3 billion raised in the first half of 2018, up from the $4.6 billion raised in the respective period last year, reports Mercom Capital.

Corporate funding increased in Q2 2018 with $2.8 billion in 34 deals, compared to the $2.5 billion in 44 deals in Q1 2018, as year-over-year funding in Q2 2018 rocketed by around 102%, compared to the $1.4 billion in Q2 2017, shows the report titled, Solar Q2 2018 Funding and M&A Executive Summary.

In the face of uncertainties surrounding the solar industry in the previous six months, financial activity saw a 15% increase year-on-year.

“The first half of 2018 has been a roller-coaster for the solar industry marked by uncertainty due to the Trump tariffs followed by the recent Chinese subsidy pullback,” commented Raj Prabhu, CEO of Mercom Capital Group. However, a full scope of repercussions of the policy change in China, announced on May 31, is yet to be seen.

“Though financial activity was better compared to the same period last year, the market is still sorting out the winners and losers that would come out of a potential slowdown in Chinese demand, which is expected to result in an oversupply situation and eventual price crash in components across the globe,” says Prabhu.

VC funding

Global VC funding, including venture capital, private equity, and corporate venture capital, for the solar sector in 1H 2018 was 36% percent lower, with $458 million compared to the $716 million raised in the first half of 2017.

But in Q2 2018 alone, VC funding for the solar sector increased to $298 million in 12 deals, compared to $161 million in 22 deals in Q1 2018. Compared year-on-year, this was a huge 133% increase, up from the $128 million raised in 23 deals in Q2 2017.

With a total of 42 VC investors participating in solar funding in 1H 2018, the biggest deals included: $112 million raised by Wunder Capital, $100 million raised by Sunnova, $55 million secured by Off-grid Electric, Sunlight Financials’ $50 million, $25 million raised by d.light design, and the $23 million raised by Solaria.

Public market funding

Solar public market funding in 1H 2018 saw a 33% increase compared to the first half of 2017 with $1.25 billion raised in 12 deals, compared to $934 million in 19 deals in 1H 2017.

Public market financing in the solar sector drastically rose to $1.1 billion in eight deals in Q2 2018, compared to just $103 million in four deals in Q1 2018, and $473 million raised in six deals during Q2 2017.

Debt financing

Debt financing activity also saw an increase of 22% in the first half of 2018, to $3.6 billion in 32 deals compared to the first half of 2017 when $3 billion was raised in 33 deals.

Most of that increase was due to two securitization deals: Vivint Solar raised $466 million through asset back notes and Dividend Finance secured $105 million in a similar deal.

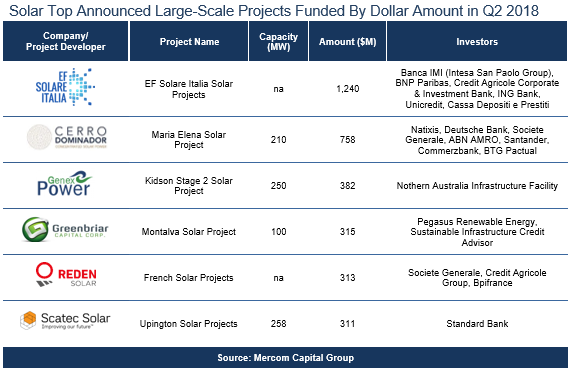

Project funding

Large-scale project funding in the first half of 2018 saw $7.96 billion for 98 projects, compared to 1H 2017 when a record $7.4 billion was raised in 81 project funding deals.

Meanwhile, residential and commercial solar funds totaled $625 million in 1H 2018, dropping drastically from $1.8 billion in the same period of 2017.

M&A

Mergers and acquisition were on the rise in 1H 2018 with a total of 46 solar transactions, compared to 41 transactions in 1H 2017.

There were 27 solar M&A transactions in Q2 2018, involving 16 solar downstream companies, six PV manufacturers, three equipment manufacturers, and two BoS companies. In comparison, there were 19 solar M&A transactions in Q1 2018 and 12 transactions in Q2 2017.

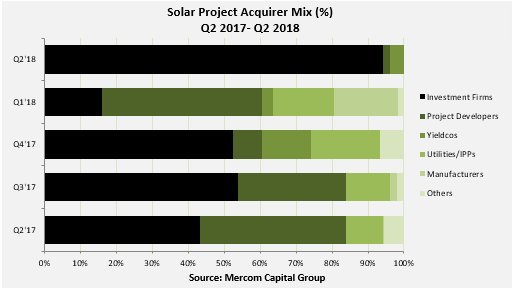

There were also 117 large-scale project acquisitions in 1H 2018 totaling 11.6 GW, compared to 101 project acquisitions totaling 10.9 GW in the first half of 2017.

Investment firms and funds were the most active acquirers in 1H 2018, picking up projects totaling 4 GW.

Yesterday, Bloomberg NEF reported that overall global investment in clean energy saw a decrease of 1% YoY in the first half of 2018, at $138.2 billion, with solar’s share dropping 19%, to $71.6 billion.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.