Milan-listed utility A2A has abandoned plans to acquire Italian solar energy asset manager RTR, a unit of UK-based private equity firm Terra Firma Capital Partners Ltd. (TFCP). In a statement to pv magazine, the company confirmed it will leave the auction for RTR, as had been reported by Italian portal Energia Oltre.

The Italian article reports three bidders are shortlisted for the acquisition: utility Enel, whose CEO Francesco Starace said in February the company was looking with interest at RTR’s portfolio; oil group Eni, whose press office told pv magazine it is not its policy to comment on rumors regarding possible transactions; and UK oil giant BP, which at the time of publication had not answered a request to confirm its interest in the deal.

RTR's press office, in its statement to pv magazine, said that since the sale process was launched, it has never commented on rumors.

Terra Firma initiated the sale of RTR in early 2018. At the time Bloomberg revealed the company’s market value was estimated by its parent company at around €1.5 billion ($1.75 billion) and BP was among the interested potential buyers, together with Masdar Abu Dhabi Future Energy Co. and German utilities EON SE and Innogy SE. According to another article from Reuters, published in May, Italian independent power producer Sonnedix and A2A were also circling.

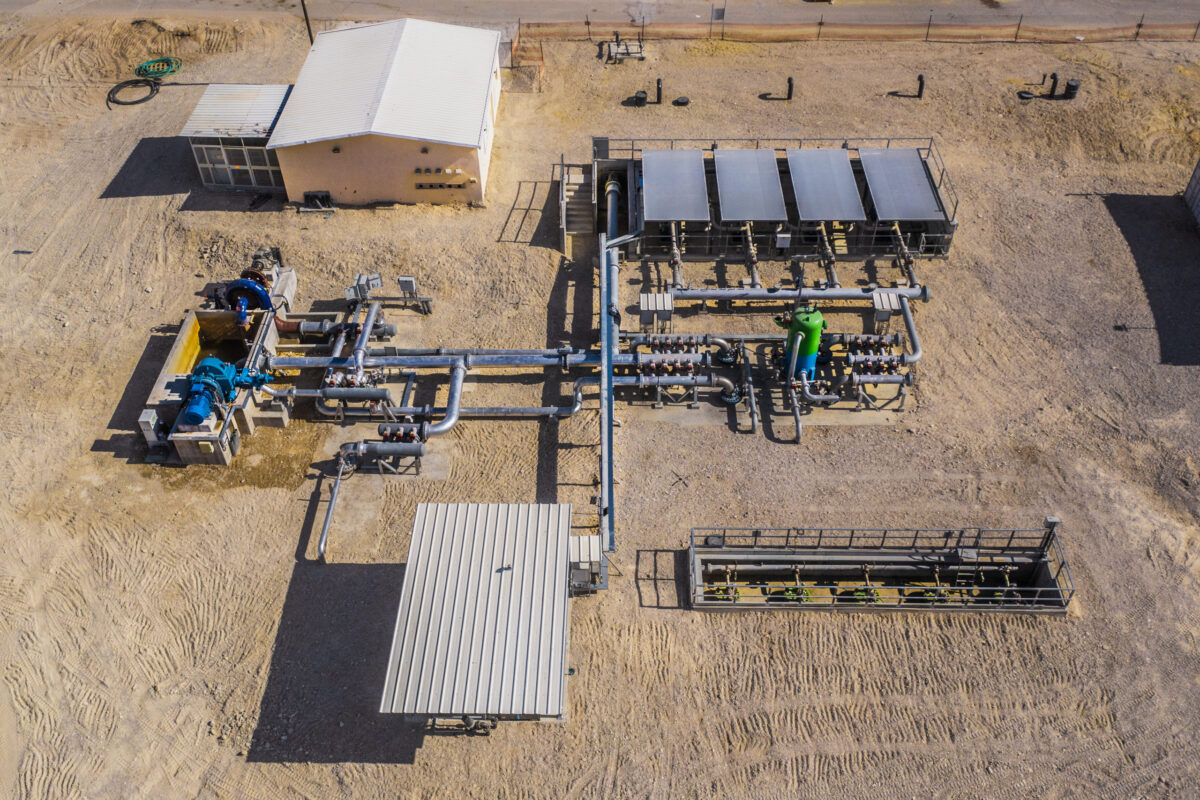

RTR was acquired by Terra Firma from Italian grid operator Terna in 2010. Terna’s PV plant portfolio and that of Italian renewable energy company Sorgenia – which RTR acquired a few months later – provided the Italian PV asset manager with a combined portfolio of 242 MW. Another 76 MW was acquired from French renewable energy company EDF Energies Nouvelles (20 MW), Rome-based power utility Acea (36 MW), and Italian industrial group Toto (24 MW) in the following years. After these major transactions, it made other smaller deals that brought total PV capacity to 334 MW, the last of the acquisitions being closed in April.

The company owns and operates 87 PV plants with an installed capacity of less than 1 MW, for a total of 66 MW; 31 plants with a capacity ranging from 1 MW to 5 MW, totalling around 70 MW; and 16 solar parks exceeding 5 MW, which amount to 196 MW of installed capacity.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.