The amount of silver needed to produce conductive silver paste for the front and back of most PV cells may be almost halved, from an average of 130 mg per cell in 2016 to approximately 65 mg by 2028, according to the Role of Silver in the Green Revolution report published by CRU Consulting – a division of CRU International Limited – on behalf of the Silver Institute.

The report's authors explain the amount of silver used in solar cell manufacturing has already decreased to a much larger extent, from 400 to 130 mg between 2007 and 2016. The authors also predict cell output will grow from 4.7 W now to 6 W by 2030, contributing to a 10.5 mg reduction in silver use per Watt, the report notes.

However CRU's analysts state silver's unmatched electroconductive qualities mean there is a “physical limit” on the possibility of further reducing silver loadings in cell production, as efficiency losses outweigh the benefits achieved from cheaper raw materials such as copper or aluminum.

During the next decade, non-silver based PV technologies are not expeccted to gain significant market share as they tend to have shorter lifespans and the global PV market, the report states, is moving toward more compact and efficient solar panels.

CRU predicts module efficiency may rise to around 25% by 2030, which would result in a 24% reduction in the number of panels needed to produce a given amount of electricity.

“These two factors – thrifting and efficiency increases – may decrease silver loadings enough that it would take a significant increase in solar capacity’s growth rate to keep silver demand from slipping – an increase that the industry as it currently stands will not be able to deliver in the long term,” the report states.

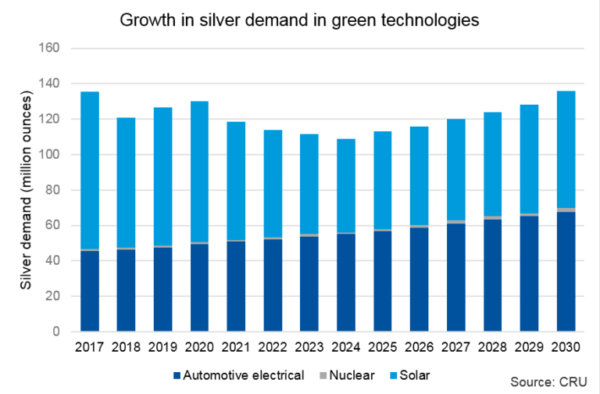

As a consequence, CRU experts forecast silver demand for the PV industry of around 70 to 80 million ounces per year until a decline to between 50 and 55 million ounces in the mid-2020s. Only by 2030 is demand expected to recover, to approximately 66 million ounces per year.

In a separate report published in May, the World Bank forecast a significant drop in the silver price, to $13.42/toz, by 2030. Up to 2021, however, the commodity price is not expected to change by a great margin, according to the analysts. Expected to close at $16.45/toz in 2021, the more significant decline in silver prices will come later, to a predicted $15.04/toz in 2025.

According to a report published by the Silver Institute in April, global industrial demand for silver grew around 4%, from 5,768 million ounces in 2016 to 5,990 million last year. This spurt was mainly due to the record growth of the PV industry, which pushed demand for silver as a component of silver pastes for solar cells, from 79.3 million ounces in 2016, to 94.1 million ounces in 2017 – year-on-year growth of around 19%.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Didnt consider automotive demand. It will drive silver, plus new tech

Well if efficiency increases, we will buy much more solar panels.

Efficiency of solar cells effects the number of cells solar panel will use. Todays cells average about 17%.Mono cells get better efficiency, will cost more. Poly cells are less efficient less cost. Better cell technology is improving and will require less silver.. The Growth Chart shown above is a good picture.

Better copper purity will be s future factor in PV costs.

With increased efficiency, demand will increase and solar will become more efficient and financially viable in more northern climates greatly expanding the use of solar panels.

Wow. It’s now July 22, 2020, and this article has really held up well, hasn’t it. Not at all. With fossil fuel demand and new commitments to green energy, combined with COVID-19, and every nation in the world drowning in debt, can I get some silver from you at $13 please.

O Yah ! everybody who predicts what silver will do in the future are always spot on right ? Dah !

Nobody has a crystal ball & especially stock brokers who tell you to buy stocks that have already been hogged out ! I say listen to your own mind & not to “so called experts”

That’s hilarious that silver will be $13 an ounce in 2030. $13 in 2030 would be like $8 today with inflation. Give me a break. Silver has a far better chance at being $80 an ounce than $13.

do you know how much silver was in the first generation of solar panels und how did developed by years.