In the first quarter of 2018, the investment activity of PV manufacturers in new production equipment was rather subdued, according to a new report from the German Engineering Federation (Verband Deutscher Maschinen- und Anlagenbau, or VDMA).

Aggregate revenues have fallen 48% compared to the previous quarter, the association said on Tuesday. Compared to the same quarter in the previous year, however, turnover was 48% higher. Order books also continue to be well filled, VDMA said, with the book-to-bill ratio at 0:4 in the first quarter of 2018. The export rate, meanwhile, was 93%.

“The high level of investment by solar cell manufacturers in the expansion of existing and new production capacities is decreasing, but production is still running at full capacity,” explains Peter Fath, Managing Director of RCT Solutions GmbH and Chairman of the Board of VDMA Photovoltaik Produktionsmittel.

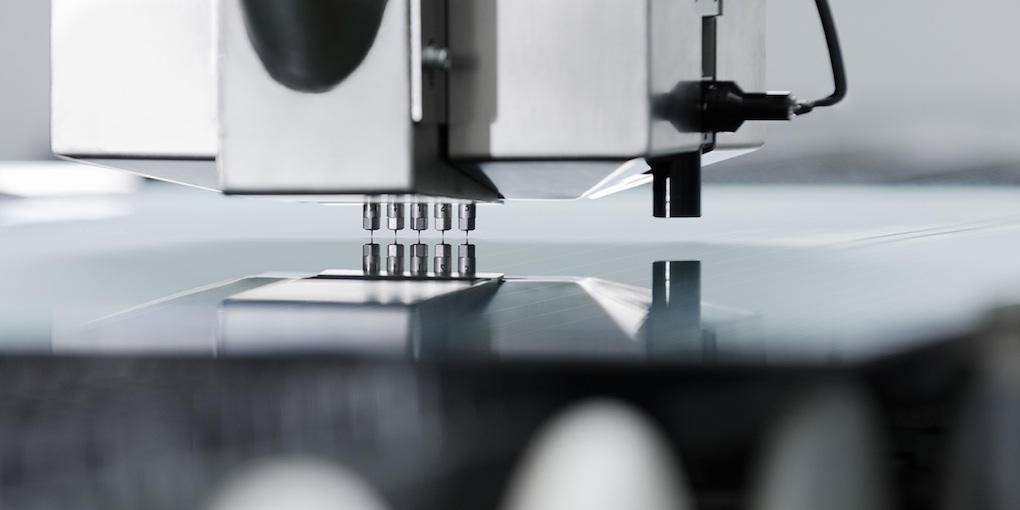

“We also observe a reduction in equipment prices. New orders were increasingly received for PERC and Black Silicon plants in crystalline silicon as well as in the thin-film sector. We see a trend to implement new production techniques in the form of upgrades to existing production lines,” he added.

Overall, order intake declined by 51% compared to the fourth quarter of 2017. Regionally, most orders are coming from Asia, which account for 75% of the total. Of this, only around half come from China.

“The orders from Asia now show a broader diversification into various Asian countries. Especially the high proportion of equipment for the production of thin-film modules shows that German production equipment is in demand,” said Jutta Trube, Head of VDMA Photovoltaik Produktionsmittel. Around 16% of new orders came from Germany in the first quarter.

The main PV suppliers continue to be located in Asia, with 86% in East Asia, 40% in China; and 7% in Taiwan. Germany is also responsible for a 7% share of sales in the first quarter of 2018 and, thus, is clearly ahead of the rest of Europe (4%) and America (3%).

In terms of technologies, thin film PV continued to be particularly in demand at the beginning of the year, with approximately 61% of sales being attributable to this segment, followed by cell production equipment, which accounted for 32% of total sales.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.