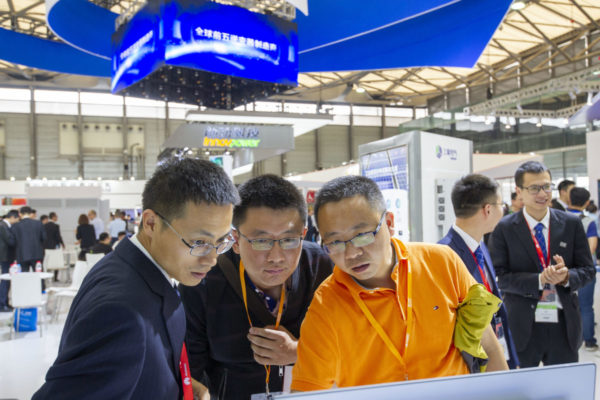

SNEC highlights included speeches from leading officials of regional PV industry associations, including the Chinese Photovoltaic Industry Association (CPIA) and its Asian equivalent APVIA, leaders from top PV companies and industrial research facilities, and representatives from related fields, all of which enabled participants from China and overseas to learn the latest news about the fast-growing industry.

Suprisingly, overseas speakers were more optimistic about the prospects of the Chinese PV market up to July next year than domestic professionals, and among the Chinese delegates, speakers representing the industry were more positive the representatives of PV associations.

Though almost all participants highlighted uncertainty, the optimists still believe the market will grow beyond the record-setting 53 GW the country installed in 2017. However, Wang Bohua, Secretary General of the CPIA, held a different view and estimates PV installation in China will slightly decrease this year, to less than 50GW.

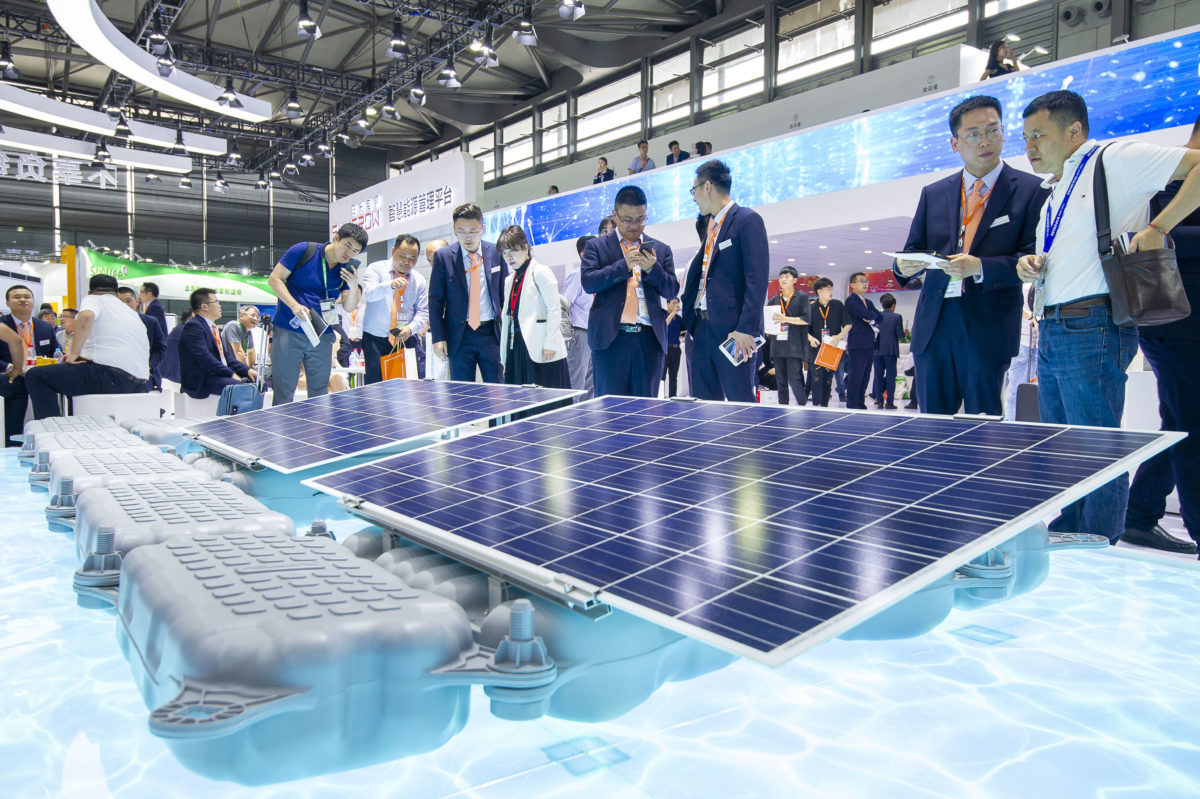

During the three-day SNEC exhibition, which opened on Monday, leading module manufacturers released new high-efficiency products, most of them based on cutting-edge PV technologies such as bifacial, next-generation PERC and n-type products, to reach new power records or higher transmission efficiency.

GCL launched new 300+ series products including single-glass and glass-glass modules equipped with multi-busbar (MBB) technology for mono and poly products. Longi presented its latest Hi-Mo3 series, with bifacial half-cut cell PERC products and Jinko showcased new mono n-type bifacial modules. JA Solar highlighted its PERC, n-type modules, along with MBB technology and bifacial glass-glass products and Hanwha, Trina Solar and CSI – as well as lesser-known manufacturers – also presented record-breaking offerings. In 2018, the typical PERC mono module (with 60 cells) reaches a power level of well over 300 W, with some attaining 330 W and very high transmission rates of over 20%. Jinko even showcased a Cheetah product with a remarkable 410 W for one piece of module.

On the inverter side, Hefei-based Sungrow released six new products, including 1000 V and 1500 V string inverters with power ratings of 136 kW and 166 kW, respectively, which can significantly reduce the system cost of distributed PV projects. Goodwe and Ginlong also presented new string inverters focused on residential rooftop PV. And Shenzhen-based Huawei released a string inverter for the residential market with a record-setting efficiency of 98.65%, as inverter manufacturers pull out the stops to prepare for the anticipated boom in the residential PV market in mainland China.

Leading Chinese module manufacturers are also developing market strategies to tap the new residential market, featuring new brand focusing and establishing marketing teams to organize the sales process, including before and after-sales service. For most manufacturers, the key to success in the field is developing distributors. Unconfirmed figures show there are already more than 50,000 distributors in China doing residential PV business and that figure may double by the end of next year. Since residential is still not covered by central government quota controls it could end up being the key segment to drive growth if, as rumored, China’s National Energy Administration (NEA) introduces quotas to control distributed PV.

SNEC also brought exciting news from former giants of the PV world. LDK is making a comeback after a successful reorganization, in the form of a new private company which has signed a strategic agreement with France's ECM for future business, the details of which remain unclear. Wuxi-based Suntech also looks stronger after emerging from reorganization several years ago. At its large SNEC booth visitors could sense ambitious plans for the Chinese and overseas markets. Yingli also had a sizeable booth, despite fears the reorganization of the formerly private company has not proceeded so smoothly. At SNEC, Yingli appeared up and running and, as one of the few module manufacturers in northern China, could have an edge in provinces close to, and north of Beijing. Another resurgent name is thin-film manufacturer Hanergy, which showcased a range of new products at SNEC, from solar-powered electric vehicles to CIGS-based rooftop offering the Hantile, with its maker claiming 3GW of production capacity for the product.

Whether the Chinese PV market ends up with slightly less or slightly more than 50 GW this year, it is clearly the colossus of the global market and will affect the pricing of solar materials, cells and modules for the foreseeable future. The Chinese market is also becoming more diverse, moving away from domination by large-scale ground-mounted PV to more rooftop installations, whether in the commercial and industrial segment or the residential space.

Typically, rooftop markets require a multi-layered sales and support structure with, for example, distributors buying from manufacturers and serving a broad base of installers. Such a market boosts employment in the industry and probably accounts for the significant increase in SNEC visitors this week, compared to last year’s exhibition. With an increasing number of people working in the industry, PV looks set be even more important to China’s central government as it seeks to wean the country off thermal power and onto renewable energy.

Authors: Vincent Shaw & Eckhart Gouras

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.