In its financial results for the first quarter, Canadian Solar reports that turnover increased by 110.5% year-on-year from $677.0 million to $1.42 billion, while shipments decreased slightly from 1,480 MW in the first quarter of 2017 to 1,374 MW in the latest quarter.

Shipments, however, exceeded the companies previous outlook, which forecast a volume between 1.3 GW and 1.35 GW. The guidance for turnover had also been slightly lower at between $1.37 billion and $1.40 billion.

Meanwhile, operating result swung from a loss $2.3 million in the first quarter of last year to a profit of $78.2 million in the same period of 2018, with net result also improving from a loss of $13.7 million to a profit of $43.8 million. Quarterly gross margin was 10.1%, compared to 13.5% in the first quarter of 2017 and 19.7% in the previous quarter. The quarter-on-quarter decrease in gross margin was mainly due, the company explained, to the low margin associated with sale of US PV plants totaling 309 MW to Korean power utility Kepco. This was offset, however, by flat and slightly up average selling price in the first quarter of 2018, it also said.

“The capacity utilization level was lower than the fourth quarter of 2017, due to several reasons, including seasonally low demand and holidays in China, the Section 201 safeguard decision on solar products by the U.S. government and the safeguard trade investigations in India,” Canadian Solar CEO, Shawn Qu stated.

In terms of capacity expansion, Canadian Solar said it will remain committed to its plan to increase its ingot and wafer capacity to 2 GW and 5 GW, respectively, by the end of 2018, while the expansion plan for its solar cell and module production is targeting 7.05 GW and 9.1 GW, respectively.

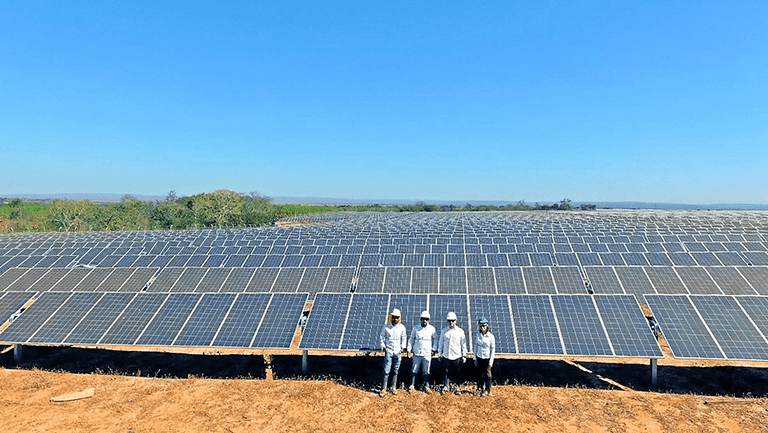

As of the end of the first quarter, the company’s late-stage utility-scale PV project pipeline had reached around 2.3 GW. This includes 459 MW in the U.S., 435.7 MW in Mexico, 422.5 MW in China, 351.3 MW in Japan, 499.2 MW in Brazil, 97.6 MW in Argentina, 24 MW in India, 24.2 MW in Australia, 18.4 MW in Chile, and 8 MW in South Korea.

In its guidance for the second quarter, Canadian Solar said it expects to ship between 1.50 GW and 1.60 GW of modules, while revenue is forecast to range from $690 million to $730 million. “We expect a shift in global demand to developing markets to offset China, India and the U.S. We also expect demand in other markets to improve, including Europe, Africa, Argentina and Mexico,” Qu added.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.