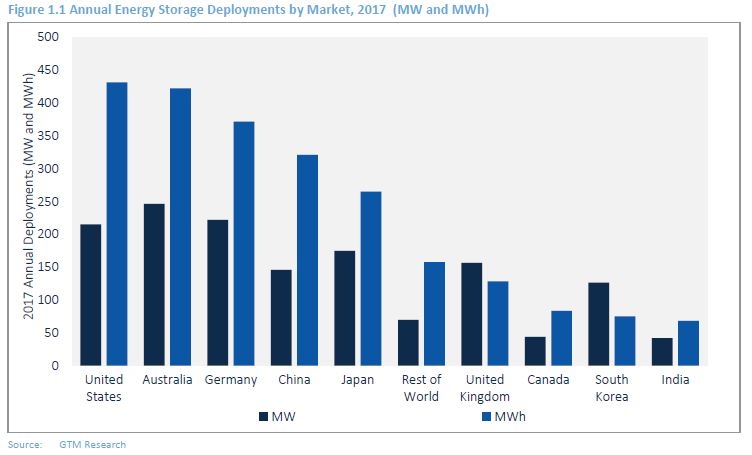

Cumulative global energy storage additions reached 1.4 GW and 2.3 GWh in 2017, according to new data published in GTM Research’s inaugural Global Energy Storage – 2017 Year in Review and 2018-2022 Outlook report.

Australia added more stored power capacity than any other nation last year, with 246 MW. This total comprised a tripling of the country’s residential (behind-the-meter) storage space, which continues to be boosted by high retail electricity rates and diminishing or expiring solar FITs, thereby boosting the uptake of home batteries for self-consumption purposes.

In the U.S., meanwhile, the 431 MWh of new stored energy capacity was the highest globally, with the first quarter (Q1) of 2017 accounting for 234 MWh of storage deployments. The GTM report states that the bulk of this Q1 activity occurred in California where the California Public Utilities Commission (CPUC) stepped up its efforts to procure additional power in the wake of the Aliso Canyon facility’s shutdown.

The remaining three quarters in the U.S. were shaped by gathering storage momentum in a handful of states that enacted new laws and targets designed to increase the uptake of storage. Arizona, New York and Massachusetts were all active in this space, while California comprised 73% of the 110 MWh of new behind-the-meter battery installations registered nationwide in 2017.

Europe eyes regulation

The leading storage markets in Europe were the U.K. and Germany – the former installing 117 MW of largely large-scale storage capacity, and the latter’s 135 MW comprising mostly front-of-meter storage but a growing portion of residential and commercial applications too.

In the U.K., the highly competitive Enhanced Frequency Response (EFR) auction drove clearing prices to record lows of £7/MWh ($9.9/MWh) for electricity, prompting the National Grid to initiate a process of restructuring for ancillary services ahead of a (duly canceled) EFR Part 2 auction. In its stead is set to come a more simplified frequency market system designed to be more transparent and place more value on speed of response technologies, which could play into storage’s hands.

However, despite the U.K. government's eagerness to support technologies that will help the National Grid expedite the shift away from coal-fired power plants (resulting in a number of positive policy announcements that will certainly boost battery uptake), the business case for storage has begun to suffer. GTM Research finds that embedded benefits of storage will be drastically scaled back from an average forecast of between £47k/MW/year to £70k/MW/year ($66k/MW/year to $99k/MW/year), down to £3k to £7k/MW/year ($4.2k/MW/year to $9.9k/MW/year) by April 2021.

Currently, of the 3 GW of proposed U.K. storage projects that have made it through the prequalification process for capacity market auctions, GTM Research finds that only around 400 MW have secured contracts, leaving a glut of uncontracted storage projects across the country.

In Germany, the solar+storage residential program, the KfW 275, continues to grow. Last year, Germany had around 80,000 behind-the-meter storage installations, predominately in the residential sector. Elsewhere in Europe, it is the residential segment that is driving most growth, with many major solar companies now including storage in their offerings to customers in order to capitalize on the continent’s increasingly decentralizing energy market.

The Asian picture

South Korea’s self-contained storage market is ticking along nicely, GTM found. The nation is closing in on its 500 MW target, having ended 2017 with 370 MW of storage installed across 13 projects, all built using domestic components and owned and operated by state transmission company Kepco.

China, meanwhile, is gathering pace in the storage space and will surpass all markets bar the U.S. by 2019, remaining in second place through to 2022.

Globally, the storage industry will continue to be shaped by continuous refinement of policy and market mechanisms designed to encourage battery uptake on several fronts. These include renewable integration, time-of-day based PPA structures, competitive market redesigns, retail rate reforms, urban and remote microgrids, and distributed resources for grid services and as virtual power plants.

Such initiatives, allied to continued cost reductions of lithium ion technology, will boost installation numbers to 8.6 GW and 21.6 GWh by 2022, the report concludes.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It is important to see the Australian growth in context. It is a revolt by ordinary householders sick and tired of being held to ransom by a corrupt electricity sector. While the vast majority of the general public are concerned about fossil fuel pollution, and the impact of climate change, especially on the iconic Great Barrier Reef, the Federal Government has done very little in recent years to facilitate or coordinate the growth of small scale solar or renewables of any kind. Indeed a powerful faction of the Liberal/National Coalition Party, heavily influenced by coal mining and gas interests, is ideologically, one could even say ‘hysterically’, opposed to any move away from total fossil fuel dependence. The LNP’s first order of business when they came to power was to repeal a very moderate carbon tax. In this war against science and economics, they are aided and abetted by Rupert Murdoch’s News Limited, which owns most of the major daily metropolitan and regional newspapers as well as Foxtel and Sky News, and maintains a steady barrage of negative propaganda about renewable energy.

Now the same faction wants to ignore the overwhelming investment preference of the PV market in one of the richest solar provinces in the world, and invest taxpayer’s money into the construction of a suite of new super-critical, but not CCS coal-fired power stations which will keep Australia burning and exporting coal well into the second half of the century.