India’s Ministry of New and Renewable Energy (MNRE) will dig into its pockets for a spare INR 234.5 billion ($3.66 billion) to boost rooftop solar PV deployment in the country over the next few years.

Faced with a daunting 40 GW rooftop installation goal by 2022, the MNRE hopes to dramatically build upon the current cumulative installed rooftop solar capacity of just over 1.8 GW by offering financial support and incentives to distribution companies (DISCOMs) to assume responsibility of this sector’s growth.

In an official government document outlining the proposal, the MNRE says that the concept, once approved, will replace the current strategy for the National Solar Mission’s Phase-II, which sets out deployment targets through to 2022.

Annually, the MNRE hopes to install incrementally increasing volumes of rooftop PV, growing from a proposed 5 GW in 2017, 6 GW in 2018, 7 GW in 2019, 8 GW in 2020, and 9 GW in 2021. Many industry observers have long held serious doubts whether India can reach such a target given the low base of installed capacity and inherent difficulties – both financial and infrastructural – in identifying enough viable roof space.

The current central financial assistance (CFA) for rooftop solar projects was implemented almost two years ago and generally meets up to 30% of a benchmark or tender cost, whichever is lower. This program has only been eligible for residential and social customers, and not the C&I space. So far, the MNRE says, some 2047 MWp of rooftop capacity has been sanctioned under the program, of which 845 MW has been installed.

The MNRE stresses that it wishes to learn from this program, which has been bedevilled by considerable delays in tendering, involvement of multiple stakeholders, a lack of mandatory notification, a lack of uniform regulation, and cost-cutting measures leading to low quality installations.

To streamline and improve this process, the MNRE will propose that DISCOMs are given sole responsibility to oversee rooftop solar deployment in each state. DISCOMs will be expected to “play a key role in the expansion of rooftop solar and have direct contact with the end user”. Therefore, DISCOMs will provide final approval for installation, manage the distribution network, and oversee the billing interface with the customer.

The MNRE hopes that, because DISCOMs are already “in touch” with end users, ie, homeowners, client acquisition will improve and aggregation costs can be reduced substantially.

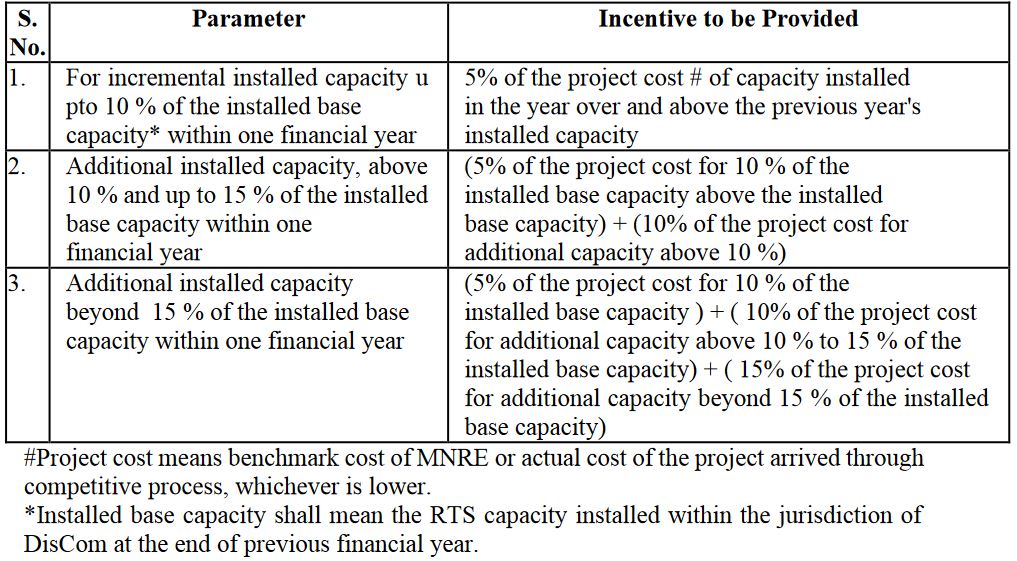

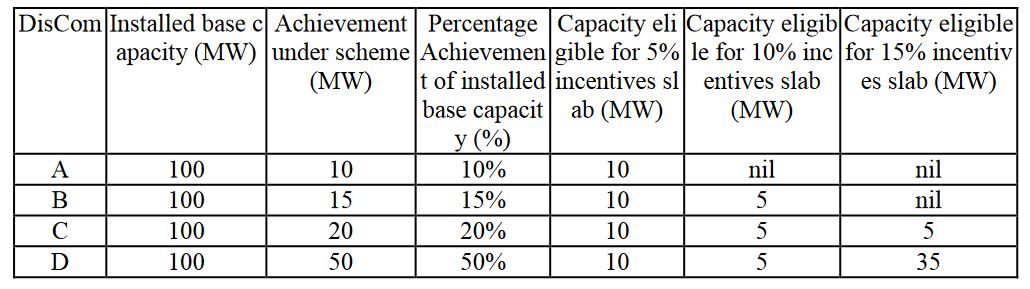

A sweetener for DISCOMs comes in the form of a rather generous financial package being put together by the MNRE in the form of performance-based fiscal support. Such incentives will be linked to every MWp of rooftop solar installed under their jurisdiction.

DISCOMs are being advised to submit to the MNRE the amount of cumulative rooftop solar capacity installed on their patch as of March 31 2018, and this figure will be taken as the installed base capacity for the first year. The incentive proposal will be based on a progressively higher incentive rates, ie, the more rooftop solar installed, the more generous the financial support (see tables).

By sector, the MNRE is aiming for the C&I space to account for 50% of all rooftop capacity by 2022 (20 GW), with government buildings, residential homes, the institutional sector and the social sector each contributing 5 GW of capacity. The CFA will remain eligible solely for the residential sector, the MNRE confirmed.

The CFA for residential installations of 5 kW or smaller will be INR 18,000/kW ($281/kW) calculated at a benchmark cost of INR 60,000/kW provided to DISCOMs by the MNRE. For rooftops in all other sectors, the rate is INR 5,500/kW ($86/kW).

This scheme is poised to be operation until March 2022, the MNRE said. Tenders for rooftop PV capacity per state will be released in February next year, with tariffs set after a reverse auction in March. From April 1 these tariffs will come into force for the next 12 months. All monies due to DISCOMs will be paid out on a quarterly basis.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Scheme is laudable but responsibility with Discoms is the enigma. It is well known that Discoms lack the capability to attract customers and are viewed with suspicion always due to misuse of funds and corrupt administrative brass. Most discoms are debt strapped and are now coming out under UDAY scheme.

Powergrid corporation or REC would have been better to manage the fund and implement the scheme. They have the capacity to race against target and work towards better quality of work coupled with long life.