Despite a decrease in total new clean energy investment, new solar-powered generating capacity in non-OECD countries grew 54% YoY in 2016 and tripled over three years fueled by low-price equipment and innovative new applications.

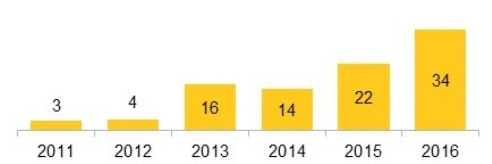

According to the Bloomberg New Energy Finance's (BNEF's) Climatescope report, which assesses 71 countries in emerging markets on their progress made towards the clean energy transition, and reports on clean energy investment in those countries, the total solar PV capacity scaled up from 22 GW added in 2015, and a mere 3 GW in 2011, to 34 GW in 2016, which alone would meet the total annual electricity demands of 45 million homes in India, or of every home in Peru or Nigeria.

Figure 1: Solar new-build in Climatescope nations (gigawatts)

Source: Bloomberg New Energy Finance

Taking on the mantle of leader among the developing nations, China accounted for 27 GW, followed by India with 4.2 GW. Meanwhile, Brazil, Chile, Jordan, Mexico Pakistan, and nine other nations saw installed photovoltaic capacity double or more.

“The massive drop in photovoltaic module prices we’ve seen over the last several years continues to reverberate through developing countries,” said Ethan Zindler, Head of Americas for BNEF. “It's creating opportunities ranging from multi-million dollar projects that serve the grid, to small-scale installations that enable farmers to boost their yields through better irrigation and to connect to the Internet.”

In renewable capacity deployment, new applications such as photovoltaics in micro-grids, pay-as-you-go battery/lantern systems, water pumps, and even mobile phone towers are driving the deployment hike, with start-ups often taking the lead, securing financing from private sources, and forging partnerships with large corporations such as telecom providers. For instance, more than 1.5 million households in Africa now use solar home systems that were bought on a mobile-money enabled financing plan, up from just 600,000 at the end of 2015, finds BNEF.

Overall, solar accounted for 19% of all new generating capacity added in Climatescope countries last year, up from 10.6% in 2015, and 2% in 2011.

Total new clean energy investment in non-OECD countries fell by $40.2 billion to $111.4 billion in 2016, from $151.6 billion in 2015. While China accounted for three quarters of the decline, new clean energy investment in all other non-OECD countries also fell 25% from 2015 levels, the report finds.

Meanwhile, in terms of policy, 76% of the nations have established domestic CO2 containment goals, demonstrating the brisk pace at which developing countries are shifting to renewables. This was also indicated by the World Bank’s RISE (Regulatory Indicators for Sustainable Energy) scorecard, which assessed the energy access, energy efficiency and renewable energy policies of 111 countries earlier this year, and found that developing nations, such as Mexico, China, India and Brazil, are increasingly taking the lead in delivering supportive policies for clean energy adoption.

However, there is still room for improvement, as according to BNEF, only two thirds (67%) have introduced feed-in tariffs, or auctions to support clean energy projects, and just 18% have set domestic greenhouse gas emissions reduction policies.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The good installation numbers are more credible than the disappointing financing ones. Bloomberg can only track financing deals that are public and specifically earmarked for clean energy. As solar in particular goes mainstream, it can tap more other sources of finance. Telcos, local governments, and retail chains can probably finance solar spending out of ordinary revenue or general lines of credit.