There is perhaps no single factor that is driving the exponential growth of solar and wind technologies as much as the continual reductions in cost. Earlier this month consultancy Lazard gave its latest numbers to this phenomenon, reporting that the global mean levelized cost of electricity (LCOE) of solar fell 10% from 2016 to 2017 to reach $50 per megawatt-hour (MWh) for crystalline silicon utility-scale solar.

The consultancy did not provide a mean figure for utility-scale thin-film solar, however the range of prices offered is $43-$48/MWh, and the mid-range here is again 10% lower than in 2016.

This makes utility-scale solar the 2nd-cheapest form of new electricity generation after wind, which came in lower at $45/MWh. These ongoing cost declines of solar allowed it to come in cheaper than combined-cycle gas generation as early as 2015, and according to Lazard in 2017 crystalline silicon utility-scale solar was 17% lower.

And as costs for solar and wind continue to fall, the gap between these renewables and conventional generation in some cases is increasing. This is because the cost of coal is remaining steady, and the cost of nuclear is growing. Lazard reports a 26% increase to $148/MWh in the LCOE for new-build nuclear from 2016 to 2017, which Lazard says reflect increased capital costs at various facilities under construction.

And solar and wind are now not only vastly cheaper than new-build coal or nuclear plants, but are in many cases cheaper than running existing plants.

“In some scenarios the full- lifecycle costs of building and operating renewables-based projects have dropped below the operating costs alone of conventional generation technologies such as coal or nuclear,” reads a press release by Lazard. “This is expected to lead to ongoing and significant deployment of alternative energy capacity.”

U.S. solar costs come in even lower

Lazard’s top-line figures are global and based on unsubsidized generation, and as such the numbers in the United States are somewhat different. When the effects of the U.S. federal Investment Tax Credit (ITC) are factored in, utility-scale solar comes in at $37-$42 per megawatt-hour for crystalline silicon, and $35-$38 for thin film.

It should also be noted that these are national prices for new build projects in 2017, whereas California regulators are reporting solar contract prices of under $30 per megawatt-hour for future projects.

And while solar in the United States has to compete with cheaper conventional generation, most notably cheaper gas due to lower fuel prices, it appears to be up to this task. Lazard’s global LCOE range for combined-cycle gas generation is $42-$78/MWh, although the consultancy notes that prices can go as low as $35/MWh.

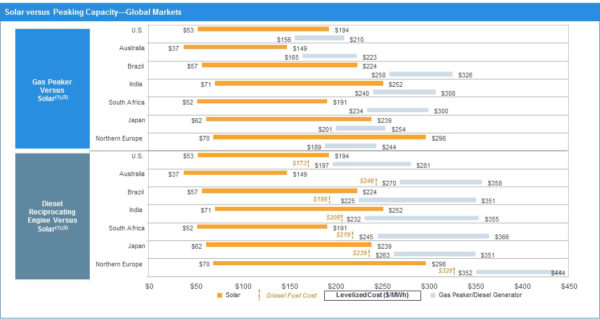

However, solar roughly coincides with peak power demand in most regions of the United States, and even commercial and industrial (C&I) solar is much cheaper than the gas generation used to meet such demand. While Lazard puts U.S. utility-scale and C&I solar at a range of $53-$194/MWh (unsubsidized), this is lower than the $153-$210/MWh that it reports for power from gas “peaker” plants.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Not mentioned, haven’t seen elsewhere: what are operating costs for each type? LCOE covers cost of adding new capacity of a specific type. This counts in cost of the plant plus operations costs, and that’s useful.

The HUGE change will be when adding wind / PV is cheaper than the operations cost of NGCC (natural gas combined cycle = modern gas turbine plants). What are those costs? How are they declining or increasing?

I’m not sure about that comparison, but other studies have found that the cost of new utility-scale wind and solar in some parts of the United States are at or below wholesale power prices, which track gas plant operating costs and the price of natural gas as a fuel.

It’s worth noting that operating costs of wind and solar are extremely low, as we are only talking maintenance and not fuel. These near-zero marginal costs for wind and solar (or less than zero in the United States for wind plants under the PTC) are what makes them disruptive in wholesale power markets.

I don’t see anything in Lazard about operating costs, but slide 11 of the full report (https://www.lazard.com/media/450337/lazard-levelized-cost-of-energy-version-110.pdf) looks at capital costs, and slide 5 talks about sensitivity to fuel prices.