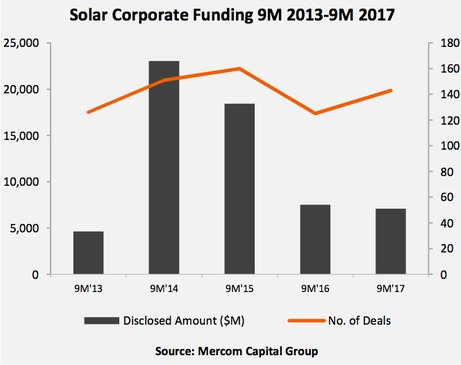

According to its Solar funding and M&A 2017 Third Quarter Report, total corporate funding in the solar sector slipped from US$7.5 billion raised in 125 deals in the first nine months of 2016, to $7.1 billion raised in 143 deals in 2017. Both are a far cry from 2014 and 2015, when both the number of deals and transaction amounts were significantly higher.

Bucking the downward trend, global VC funding for the first nine months of the year rose to $985 million, slightly higher than the $925 million raised during the same period of 2016. Quarterly, meanwhile, it more than doubled in Q3, from $269 million raised in 23 deals, compared to $128 million raised in the same number of deals in Q2.

Downstream is still a favorite among VC investors, with over 70% of the funds, or $193 million, channeled into 13 deals. The lion’s share of this was the $100 million raised by Indian rooftop developer CleanMax Solar.

Overall, strong quarterly increases in total corporate funding were recorded, with Q3 2017 seeing $2.4 billion raised in 45 deals compared to the $1.4 billion raised in 37 deals in Q2.

Debt financing, while falling nearly 6% YoY when $5.4 billion was raised across 55 deals, saw a sharp quarterly increase, from $798 million raised in eight deals in Q2 to $2.1 billion in 18 deals.

Public market funding witnessed both lower YoY – $1 billion raised in 23 deals against $1.2 billion raised in 14 deals in 2016 – and lower quarterly – $79 million raised in four deals against $473 million raised in six deals in Q2 – results.

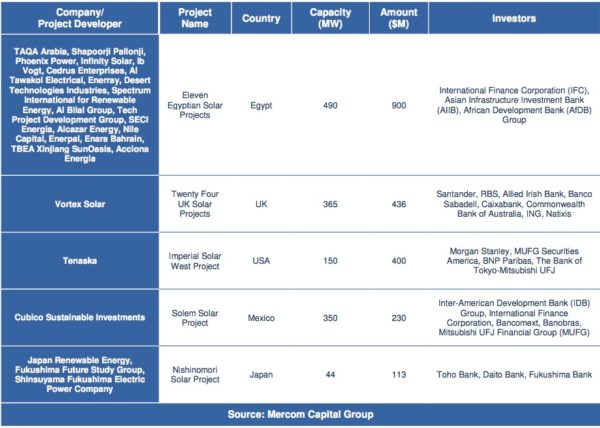

Large-scale project funding also witnessed a significant quarterly drop, from $4.8 billion raised in 48 deals in Q2 to $2.8 billion raised in 36 deals. Overall, large-scale construction announcements in the third quarter reached 15.7 GW across 296 projects. See the table below for the top 5 announced large-scale projects funded by dollar amount in Q3.

Despite recovering in Q2, residential and commercial solar funds fell, with just $400 million raised in three deals in Q3, compared to $1.2 billion raised in four deals the previous quarter.

Looking to M&A activity, the first nine months of 2017 recorded 58 solar M&A transactions, compared to the 48 in 2016. Of this, Q3 saw 18, up from the previous quarter’s 11.

There were 60 large-scale solar project acquisitions in Q3, reports Mercom Capital, compared to 52 in Q2 2017. Meanwhile, a total of 3.7 GW of solar projects were acquired in Q3, compared to 3.5 GW in Q2.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.