Mexico’s Department of Energy (Sener) and the government-run agency Centro Nacional de Control de Energía (Cenace) have announced the preliminary results of the country’s third power auction for large-scale renewable energy and gas power projects.

According to Cenace, the average price of the 16 pre-selected bids is just $20.57/MWh and their combined capacity is of 2.56 GW. Overall, the agency had accepted 46 project proposals in the preliminary phase of the auction. The Mexican government specified that the average price of the bids is the combination of a MWh figure and a clean energy certificate.

Solar may account for around 55.35% of contracted power with 3.0 TWh and 58.31% of clean energy certificates, while wind would account for the remaining percentages for both contracted power and renewable energy certificates. Overall, the auction could award contracts for 5.49 TWh and 5.95 million clean energy certificates. The auction is also open to the turbo-gas technology, which has no share in terms of sale of power and clean energy certificates, but is a prevailing technology in terms of capacity sale, accounting for 500 MW of the 593 MW that will be bought every year (of which solar has only a 10 MW share).

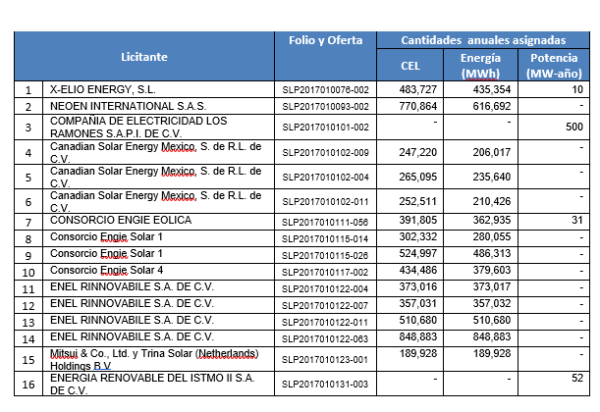

The 16 bids were submitted by, among others, Spanish developer X-Elio (435,354 MWh), French independent power producer Neoen (616,692 MWh), Chinese-Canadian module maker Canadian Solar (652,083 MWh), French energy giant Engie (1,508,906 MWh), Italian power utility Enel (2,089,612 MWh), and a Chinese-Japanese consortium formed by Mistui and Trina Solar (189,928 MWh) .

Furthermore, the Cenace revealed that pre-selected bids may account for 90.2% of the offered power, 97.8% of the clean certificate offer and 41.9% of offered capacity.

The Cenace added that the energy bought in the auction could equate to around 1.78% of Mexico’s annual power generation, and that the construction of the pre-selected projects may require an aggregate investment of around $2.36 million. Selected projects must start delivering power to the local grid by January 2020 and will sell power and clean energy certificates to the country’s power utility CFE and other buyers such as Iberdrola Clientes and Menkent (CEMEX) under a long-term PPA. The auction, in fact, was open for the first time to multiple buyers. A newly created clearing house, with which final contracts will be signed, is managing the buying-selling offers. The auction's final results will be announced on November 22.

In the country’s first two auctions, which were held last year, PV projects with a combined capacity of 3.6 GW were ultimately selected. In both of them, around 1.8 GW of contracts for solar power projects were awarded. In the first auction, the final average price for solar power was $44.9/MWh, while in the second tender the average price for PV was $31.7/MWh.

Mexico's clean certificate scheme, which was introduced with Mexico’s energy reform, will come into force in January 2018. Clean energy requirements have been introduced for both suppliers and large consumers, starting in 2018 with a requirement of 5%. In 2019 the quota will rise to 5.8%. Furthermore, the Mexican government intends to increase the percentage of clean energy certificates covering the purchase of power by local power providers and industrial customers to 7.4% in 2020, 10.9% in 2021 and 13.9% in 2022.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Perhaps, “….the pre-selected projects may require an aggregate investment of around $2.36 billion (not million.) ….”