Indian solar market analysts Bridge to India have issued a report this week that highlights the significant challenges the Indian solar market is currently facing.

Specifically, the Goods and Services Tax (GST) is serving to increase solar project execution costs. Meanwhile, module prices had shot up as bidders now factor in an additional 20% price decline by the end of this year. Chinese module suppliers have even grown reluctant to supply to India while the government mulls an anti-dumping duty petition designed to support domestic solar manufacturers.

However, according to Bridge to India, the most prominent challenge facing the sector is slowing power demand. Lack of visibility over project pipelines is forcing developers to bid for aggressive tariffs and reconsider strategic options, including consolidation.

Bridge to India has analyzed the demand-supply scenario in India’s primary states that contribute to the solar market, and raised concerns regarding future PV growth.

The ten largest states in India have power consumption higher than 50 billion kWh each, and together, they account for 75% of India’s total power demand. These states, located mainly in central and southern India, should also account for the bulk of solar power demand.

Five of these states – Karnataka, Andhra Pradesh, Tamil Nadu, Telangana, and Rajasthan – have led sector growth so far and tied up more than 3 GW of solar capacity each. Madhya Pradesh and Punjab have tied up another 2 GW and 1 GW respectively. These seven states together make up for over 80% of India’s total installed and pipeline capacity of 27 GW.

They have front-loaded their solar power demand and are well ahead of their annual targets, determined by the Ministry of New and Renewable Energy (MNRE). Solar activity in these states is inevitably expected to slow going forward, and indeed, some of them are already canceling ongoing tenders because of these conditions.

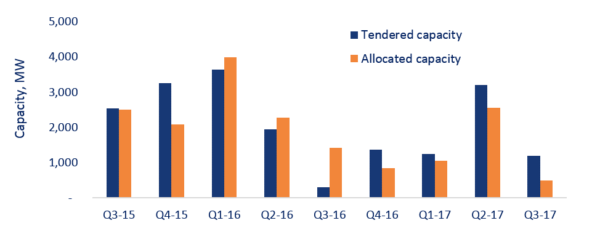

Source: Bridge to India research

In contrast, combined installed and tendered pipeline capacity of the three largest power consuming states of Maharashtra, Uttar Pradesh and Gujarat, is lower than that of Karnataka on a standalone basis.

In May 2017, Bridge to India predicted that Uttar Pradesh could be a dark horse for India’s new solar allocations. Since then, the state has issued a 750 MW tender under a SECI scheme and is believed to be considering further bids.

Maharashtra’s power consumption is almost three times that of Andhra Pradesh, but its installed solar capacity is just one-third in comparison. Gujarat, a solar frontrunner back in 2012-13, is also lagging behind. It has added a mere 211 MW in the last two years.

Unfortunately, the prevailing power surplus situation in India suggests that slowdown in solar power demand may continue for three to four years, say the analysts.

Hence, Bridge to India predicts that utility-scale solar capacity additions will peak this year (at about 8 GW) and then stabilize at a much lower 5-6 GW per annum until at least 2020.

However, rooftop solar is expected to provide some relief by continuing to grow at a healthy rate, becoming a 3 GW per annum market by 2020.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.