The regional development bank estimates that emerging markets throughout Asia are facing an infrastructure funding shortfall of roughly $26 trillion through 2030. “This necessitates crowding-in private sources to meet financing, efficiency and technology gaps,” the ADB says in its new Catalyzing Green Finance report. “However, a lack of bankable projects is a major hurdle.”

It advocates the use of the so-called Green Finance Catalyzing Facility (GFCF), which is a blended financing framework that state actors and development institutions can use to more effectively gain access to development funds. The GFCF should be a comprehensive package backed by governments to expand green finance capacity and support the development of renewables and other infrastructure-related projects.

“The GFCF provides useful inputs for the current debate on mainstreaming green finance into country financial systems,” the ADB says. “It provides a vehicle for leveraging concessional funds, and explicitly aims to crowd-in private sector finance.”

The ADB advocates a blended finance approach, as concessional finance can be used in the initial, relatively riskier stages of project development. Then commercial or semi-commercial sources of finance can be leveraged later in the project development process.

“It proposes a new role for government funds, not as a capital asset financier but as an operations revenue/returns guarantor, which reduces the upfront financing burden from governments,” the ADB explains.

“It explicitly links flow of funds to actual achievements of green benefits through defined targets and indicators — if these targets are not met funds will not flow, making the GFCF a performance-linked facility. It proposes the valuing of green benefits that can be difficult to quantify and are often not valued, or not valued sufficiently by introducing a minimum revenue guarantee payment, to ensure projects meet a specified rate of return over their lifecycle period.”

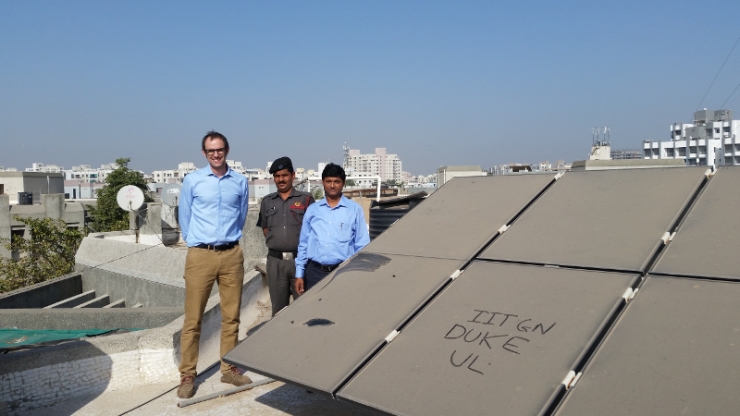

GFCF-backed initiatives could help to provide financing for a range of energy projects, including solar installations and wind farms. The ADB argues that such blended financing frameworks can help to mitigate risks that usually scare off private investors. However, governments also need to facilitate the development of pipelines of bankable, environmentally friendly infrastructure projects to directly spur private-sector investment.

The ADB believes that it is important to provide funding for small initiatives, rather than solely focusing on large green infrastructure projects, as lower-profile endeavours can help to “catalyze models of technological, economic and social approaches to transformative change.” It points to a proposal submitted last year by French transport infrastructure builder Colas to construct the Wattway, a 1,000-km road covered with polycrystalline solar panels, as a key example.

The ADB also notes how Canada, Indonesia and India have pioneered the idea of national funding vehicles to provide financing. In particular, the Indian authorities have encouraged the participation of private-sector funds in financing infrastructure projects by providing government and state-guaranteed public funding under the Viability Gap Funding Scheme (VGF). According to the terms of the scheme — which was started in 2004 to facilitate the formation of public–private partnerships — the government provides a 20% to 40% concessional finance incentive to help make public–private partnership projects more bankable.

“The mechanism is shown to have catalyzed a large number of infrastructure projects and could also be used in the green finance sector,” says the ADB. It argues that the scheme shows how governments, via innovative policy initiatives, can help to mobilize private capital for infrastructure projects.

In India, where PV developers are struggling to cover project costs in the face of declining solar tariffs, the central government has championed the use of VGF schemes to support the development of 5 GW of grid-connected solar capacity. VGF is being provided under the fourth batch of the second phase of the National Solar Mission, for example.

“VGF provides the government grant funds to support infrastructure projects that are economically justified but fall short of financial viability,” the ADB explains.

In particular, the regional development bank believes that such national financing vehicles can be used to bridge the financing gap to provide funding to environment-focused projects such as solar projects. As it notes, such state-directed methods are critical to governments being able to meet their Nationally Determined Contributions (NDCs) under the Paris climate accord.

“It requires green finance, the linkage to green projects, policy and regulatory reform, as well as institutional and technical capacity building, for governments in developing countries to build much-needed domestic systems for the access, management, and deployment of green finance,” said the ADB. “On the other hand, without a ready pipeline of well-developed, bankable projects, national financing vehicles will not be able to bring green finance to actual projects.”

The GFCF could also be used to raise funds for solar projects via the issuance of green bonds.

“Green bonds could be issued to either capitalize the GFCF, or to finance specific underlying projects,” the ADB says. “Examples would be single project bonds that provide exposure to specific low-carbon projects, or bonds that directly fund asset portfolios in offshore wind, solar energy, energy efficiency, or even the GFCF itself. Green equity issuance would allow the GFCF as a vehicle to provide investment opportunities to institutional investors in a diversified pool of projects structure and may thus be attractive, in a similar fashion to an Investment Trust Vehicle structure.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.