The International Finance Corporation (IFC) has invested INR 6.6 billion ($103 million) into L&T Infrastructure Finance Company Ltd. via taking out a subscription in the first market-approved Green Bonds issue in India.

The Green Bonds were introduced into India by the country’s Securities and Exchange Board of India (SEBI) on May 30, and allow investors to have their bonds qualified as Green when proceeds are used in the development of projects that support India’s renewable energy infrastructure.

This is SEBI’s first Green Bond issuance, and is expected to act as a catalyst for similar programs, particularly as solar development has some way to go if India is to hit its 2022 target of 100 GW of solar installations.

An additional $2.5 trillion in funding is estimated to be required to enable India to meet its climate mitigation targets by 2030

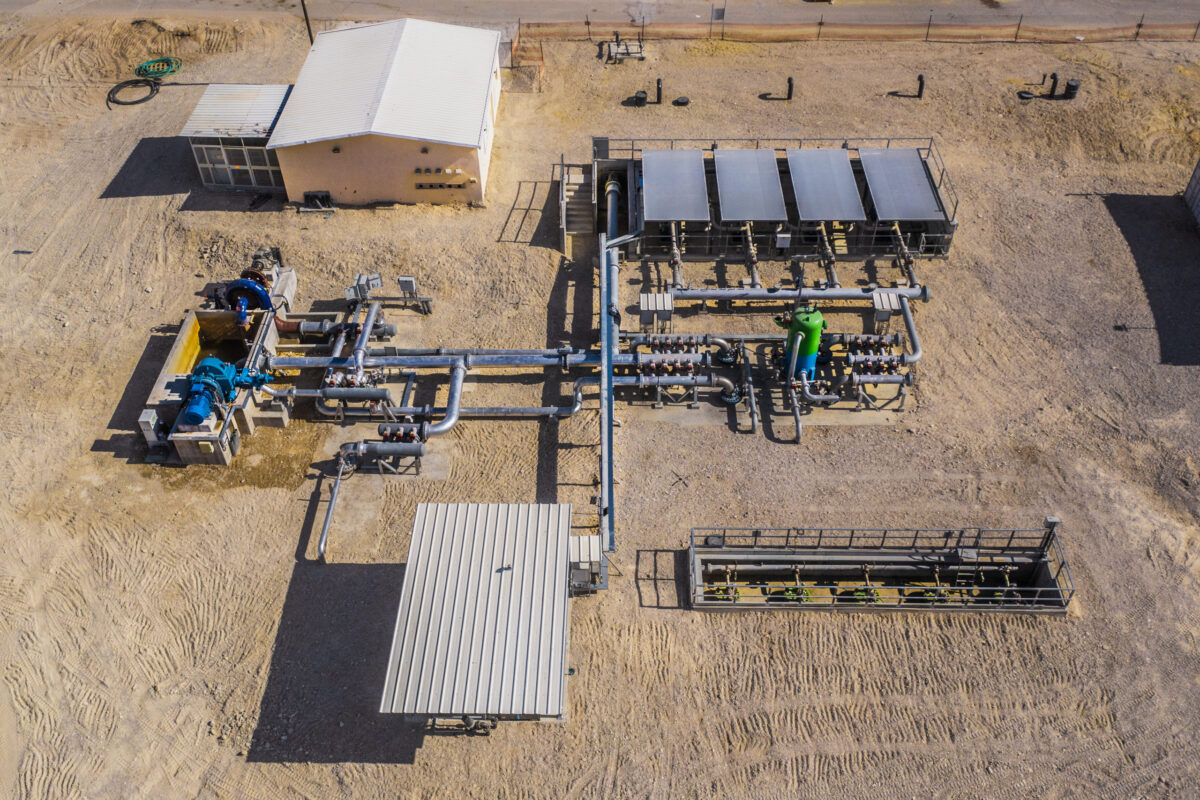

The IFC intends to increase its investment in India’s soaring solar sector, and thus L&T Infrastructure Finance will utilize the funds to provide loans for the development of solar power projects.

IFC has already invested more than $1.2 billion in India’s clean energy and climate-friendly sectors, and has also partnered with Indian conglomerate Tata Group to create the first private sector green investment bank in India – Tata Cleantech Capital Limited.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.