The Kyoto-based group has confirmed that it has gradually scaled back production at a facility in Mie prefecture, near the city of Nagoya, since last year and now no longer produces PV modules at the site. The company has shifted output from the Mie factory to a plant in adjacent Shiga prefecture, in addition to a facility run by an undisclosed Japanese subcontractor.

“It is a structural reform to continually expand our business and not a downsizing of our business,” a Kyocera spokesperson said by email. “We are not necessarily reducing our production amount.”

However, the company’s competitors — including thin-film PV specialist Solar Frontier and Panasonic — have scaled back module output in Japan over the past year or so, underscoring falling demand for PV systems in Japan, in line with revisions to the government’s feed-in tariff (FIT) system and the introduction of an auction system for projects above 2 MW in size.

In January, Kyocera reported a third-quarter net profit of ¥34,699 million ($311.9 million), up sharply from ¥8,712 million during the same period a year earlier. It performed strongly — largely on the strength of its automotive and communications components businesses — despite what it described as falling demand for PV systems in Japan.

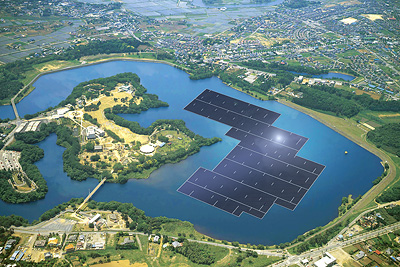

The company — which will release its fiscal 2016 results on May 1 — has been involved in some of Japan’s highest-profile solar installations in recent years. It built the 70 MW Nanatsujima project in Kagoshima prefecture, which was among the country’s biggest solar arrays when it was completed in 2014. And it aims to finish building Japan’s largest floating PV array — a 13.7 MW installation on a dam in Chiba prefecture — at some point in the current fiscal year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.