IDFC Alternatives, a unit of India-based infrastructure-focused lender IDFC Ltd, stands ready to allocate around US$200 million in order to acquire First Solar’s 200 MW assets in India.

Earlier in March, Mint reported that First Solar was contemplating the sale of around 200 MW of its Indian project portfolio, which totals 260 MW located in the states of Andhra Pradesh and Telangana.

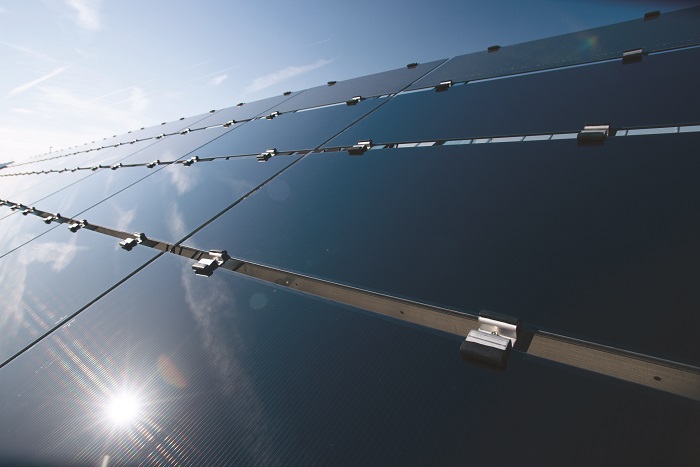

The U.S. vertically integrated solar company was one of the first foreign companies to enter the Indian solar market, and in terms of total shipments it counts the country as its second-largest market, having supplied over 1 GW of panels.

News about the competitiveness of India’s market keeps rolling in, with the latest lowering of the price floor of $0.0494/kWh in NTPC-tendered auction of 250 MW grabbing the headlines.

With its cumulative solar capacity constantly on the rise, India seems set to remain a hive of solar activity in the year ahead, as it prepares to overtake Japan as the world’s third largest PV market.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.