Reams and reams of copy have been written about Turkey over the ages. This curious country holds the (un)enviable position of straddling east and west, both a buffer and a bridge between Europe and the Middle East, and a source of much hope and frustration for the lands and cultures that lay either side of it.

Within Turkey there is division or harmony – depending on where you look and to whom you speak. But this fascinating country equally holds many truisms: it is beautiful, diverse, dripping in history and blessed with some of the highest levels of solar insolation in the world.

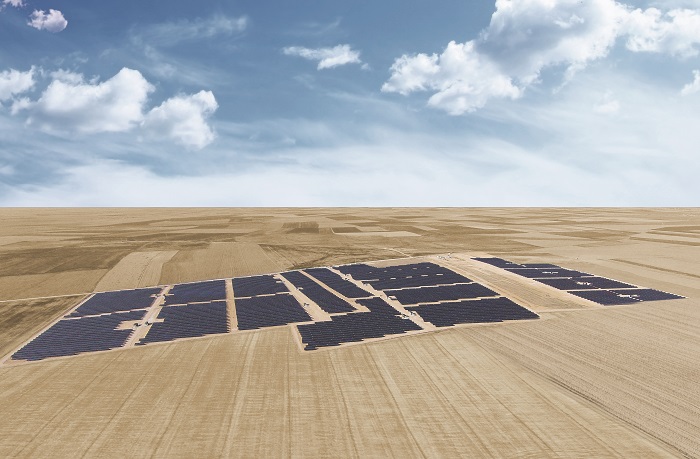

That Turkey’s abundant solar resource has long been ever-so-slightly out of reach for international developers has been a regular source of consternation. But the era of unfulfilled Turkish PV potential could be coming to an end following the confirmation this week that Hanwha Q Cells, the South Korean solar giant, has entered into a partnership to develop the 1 GW solar plant in Konya after winning the government’s tender with a bid of $0.0699/kWh.

Collaborating with local firm Kalyon Enerji, Hanwha Q Cells’ presence in the Turkish market has been welcomed by local analysts who believe that such a recognizable and respected candidate could help usher in greater international interest in Turkey’s solar sector.

As part of the tender win, a 500 MW PV factory will also be built, handling everything from ingots through to solar modules.

Götz Fischbeck of Smart Solar Consulting believes that this deal could mark the beginning of a new manufacturing landscape in Turkish solar.

“The key issue of this investment from the government’s perspective is to establish state-of-the-art PV manufacturing know-how in Turkey with the hopes of this being the nucleus to further growth of PV manufacturing in the long run,” Fischbeck said. “If we foresee global annual PV demand as greater than 100 GWp by 2020 and greater than 150 GWp by 2025, I do not expect that +90% of these volumes will only originate from fabs in China and Taiwan.

“Through a combination of import duties or local content requirements/incentives we will eventually see a manufacturing landscape emerge where we will also have a number of GW-fabs outside of China/Taiwan. What portion of global PV production will be outside of the traditional production hubs in the future very much depends on future developments in international trade relations. Right now we experience a time where more nationalistic and protectionist policies are gaining popularity in many countries around the globe. How far this will go I have a hard time to predict at this time.

Just because the domestic production might not be able to reach the same low costs compared to the leading global manufacturers doesn’t mean that solar electricity from local producers would not still be the most affordable source of electricity in comparison to other technologies. If you then factor in the benefit of local jobs, tax revenues, own competencies etc., I can see why politicians have a high interest in pushing such deployment models (i.e. forcing foreign companies to share their technological and manufacturing know-how). After all, China has very successfully employed this model in many industries over the past 20 years.”

Up on the roof

Over in the U.S., the solar industry remains seemingly forever in the throes of crisis, breakthrough, evolution or all three. Such is the climate of uncertainty created by President Donald Trump. Viewed dispassionately and from afar, however, the market is a relative beacon of good sense, with stable growth in utility, C&I and residential sectors pretty much a given for the next 18 months.

Enphase Energy, the California-headquartered microinverter specialist, is eager to tap into this sense of calm with the launch of its new IQ microinverter, which was rolled out to the U.S. market this week. The company claims that it is a game-changer in terms of installation, but the big change is likely to come later this year when leading module providers such as LG, SolarWorld and JinkoSolar begin shipping their AC modules, complete with the new Enphase microinverter already embedded at the factory.

French fancy

Turkey’s 1 GW solar plant is not the first in the region to attract international attention, with Dubai’s 1 GW Mohammed bin Rashid Al Maktoum Solar Park also turning heads the more it develops.

This week it was confirmed that EDF Energies Nouvelles, the renewable energy unit of French power utility EDF, will join a Masdar-led consortium to build the third, 800 MW phase of the plant. Spanish firm GranSolar and Saudi Arabia’s Fotowatio Renewable Ventures (FRV) are already on board, and EDF’s involvement brings yet more international flavor to the project.

EDF said that the first 200 MW unit of Phase III is due for completion by April next year, while another 300 MW is expected to come on stream in April 2019. The final 300 MW unit is scheduled to come online in April 2020. More details on the terms of cooperation were not provided.

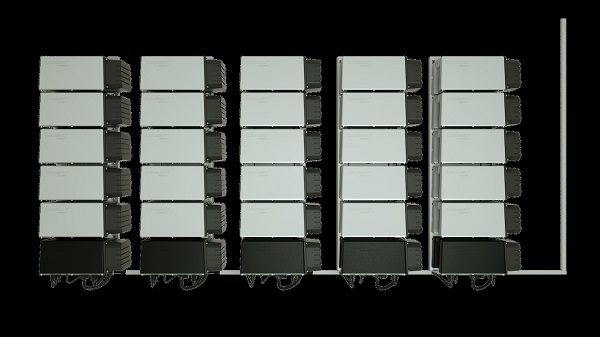

Solarwatt’s modular storage system

Germany’s Solarwatt has this week launched a fully-modular battery storage system that it claims will be suitable for installations ranging in scale from small residential up to commercial and industrial rooftops.

Called the MyReserve Matrix, the new system comprises two individual units, the MyReserve Command unit, which incorporates the power electronic components, and the 2.2 kWh battery MyReserve Pack.

Solarwatt has introduced a new highly flexible battery product to the fast-moving solar+storage market. The Solarwatt MyReserve Matrix separates the battery cells from the power electronics, to result in a system that can be scaled to a range of end users, installed and serviced with relative ease, and even scaled over time, as household or business energy needs change.

Up to five 2.2 kWh battery packs can be coupled with a singe Command unit, delivering up to 11 kWh of storage capacity and 4 kW of power output. Solarwatt says that this will allow for systems with capacities as little as 2.2 kWh up to 11 kWh on a single Command unit.

And in other news…

Hanwha Q Cells and Canadian Solar both published pretty healthy 2016 annual financials this week, a Stanford University report on U.S. solar caused a few ripples, and Sweden signalled plans to investigate ways to remove building permits for PV in efforts to liberalize the nation’s residential solar sector.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.