SolarWorld, the German solar manufacturer, has released preliminary business figures for 2016 that reveal stable increases in revenue and shipments year-on-year (YOY).

Consolidated revenues reached €803 million in 2016 ($853 million), which is a 5% increase on 2015’s €763 million. Shipments hit 1,375 MW, up 19% on 2015’s 1,159 MW.

SolarWorld’s EBITDA, however, was negative at €-26 million, down from positive €41 million in 2015. Last year’s figures include provisions of €12 million that were steered towards longer-term operating activities that will continue to take effect until 2019.

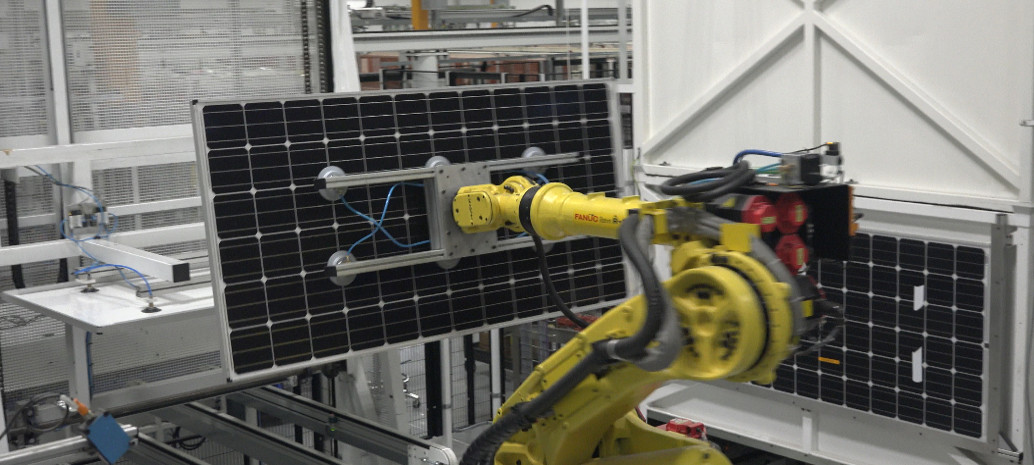

Based on its 2016 preliminary financials, SolarWorld is looking to focus on the development and promotion of monocrystalline high-efficiency products in 2017 as a means of streamlining its competitiveness, the company said in a press statement.

To do so, the firm warns of potential job losses of around 400 between now and 2019 due to considerably decreased expenses in production, sales and overheads. Staff cuts will occur in equal parts production and overheads. However, SolarWorld believes that it can still increase its annual module shipments to 2 GW over that time period.

SolarWorld will, over the course of the year, shut down production of multicrystalline wafers, cells and modules due to their inherent lower efficiencies. Instead, the focus will switch entirely to the production of mono technology and PERC. In an interview posted on the SolarWorld website, CEO Frank Asbeck said that existing orders for multi will be delivered in 2017, but production beyond these orders will cease.

“Whoever buys SolarWorld shall get high efficiency – always,” said Asbeck. “We will compete successfully by focusing exclusively on innovative solar technology with the highest quality, longevity and efficiency.”

As reported last week, SolarWorld is already taking measures to “bundle” its production capabilities. This will include grouping crystal growing and cell manufacturing in Arnstadt, and wafering and module manufacturing in Freiberg. These changes, the company believes, will allow it to reach economies of scale faster, reduce redundancies and simplify its production processes.

SolarWorld’s U.S. production facility at Hillsboro will continue to focus solely on the production of PERC.

“These measures will decrease costs and increase efficiency significantly,” added Asbeck. “Our aim is to come out of a difficult phase for the solar market stronger than before and to raise module shipments to about 2 GW by 2019.”

Asbeck also confirmed that production of glass-glass modules will continue. “In combination with PERC and our further development, the glass-glass module becomes a bifacial module.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.