May 2019: Fridays forever

Since the last reduction in the German feed-in tariff for medium-sized PV systems at the beginning of April, not much has changed in terms of module prices. This is down to unchanged demand in the country – at least in the first days of April. What is more, any local lags in the market are outweighed by steadily rising demand throughout Europe.

Schoolchildren and students all over the world have been taking to the streets on Fridays to protest the inaction of their parents’ and grandparents’ generations. Young people no longer want to accept the frivolous endangerment of their livelihoods on this planet. Facts about the causes and effects of the ongoing destruction of the environment have been known for decades, but beyond high-minded declarations no one has taken decisive action. Carbon emissions and the resulting rise in atmospheric temperatures, the littering of the world’s oceans, the extinction of species – it all continues unabated.

Fridays for Future

What Greta Thunberg began with her “Skolstrejk För Klimatet” in August 2018, which the global public then became aware of after her impressive speech at COP24 in December, has now grown into a massive global movement, which operates under the name “Fridays For Future (FFF).” Even Barack Obama recently praised the young people’s commitment during a visit to Berlin, albeit with a typical appeal to moderation: “When I was a young activist, I always wanted one hundred percent success,” but, he continued, it turned out that this was not possible, and that compromise was the main thing in a democratic and open society.

This may be the right approach, but if the compromise is to be anything other than lazy or minimal, negotiations have to start with radical or outrageous demands. So-called ‘realistic’ demands of one side in combination with egoistic or even inflated demands on the other invariably lead to results with which the other side can often live very comfortably, since in the end it hardly has to make any concessions.

Package of measures

This is the students’ reaction to criticism that their protests lack substance as long as they fail to formulate demands or solutions. A package of measures is now on the table. The starting point is to limit global warming to 1.5 degrees, now a broad consensus. From this, the students deduce that Germany must bring its CO2 emissions to net zero by 2035 and completely shift its energy supply to renewables. The coal phase-out should be completed by 2030. A quarter of the country’s power plants would have to be taken offline this year. In addition, the activists demand all subsidies for fossil fuels be abolished by the end of the year, and all greenhouse gas emissions be taxed at €180 per metric ton.

Of course, there was a prompt outcry from both conservative and liberal parties as well as industry associations. The demands were called unrealistic, there were still no viable alternatives, and Germany’s status as a business location would be endangered – the same old story. But Germany’s future is in danger anyway, if ruling parties and major corporations do not change course, making a rapid switch to low-emission power generation, e-mobility, and other forward-looking technologies in the age of digitalization. Instead, they stir up fear of the economic supremacy of China, a country already more advanced in all these areas and presumably striving for world domination.

In this respect, it is a good thing if we push for more ambitious steps, a whole generation goes on strike until something moves forward. The easy road and conformity were yesterday. The young generation seems to understand that prosperity at the expense of one’s own future is not a real option, and certainly not a desirable one. What conclusions can we “old folks” draw from this?

Well, why not support the protests and put our full weight behind them! Let’s motivate our children and young family members who have not yet become active to join the FFF movement. We can also offer more solutions in the form of new, interesting, and forward-looking business models, products, and approaches.

Greta will certainly not end her school strike yet. A premature abandonment would mean surrender to the incompetence of their parents’ generation and a betrayal of their own future.

Most who have done little or nothing about climate change to date will not experience the most drastic consequences themselves. There is little incentive in our egomaniacal and narcissistic society to move out of our much-loved comfort zone. Our children, however, will suffer terribly, one day wondering if what they learned in school or vocational training will help them to develop adequate survival strategies. Protests are generally still peaceful, but could soon become more radical to attract greater attention and put even more pressure on the public, business, and politicians. School’s out on Friday! Is school out forever?

Martin Schachinger, pvXchange.com

April 2019: Clash of the titans

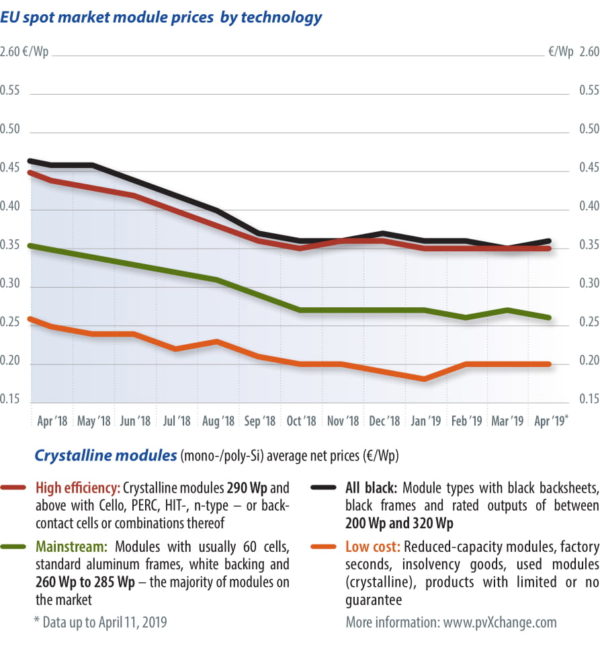

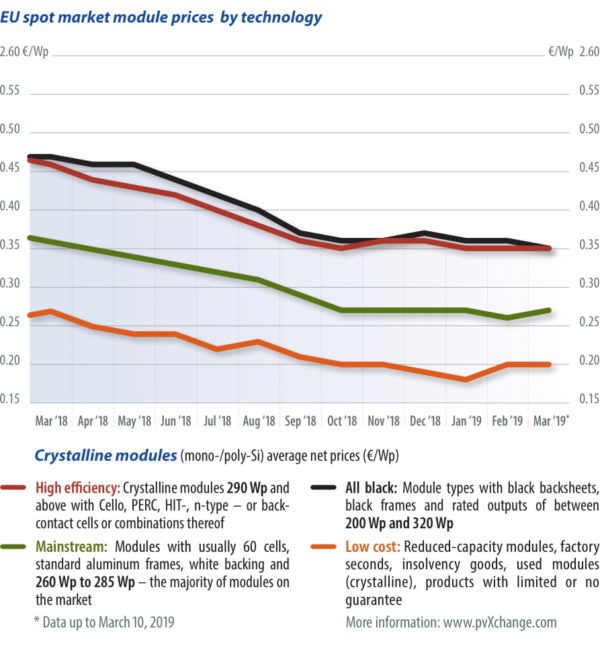

The current market situation, at least for Central Europe, can be summarized as follows: same old story. The price level has neither changed over the past month nor has the general availability of the different module types improved – on the contrary.

Whereas last month it was still possible to order relatively reliable multicrystalline modules for short-term delivery from many suppliers, as early as the beginning of March, even for ‘mainstream’ modules, buyers were put off until April, May, or even June. This is unfortunate for those in Germany who have to connect to the grid by the end of the month to qualify for the current FIT. Starting in April, rooftop systems between 40 and 750 kW covered by the German EEG will be remunerated at just €0.089/kWh – not, as previously threatened, the same rate as ground-mounted systems, but not much higher.

Since there is not much to report on the price front at the moment that I have not already covered previously, I want to turn my attention to the manufacturers themselves and their strategies. In view of the filing of patent lawsuits by Hanwha Q Cells against three of its competitors – not only has it become the center of attention, but also JinkoSolar and Longi Solar have found themselves in the spotlight. REC Group is also known to be involved in the dispute, but I will only refer here to the three companies with production capacities beyond 7 GW, all of which aspire to or are trying to defend market dominance – a clash of titans.

The manufacturers under attack report, however, that they have only heard about this lawsuit through the press. Apparently, none of the defendants had received any mail from the courts as of mid-March. Nevertheless, more or less detailed position statements by the companies are already circulating. Of course, the question arises as to why this dispute is being made public at such an early stage of the dispute. Is this a calculated step or just an embarrassing misstep? What does Hanwha Q Cells expect to gain from this frontal attack on some of its biggest competitors, especially in a lawsuit with an uncertain outcome that could drag on for years? Hanwha Q Cells seems quite confident that it was a pioneer in PERC technology with its Q.antum cell introduced some four years ago and that rivals have merely copied it. The latter reject the accusation, insisting that they concurrently developed this technology themselves and are permitted to use it lawfully.

Aggressive strategy

Whether Q Cells has the resources to survive the dispute to the end is questionable. It is possible that parent company Hanwha, which is worth billions, will have its subsidiary’s back. Products already on the market from JinkoSolar, Longi Solar, and REC are unlikely to be banned under any circumstances – users of these products can breathe easy for now.

Q Cells, the former European industry leader, has been forced to play catch-up with a huge amount of market share since its collapse and insolvency in 2012, shares that have since been lost to the competition. It has already been quite successful, however, thanks to an aggressive product and pricing policy and, not least, the financial opportunities offered by the involvement of Hanwha Group. At least in Germany, Q Cells is already the market leader again with a share of nearly 30%. But at the European level the situation is no longer as clear. JinkoSolar in particular is making inroads into the market. The group has been leading the BloombergNEF list of the largest and financially strongest cell and module manufacturers for a good year now, and it intends to maintain its position in the global market. There is also the newcomer Longi Solar, which, thanks to its consistent growth strategy, has made it into the top 10 producers by capacity within a very short time. So, is it a coincidence that these two companies are among the defendants?

Has Hanwha Q Cells perhaps overreached in the cutthroat competition? Has the group grown too fast, hired too many staff, and accepted too high development and production costs at a time when module prices started their nosedive last year, and thus developed an acute profitability problem? Acerbic voices mutter that the company would be better served putting its own house in order and learning to deliver reliably before entangling itself in protracted legal disputes. Well, perhaps that is precisely the key to finding a way out of the downward price spiral; namely, to have the competition indirectly bear the cost of the development and launch of patented products on the market.

This could be a dead end, however, given the length and complexity of this type of litigation. The current respite in the steady decline of module prices could soon be over. When that happens, other survival strategies will be needed apart from lashing out in all directions. How about high-quality, inexpensive, and, above all, readily available products?

Martin Schachinger, pvXchange.com

March 2019: Groundhog Day…

Numerous indicators point to an impending sharp decline in PV installations, at least in Germany, after March 31.

Availability is poor, prices have largely stagnated since the beginning of the year, and manufacturers have postponed or canceled promised deliveries from Asia. As a result of monthly reductions in feed-in tariffs, we are now seeing a full-fledged run on the few lots of modules still available on short notice. With each passing month, anxiety mounts over whether urgently needed components will be delivered on time. When deadlines are broken, installers face harsh contractual penalties, while system operators rack up major losses. Yet module producers seem to be taking all this in stride.

The eternal pork cycle: Initially, the PV market develops well, with installations almost reaching the level for a healthy industry. Then some institute or other detects overfunding, and drastic measures ensue. The market plunges into turmoil, and the scramble begins to snatch up the last affordable stocks. Resupply can be slow, and subsequent shipments are generally no longer at prices that make new installations viable. Since Europe is not the center of the PV world, manufacturers tend to wait and see how things shape up, preferring to focus on less volatile markets that promise better margins.

Once the pain is sufficiently high in Europe, and installers are prepared to pay inflated prices and forgo returns as the cost of doing business, deliveries resume. This, at least, is the apparent market strategy that some top manufacturers have adopted in the short term. Some module types will presumably not become available with any reliability until June or July, the claim being that factories are working at full capacity to fill pre-orders, according to information from Canadian Solar, JinkoSolar, JA Solar, and Suntech, among others. But modules manufactured up to that point will not all flow to Europe – quite the contrary. Deliveries are diverted or held back to serve preferred markets in Asia and the Americas. In this sense, the market over the next few months will look much as it did in mid-2017, late 2015, and early 2014 – that is, every 1.5 years or so, installation figures will drop off a cliff.

EEG in trouble?

In Germany, the guaranteed FIT in the mid-range system segment will be so low that if material and installation costs remain flat or rise, plants financed under the Renewable Energy Sources Act (EEG) will struggle to turn a profit. However, regulatory hurdles and contractual challenges for tenant power models or PPAs are too high even to attempt, especially for smaller players. Calls for abolition of the EEG are becoming increasingly loud. People are hoping for independence from political whims and what they see as wrong-headed decisions. The media celebrates the first ground-mounted systems that get by without any government-guaranteed funding, but are these utility-scale plants a blueprint for what awaits us in the post-EEG era? I’m afraid not. As far as the broad feasibility of such a concept is concerned, we are only at the beginning. These are important lighthouse projects, but their significance is already dubious.

Without the security of government funding, medium to large investments will no longer be viable. Banks will make a wide berth around any investment in PV where repayment will be secured solely by the creditworthiness of the customer, especially for commercial systems for which long-term use is not assured. So how might an alternative to today’s EEG look? Should the future belong to tenders? Karl-Heinz Remmers recently told me that he could imagine this if accompanied by further smart measures to support the market, but he does not expect anything substantial from policymakers on this issue, even in this legislative period.

We, the renewable energy specialists and stakeholders, should contribute as many intelligent ideas and concepts as possible to avoid a further sustained slump and hand yet another victory to those bent on delaying a rapid phase-out of coal and nuclear.

Martin Schachinger

pvXchange.com

February 2019: The snow keeps falling – module prices do not

After a uniquely pleasant but dry summer and autumn, it has been raining and snowing in central Europe for weeks with no sign of letting up. Judging by sheer volume, the god of precipitation apparently wants to make up for his neglect of last year.

The weather of late has conjured memories of the catastrophic winter of 2006. PV plant owners are struggling to maintain the stability of their structures, not least because entering their facilities to clear the snow is nearly impossible in these weather conditions.

It is doubtful that thawing modules by reversing the flow of power in winter is a practical solution. Even if a slab of snow can be set in motion, it is unlikely to get past the edge of the roof or its snow guard system. It is also doubtful that this would make sense from an energy perspective. One approach might be a mechanical snow clearing device that could be used to clean modules in the summer. It is exciting to think about innovations we might be presented with in the future.

But what is the market doing now, and how are module prices trending at the start of the new year?

Slow start

For weather reasons, demand has been flat so far. In the Alpine regions, in view of the massive amounts of snow, it is likely that business is just beginning to ramp up. The rest of Europe is likely hobbled by sustained rainy weather, but that said, in parts of Germany installers seem to have started work already. There is also plenty of catching up to do on projects left idle between Christmas and New Year. The next big cut in feed-in tariffs for mid-sized PV plants is coming up, motivating operators to get their new installations connected to the grid.

Most modules delivered since the second week of January, however, were ordered last year. Those just now going shopping for components may be surprised to find empty warehouses and long delivery times – they will not be picking and choosing among brands and products, at any rate. There are still modules and inverters to be had from wholesalers, but almost all the big manufacturers are virtually sold out, and are consoling their customers with news that deliveries will resume in Q2 or even Q3. Supply is particularly bad for high-efficiency mono c-Si modules. In contrast, multi modules are still plentiful, at least on the spot market.

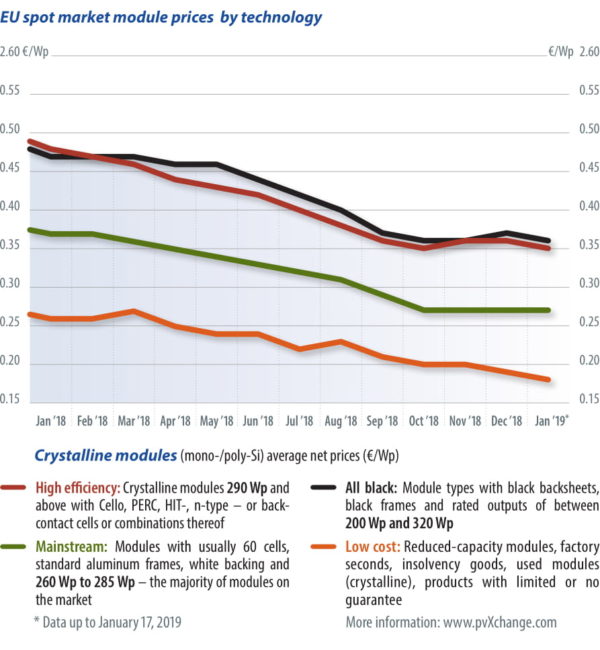

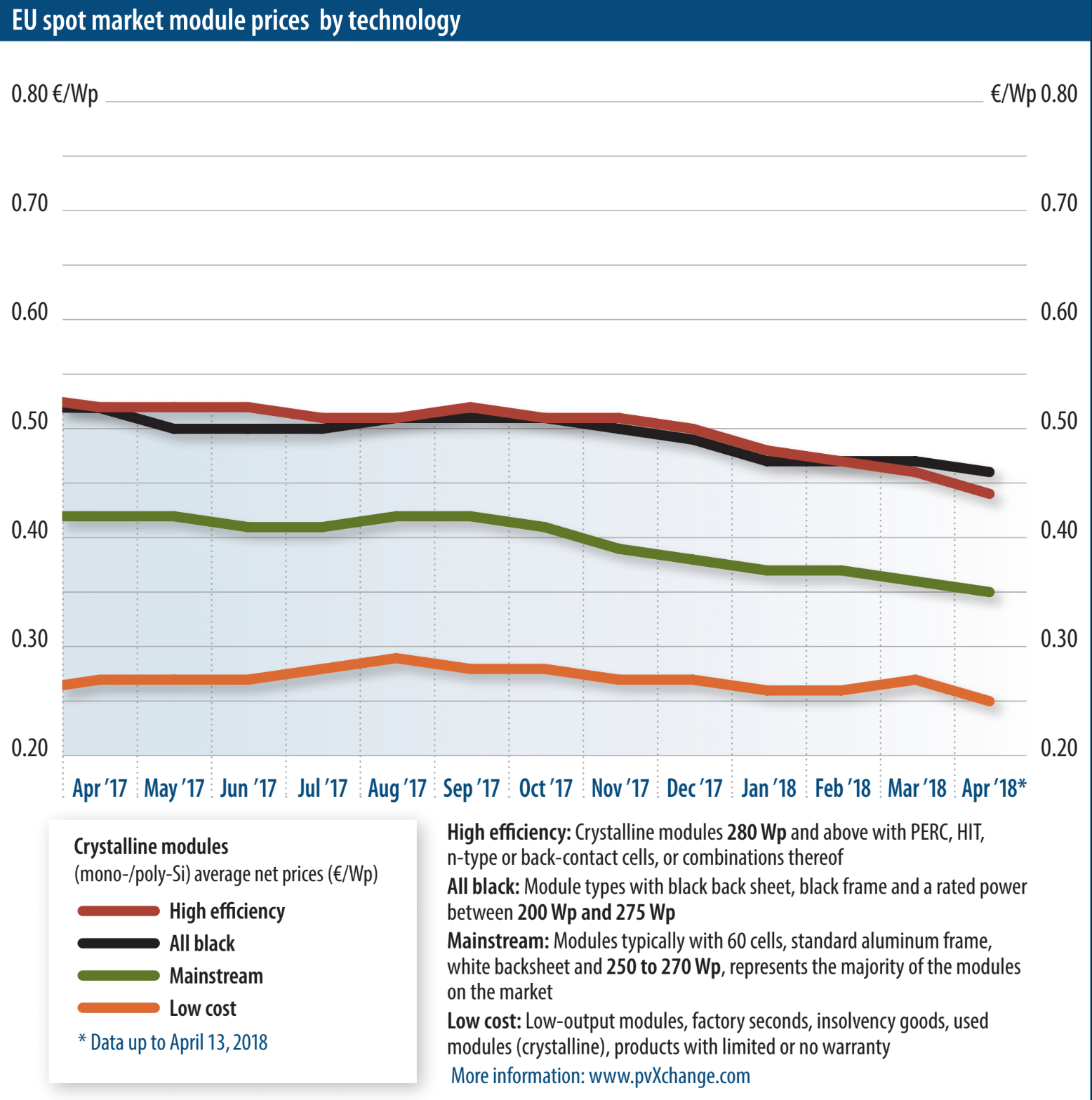

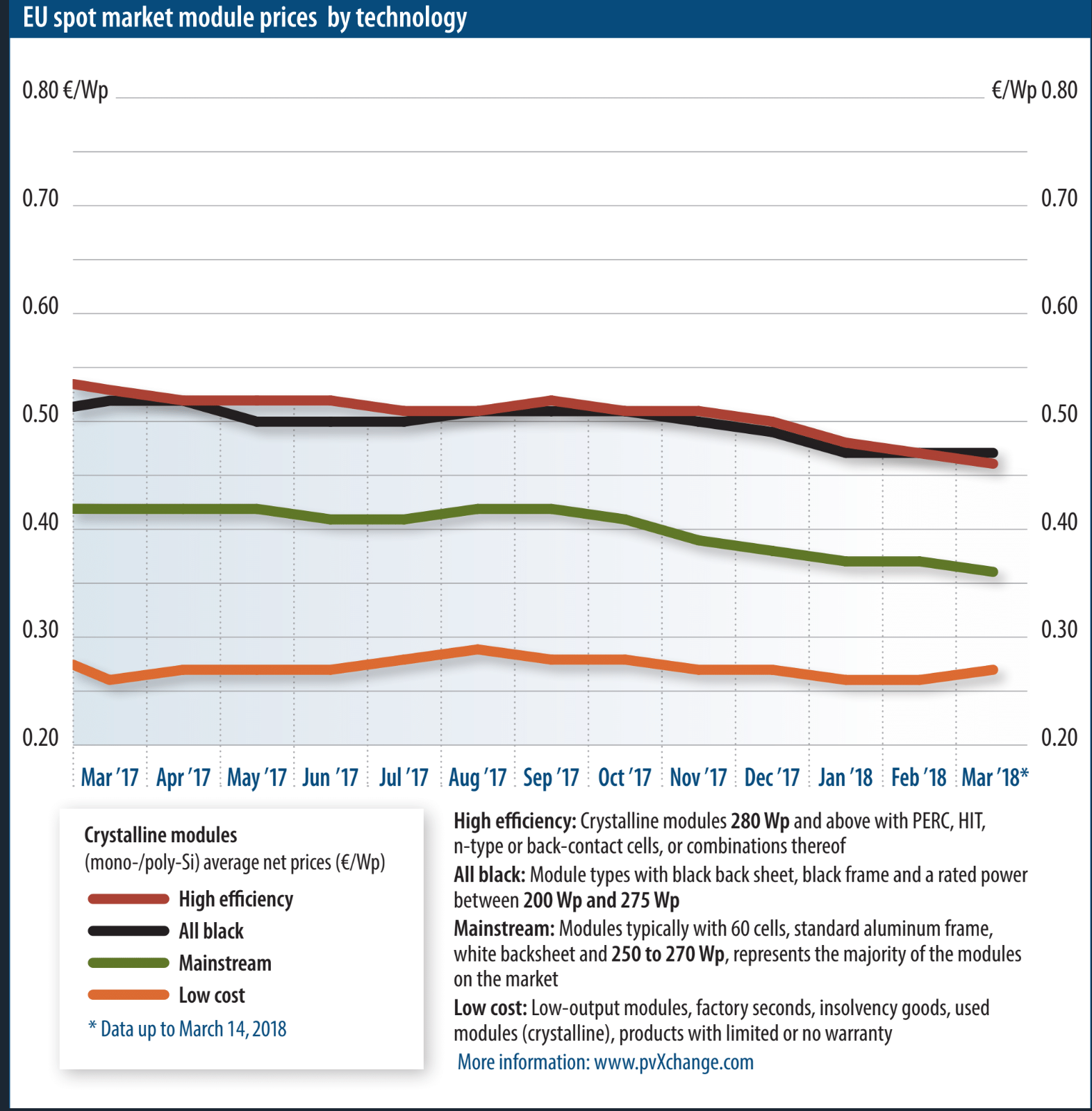

The current situation is not accurately reflected in module prices. While prices for the mostly multi mainstream modules have stagnated, they have actually dropped somewhat over the previous month for mono (high-efficiency and all black). This can be ascribed to the reduction in prices for products branded AUO-Benq, LG, and Panasonic, which until now have been much more expensive. These mark-downs have a greater effect on the average price of this module class than those of other brands. Unfortunately, customers never see much of these slight but visible discounts because in many cases there is no actual availability. Goods available on short notice may be subject to price movements in the opposite direction.

Pushing performance

One more gratifying development is that the general trend in performance classes continues to creep upward. The target at present can be considered to be 400 W. Manufacturers will be judged on which can achieve this first, with a workable product. I have taken this into account and raised the output threshold between the Mainstream and High-Efficiency module groups by 5 W to 290 W.

The trend towards stagnating prices with slight upward and downward fluctuations will be with us throughout Q1. As long as there are no big surprises from further political meddling, supplies should roughly balance with demand. Global demand will also climb at a moderate rate, as no boom is expected in China before the second half of the year. However, it is still uncertain how the German market will develop following the second quarter when the final stage of FIT reductions bite. I anticipate at least a temporary market collapse and associated oversupply, which could lead manufacturers and dealers to correct prices downward. Just when this materializes and to what extent remains to be seen.

Martin Schachinger

pvXchange.com

January 2019: The game goes on

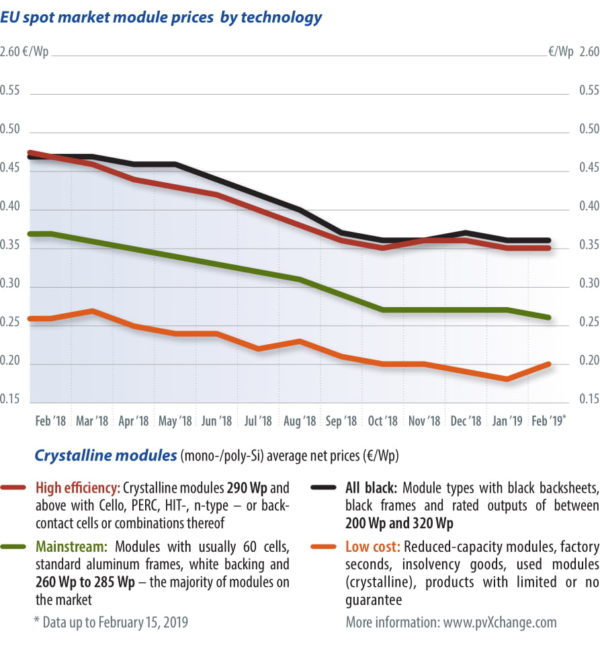

If you want to talk to manufacturers about module prices for 2019 – to submit a binding tender offer, perhaps – prepare to be disappointed. No one knows where the market is headed yet, which is why no one really wants to commit themselves – in other words, planning security is still tending towards zero.

Apparently, the German government's backing off from the short-term cuts to feed-in tariffs in the mid-sized plant segment is still not sufficient inducement for suppliers to ratchet up their capacities or delivery volumes. The deeper cuts to the EEG will now be introduced gradually in February, March and April 2019, rather than as a one-off bump in January. This has done little to calm the market, however.

The forecasts for markets such as Asia and South America also promise continued high global demand and local bottlenecks, with producers speculating on stagnating to slightly rising prices. By way of consolation, the major Asian manufacturers are promising their customers that they will adjust their cell and module prices after the Chinese New Year at the latest; that is, in February 2019.

A glance at 2018 shows that module prices were very dynamic. 2018 was marked by a sharp fall in prices, triggered on the one hand by the cuts in incentive programs in China announced in the middle of the year – which, incidentally, were not as dramatic as initially assumed – and on the other by the abolition of the minimum import price (MIP). After fully five years of market regulation, which the EU Commission believed would counteract price dumping by Chinese manufacturers – a claim substantiated by preliminary investigations – and save the domestic solar industry, the measures were removed in September 2018. Yet their success was modest – hardly any local manufacturer has managed to survive, and the market power of Chinese suppliers is still omnipresent.

The market found its bottom in early October: careening module prices abruptly stabilized. Demand in Europe generally rose after the summer break, which meant that the availability of certain module types threatened to tighten up once more.

The whole situation escalated with the sudden announcement by the German government that it intended to reduce the feed-in tariff for rooftop PV systems between 40 and 750 kWp by 20% to the level of ground-mounted systems as early as January 2019 – allegedly due to excessive subsidies. The resulting commotion in the market eased somewhat once the cuts were ultimately adopted in a more moderate form. Overall, in the fourth quarter Germany achieved very respectable installation figures for new plants, on par with one would actually always wish for, or need, to even come close to achieving the government's self-imposed climate targets.

What’s in store in 2019?

Many tier-1 products are currently either completely unavailable or no longer available in quantities sufficient to accommodate large-scale projects at short notice. The manufacturers in this space say they are sold out until March or April. Although single-digit megawatt volumes are still available on the spot market, customers do not have much choice when it comes to brand selection.

Everything now depends on future developments in regions such as Asia and South America. If demand there persists at a high level – for China an increase of 50 GW or more is already forecast for 2019 – cell and module prices will indeed stagnate in the long term. In Europe, growth is expected to be rather muted again, although some countries are setting ambitious targets for the coming years and announcing new tender models.

Unfortunately, we are still a long way from decoupling market growth from subsidies as long as the regulatory framework for straightforward plant construction under PPAs is still lacking. PV plants that do not require state subsidies or the EEG are still lighthouse projects. The installers of these systems are dependent on the continued fall in module prices, which have yet to materialize.

For 2019, I do not expect any further significant drop in prices, but I do not expect prices to rise either. In the coming months, multicrystalline cells will gradually be replaced by mono-PERC and other highly efficient technologies, leading to some potential savings in the substructure and assembly costs. A revival of thin-film modules is still to come. Nevertheless, there are still far more manufacturers and production capacities beyond First Solar than one might want to believe on the face of it. In the building integration sector in particular, some interesting products are likely to be presented in the near future – so, there is plenty to get excited about!

Martin Schachinger

pvXchange.com

December 2018: Zero planning security

“I’m not installing anymore this year – I’m not going to put myself through that kind of stress.”

You increasingly hear this or something similar when you talk shop to planners or installers in Germany these days. And you can also hear some variant of, “If I order more modules now, can you guarantee me that I’ll actually get them on time?”

In short, there is a simmering discontent in the market that occasionally boils over into all-out anger but also expresses itself as simple resignation. So, what is it that has quashed the generally positive mood so quickly?

Well, the politicians are about to bring about what they apparently prefer to do whenever the tender little seedling of solar again threatens to grow into a stately plant – they trample on it by prophesying horrendous costs for the general public, and feed their prognostications with poisoned water in the form of massive cuts in subsidies, the withdrawal of privileges, and further reprisals, to ensure that all new shoots are certain to die of it as quickly as possible.

Unfortunately, the mere utterance of changes and cuts is now enough to confuse the market and bury any planning certainty. This happened at the beginning of November, when the Federal Ministry for Economic Affairs and Energy announced that the feed-in tariff for roof-mounted photovoltaic systems between 40 and 750 kilowatts peak would be reduced by around 20% to the level of ground-mounted systems by January 1.

It is hardly surprising that an unprecedented run on all resources available this year began. However, since no one was prepared for this scenario, capacities became scarce within just a few days, be it for modules, inverters, substructures, or even installation services. The stakeholders, almost without exception, are currently trying to complete any rooftop systems that are halfway ready for construction this year or to push forward projects planned for next spring. Where this is not possible for whatever reason, projects have been put on ice as a precaution. For investors and the entire development of the solar industry, this situation is a catastrophe.

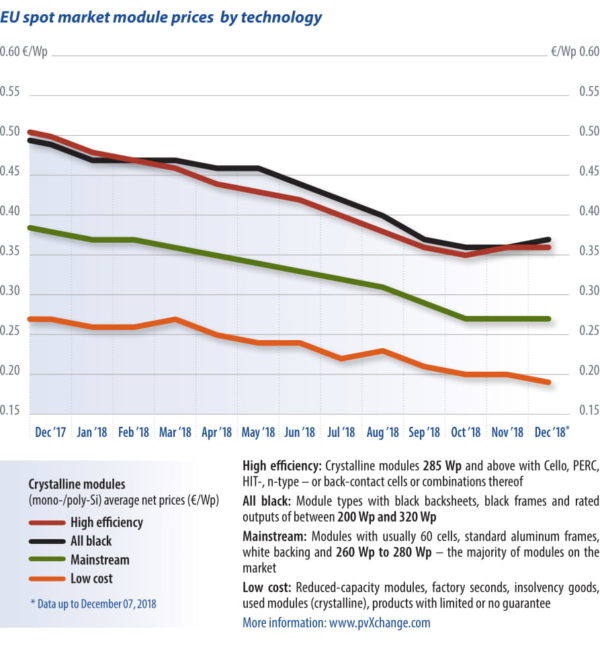

The development of module prices has meanwhile also shown a clear trend towards price stagnation or slight increases. Even before the Renewable Energy Law (EEG) adjustments became known, the major manufacturers had reported an emerging bottleneck, which can be attributed primarily to increased demand in the southern hemisphere and Asia. The few goods still freely available in Europe are now quickly sold out or offered at significantly higher prices. Due to the uncertainty about future developments in Germany, which will continue at least until the next meeting of the Bundestag Economic Committee on December 12, 2018, no reliable statements can be made about the availability and further price development of solar components.

In the spot market at least, we can expect that due to order cancellations, manufacturers and wholesalers will always be able to offer surplus stocks at moderate prices. These prices are likely to fall as the Christmas season and the end of the year approach. If, in the meantime, the political parties send clear signals in favor of easing or postponing the deadline, the situation could immediately change radically. After the good performance of the Greens in several state elections, the party certainly has the political leverage to influence the government’s plans. There is also hope on the part of some SPD and CDU-governed federal states, which have a high density of solar firms and traders.

Indeed, it has become apparent that we will not be able to continue for much longer without resource-conserving, low-polluting energy production, and that there is public demand for more green electricity. Yet, policymakers’ actions speak a completely different language – they have made every conceivable attempt to prevent the rapid implementation of the energy transition. Billions in giveaways to the old energy industry, delays in phasing out coal, Dieselgate, and the unchecked flood of plastics are just a few of the highlights in a gigantic tableau of failure. For years, well-known problems have been covered up and whitewashed, with remedies delayed. But as soon as it comes to the solar industry, it is suddenly possible to push through deep cuts at an accelerated pace at every level within weeks! They claim to want to make the energy transition affordable and protect citizens from unreasonable burdens. The opposite will be the case – it will cost us all dearly

Martin Schachinger, pvXchange.com

November 2018: Is the bottom in sight?

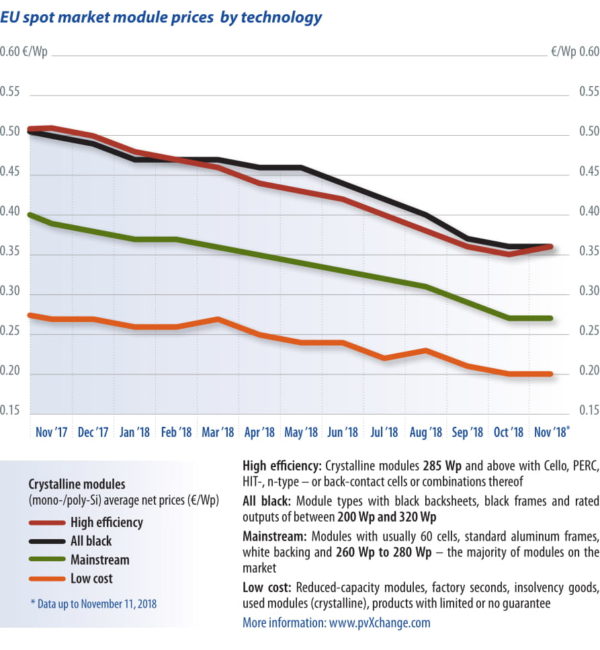

Judging merely by the prices over the past few weeks, the answer would seem to be an unequivocal no. But if you believe the voices of some manufacturers, then the end of the across-the-board slump in module prices is within reach. Once again, a shortage seems to be emerging, at least among some tier-1 manufacturers.

Both inexpensive multicrystalline and high-performance monocrystalline modules with PERC cells are no longer available on short notice in whatever quantity is desired. Apparently the products of the top manufacturers have sold so well in recent weeks due to the low prices that short-term supplies are no longer guaranteed.

Some manufacturers have even started turning away major project enquiries for this year and are advising customers to wait until the first quarter of next year. And potential buyers can drop their hopes for further discounts – quite the opposite.

Solar module prices for delivery in October and early November are at best stable, if not rising slightly. That goes to show how rapidly the market can turn around.

Some producers had apparently cut back production immediately after the subsidy cuts in China became public to avoid producing module stockpiles and risk further erosion in value.

Less production in Asia also means that fewer goods are shipped to Europe. Many modules that were already stored in and around the Port of Rotterdam have probably already been sold over the past few weeks.

Also, there are currently still few container goods delivered directly from China. The many smaller manufacturers active in the European region in the past first have to regain a foothold. Due to the recently removed market restrictions, they had scarcely any realistic sales opportunities in the European market over the past five years.

These tier-2 and tier-3 products are trading at a price discount of only a few cents per watt peak but are a riskier buy than the established brands. The major players now also have a noticeable technological lead, which is reflected in more modern cell formats and higher performance classes.

Producers who do not make significant investments in research and development will be hard pressed to compete with ever more efficient modules using less material.

A recently published forecast by the International Energy Agency (IEA) expects the number of new installations worldwide to fall by 15% year-on-year to around 83 gigawatts in 2018. The slump is mainly attributable to lower demand due to reduced state support programs in China.

In my view, however, the authors have failed to give adequate weight to the increased attractiveness of PV systems thanks to falling module prices.

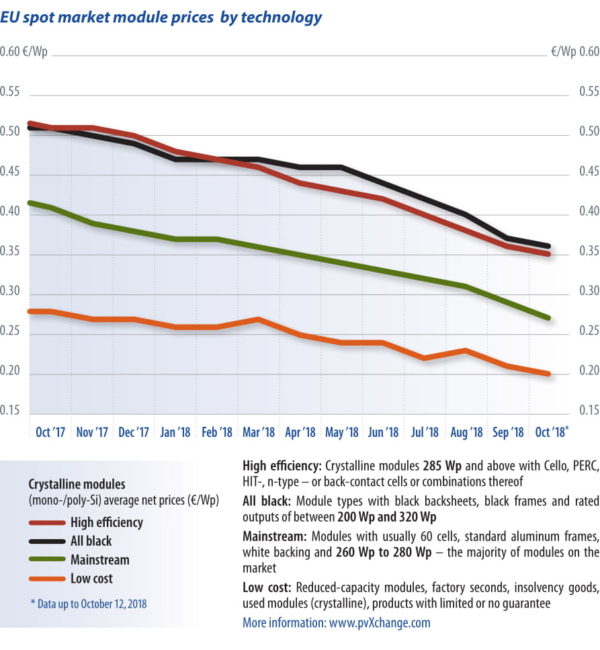

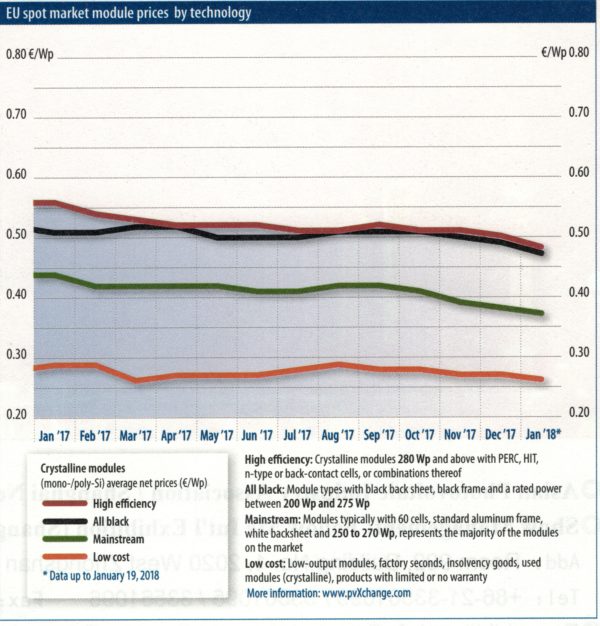

By the end of the year, these will have fallen in some categories by up to 30% compared with the price level in December of last year. This of course boosts demand, and not just in the area of new plant construction.

The repowering of old plants – that is, replacement of poorly performing old modules with the latest generation of products – is also becoming increasingly attractive. At module prices that are just a 10th of the price of the original modules installed eight to ten years ago, the financial cost of a system upgrade can quickly pay off.

Declining demand naturally leads to overcapacities among manufacturers, which are not completely offset by control measures taken by the affected companies, such as plant shutdowns to create artificial shortages.

The analysts at TrendForce claim that global module production capacities now total around 150 gigawatts, which equates to almost double the level of this year’s demand.

As a result, we are on the cusp of another wave of consolidation of unprecedented magnitude. According to some manufacturers, global market prices for multicrystalline solar modules are already in a critical range anyway, in which hardly any modules can be produced that meet today’s requirements.

Further price reductions are practically impossible if current quality standards are maintained, at least with the familiar technologies and manufacturing processes. Simply scaling to ever larger dimensions beyond the 10 GW production capacity range could provide a remedy.

Such gigantic factories, which alone could supply a 10th of the world’s demand, would first have to be run at full capacity to benefit from all the economies of scale. One wonders how many of these “gigafabs” could operate at the same time and in competition with each other and what would happen to the many hundreds of smaller production facilities that currently still exist throughout the world.

At present, this seems to be the trend, especially among European manufacturers who, although they are still holding on to their own brands that are well established with their customers, have long since had the modules themselves produced in one of the large contract manufacturing plants in Asia.

After all, the European companies are still liable for their warranties. But how much is that really worth in a limited liability company with low liquidity reserves?

To be on the safe side, the plant operator is more likely to go to one of the major Asian manufacturers, which at least also has a sales office and a service team in Europe that can be contacted in the event of problems.

Nevertheless, carefully checking the terms and conditions of warranties and how they are secured in the event of a claim is essential to avoid any nasty surprises later on.

The rule of thumb here is relatively simple: The lower the product price, the more carefully the conditions of sale should be examined.

High quality materials, quality assurance, and warranty reinsurance cost money, which is immediately reflected in the price – if you buy too cheap, you buy twice or pay with your life…

Martin Schachinger, pvXchange.com

October 2018: Everything must go?!

It’s official: as of September 3, the minimum import price is relegated to history! After the majority of EU representatives consulted in preliminary talks spoke out against further market restrictions, the Commission is refraining from a further review of possible acts of price dumping by Chinese manufacturers. In the context of protectionist measures in the USA and corresponding retaliatory measures by Europe and China, continued market restrictions for Asian solar products would have sent a very bad signal.

It’s official: as of September 3, the minimum import price is relegated to history! After the majority of EU representatives consulted in preliminary talks spoke out against further market restrictions, the Commission is refraining from a further review of possible acts of price dumping by Chinese manufacturers. In the context of protectionist measures in the USA and corresponding retaliatory measures by Europe and China, continued market restrictions for Asian solar products would have sent a very bad signal.

A chapter that opened in 2013 and led to major turmoil in the PV industry will finally be closed at the end of 2018. There is one thing the very contentious punitive tariffs and protective mechanisms have not achieved, however, and that is the rescue of European cell and module production. From this perspective, the policy was an incredible waste of resources and opportunities that set the European PV market back years. Numerous regions around the world have long since bypassed former leading markets such as Italy, Spain, and of course, Germany, in terms of installation figures. For many years now, European markets have been merely a footnote in solar history.

Waiting for a sign

But what does the abolition of market regulation mean for domestic markets and the further expansion of solar energy? Not all players are back from the summer break yet, either on the supply side or on the purchasing side. Following subdued demand over the past four to six weeks, when prices remained largely stable, machinery now has to be restarted, and many projects may have to be recalculated. To this end, players are awaiting essential price signals from the market. At the moment these are scarce – apparently none of the big manufacturers want to take the first step. They are biding their time, waiting to see when the competition will react, or pointing to well filled order books. For nearly all well-known brands, price corrections in supply contracts are not expected before the end of September, when the current turbulence has subsided.

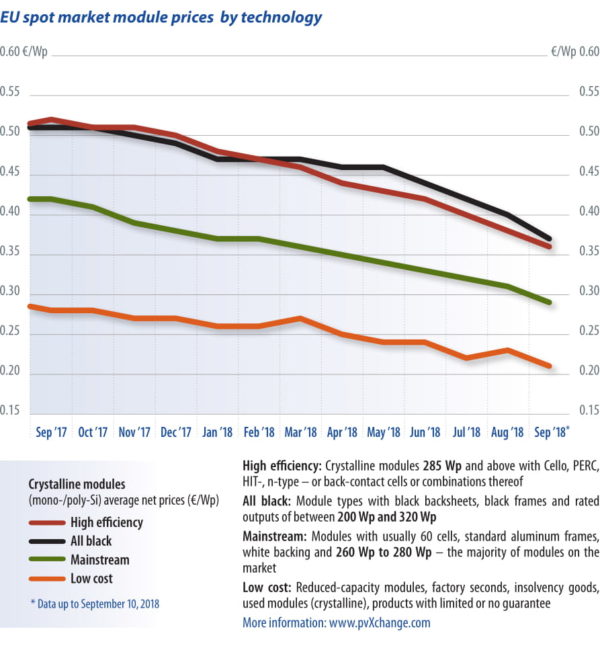

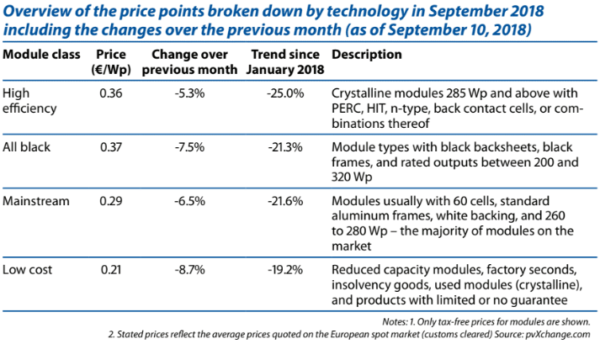

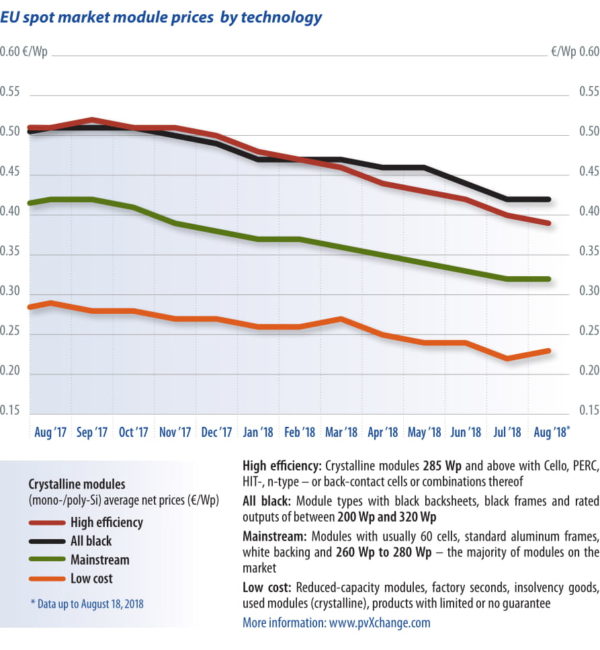

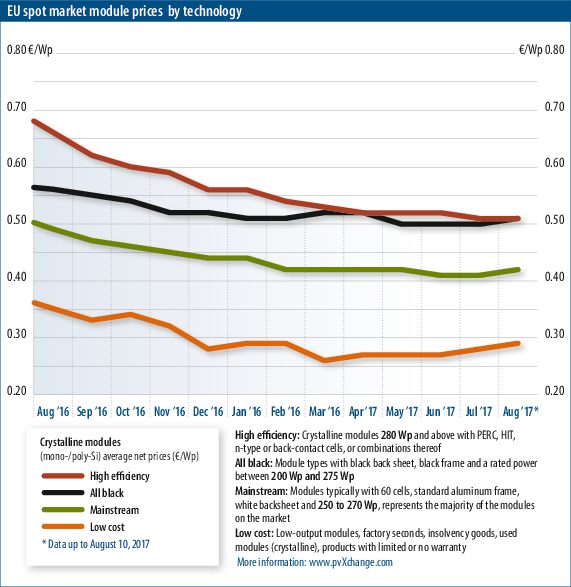

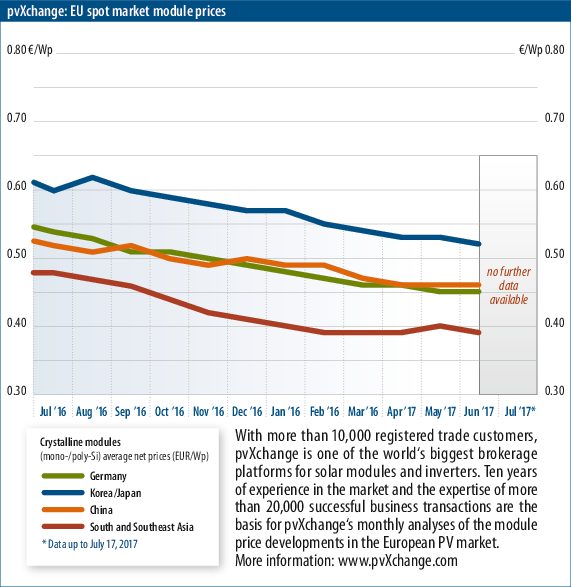

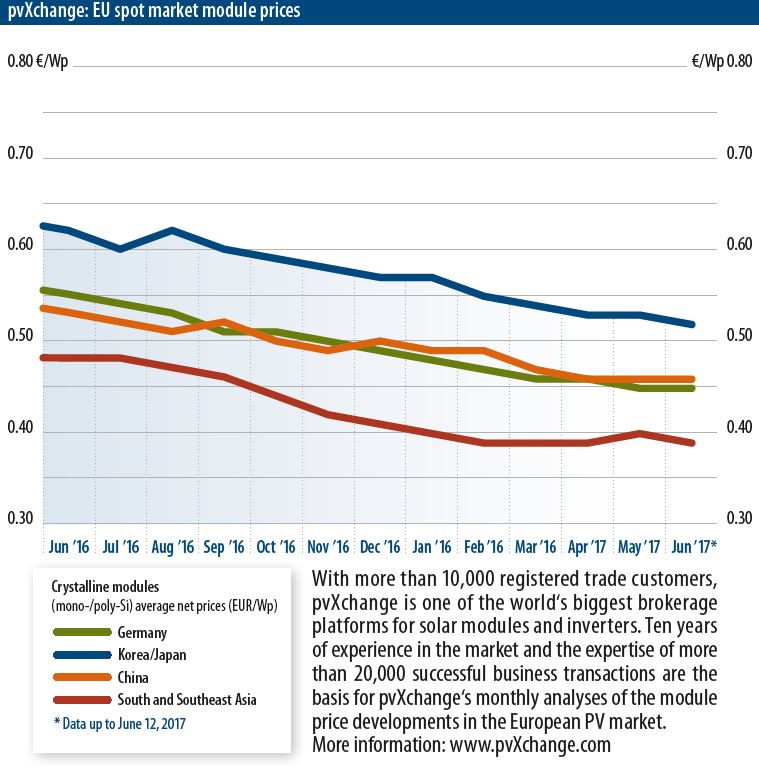

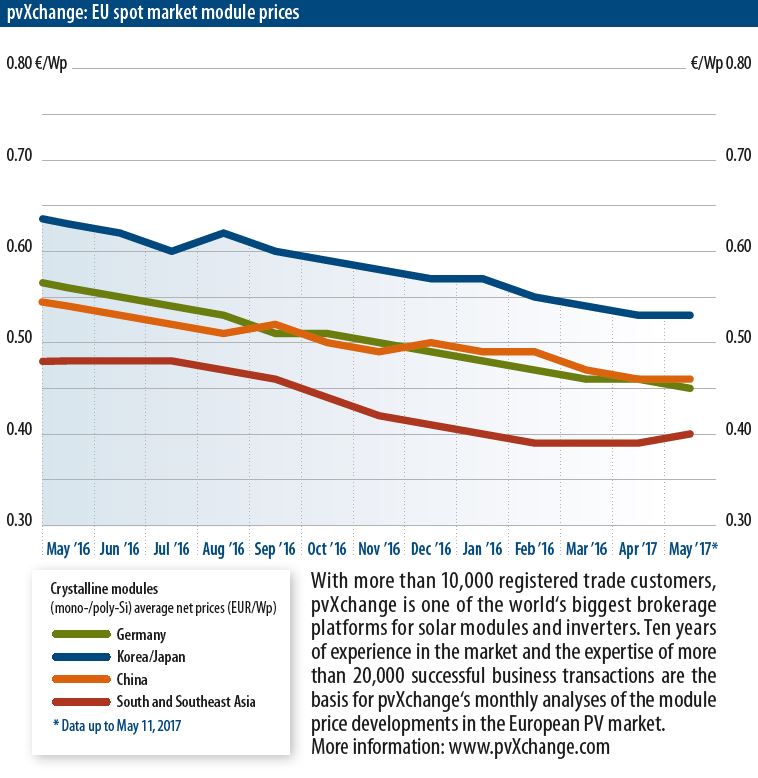

Increasingly, however, smaller (tier-2) manufacturers are already taking action, and throwing modules into the ring at prices in the lower 20 cent range. Some tier-1 products are also already being offered at prices well below the current minimum import price, even though the information from Brussels is brand new. Thus, index prices have to be adjusted downwards by one to two cents per watt, almost on a weekly basis. Monocrystalline modules in particular have so far been trading here well above world market prices and have a lot of catching up to do. Prices for high efficiency and all black modules have fallen by up to three cents in the past three weeks, while the mainstream module price is only two cents below the previous month’s level. In percentage terms, this corresponds to a reduction of 5.3% to a maximum of 7.5% – the price avalanche is slowly but surely gathering momentum.

One wonders what the next steps will be, and when the first modules made in China will arrive on European shores. Until the official end of restrictions, they were not allowed to be imported into the EU without high penalties. However, we can expect containers to be unloaded in the ports of Rotterdam, Antwerp, and Hamburg in the next few days and weeks, and waved through customs without surcharges. Then, it is a matter of speculation as to what price level will establish itself. Supposedly modules are already trading at prices close to cost of production. On the other hand, large inventories have to be drawn down, and the law of supply and demand still applies. As the end of the price spiral is not yet in sight, there is a rush to liquidate inventories and if necessary to sell goods below production cost to avoid even greater write-downs.

For investors and installers, however, positive development is emerging. Lower prices mean that many projects, especially from previous tenders, can now be implemented more easily, and higher returns achieved. The only limiting factor will be scarcity of installation capacity, which is already becoming apparent. Of course, consideration should also be given to the influence of low prices on quality. Many manufacturers will probably be forced to cut costs wherever possible at the expense of the quality and long-term stability of their products. We therefore need vigilance and a bit of common sense not to leap at every bargain dangled in front of our noses.

Martin Schachinger, pvXchange.com

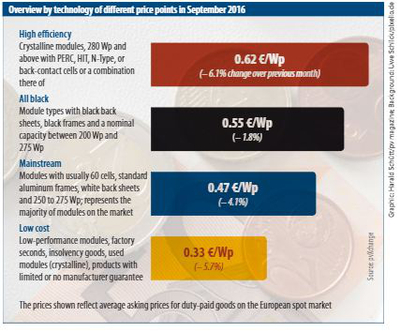

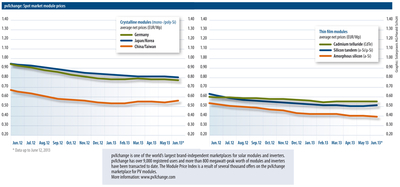

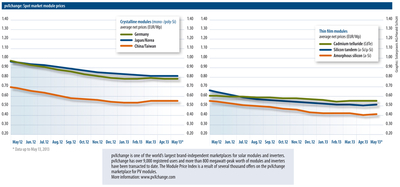

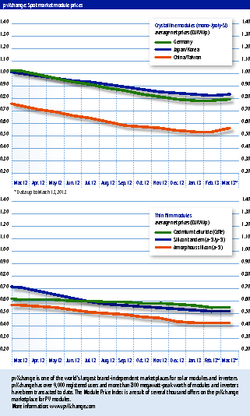

Table: pvXchange

September 2018: PV poker game

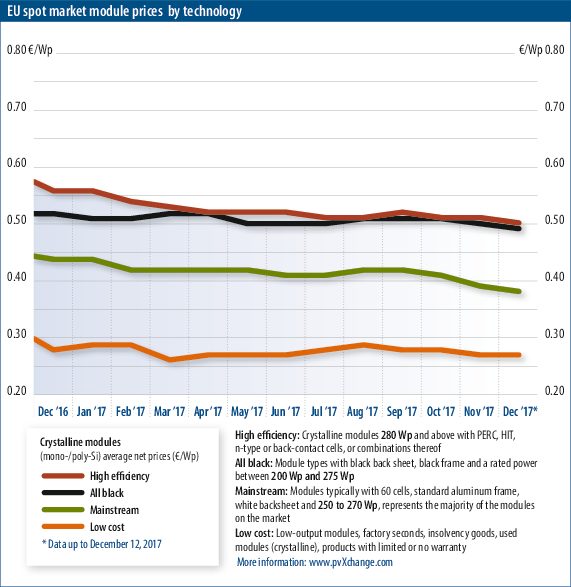

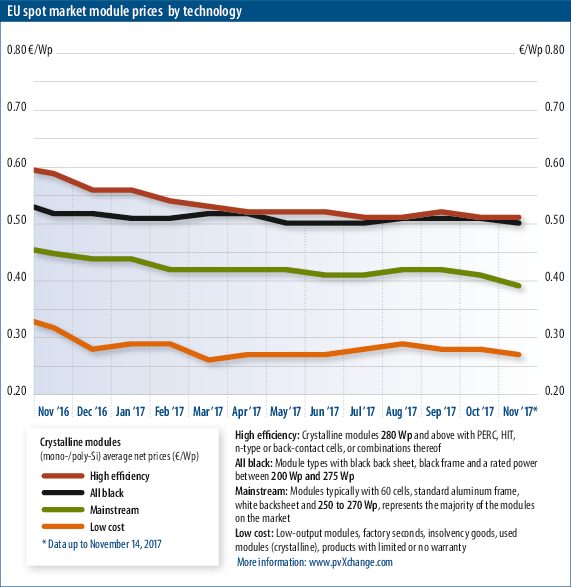

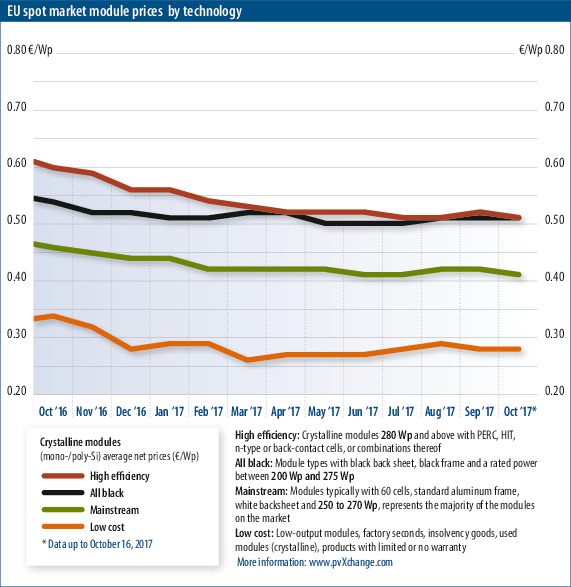

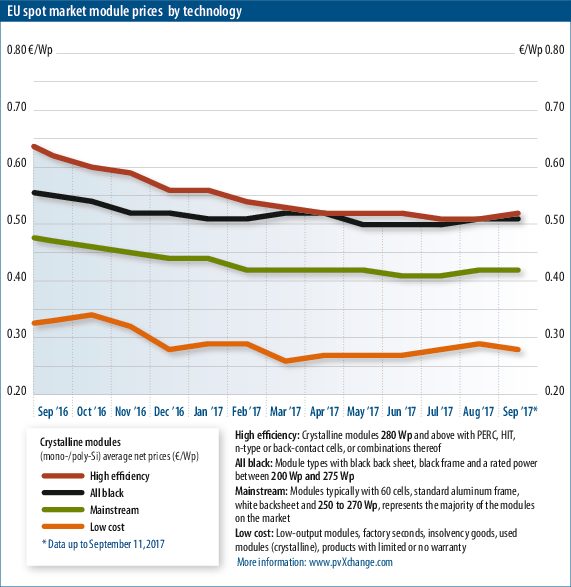

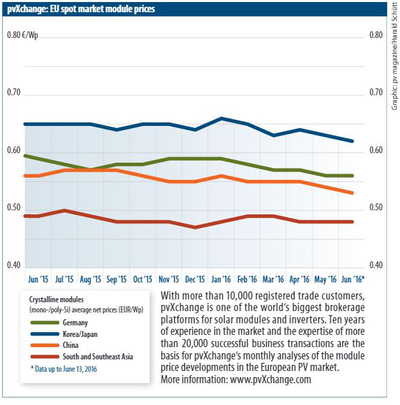

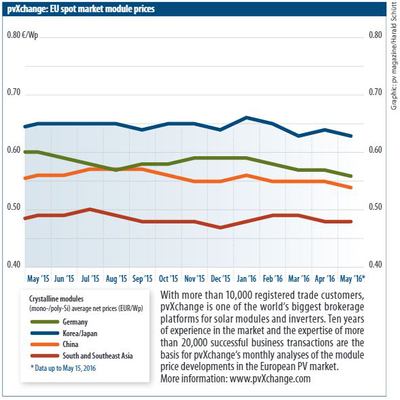

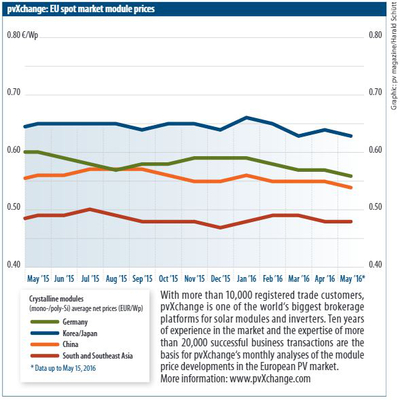

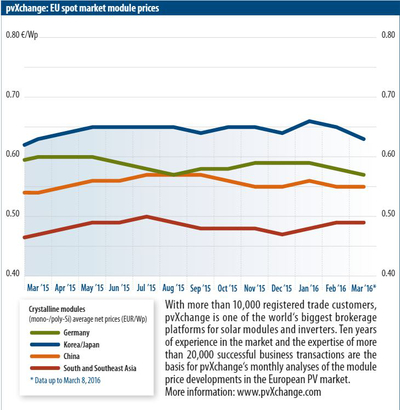

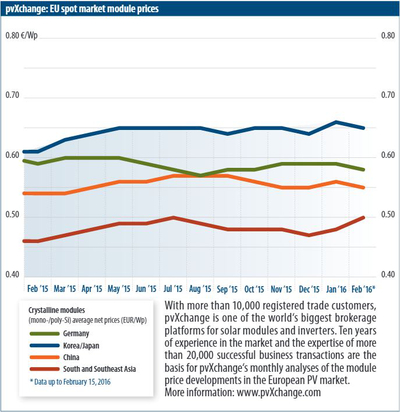

Graph: pvXchange.com/ Harald Schütt

With subdued demand over the past four to six weeks, prices have remained largely stable. Only certain products were offered at a discount over the previous month, which has led to minor price changes for high-efficiency modules and standard multicrystalline modules (mainstream). However, the price changes are actually smaller than the rounded index values make it appear, and are in the sub-0.5 euro cents per watt-peak range. Particularly with the major brands such as Hanwha Q Cells, JinkoSolar, and Canadian Solar, there is not much activity at the moment.

There are a number of reasons why retailers’ sales figures are generally weak. First of all, the persistent high tem- peratures combined with the school hol- idays in Central Europe should be men- tioned, which seems rather unspectacular, since this is a seasonal phenomenon and therefore occurs regularly in summer. However, there is another effect at play, which is due to the upcoming but still uncertain decision of the EU Commission regarding an extension of import restric- tions for Chinese cells and modules. On September 3, the measures currently in force will expire and the Commission will have to state whether it will continue to review the dumping and subsidy infrac- tions, or whether it will let the matter rest. In the event of a review, there is a risk of a provisional upholding of punitive tar- iffs and minimum import prices, at least until the Commissioners have reached a finding. However, this is not anticipated before the beginning of 2019. Since the stakes are high – particularly for man- ufacturers and retailers – rumors and wild speculation abound about the out- come of internal EU negotiations. It should be clear enough that this deci- sion will be influenced largely by foreign policy. Numerous politicians throughout Europe, but also affected companies, have already been consulted and mutual inter- ests weighed in order to come to a con- clusion. But authoritative information that gives an indication of the outcome of the negotiations is nowhere to be found – everything is still wide open, and there are still plenty of things that can happen.

Wait and see

All that remains for the affected compa- nies at all levels of the PV value chain is to wait and see or place a bet on the out- come of the negotiations. Depending on how they read the situation, suppliers are either calm and keeping to current price levels or are betting on the elimination of market regulation measures. As a result, more discounts are now being offered to reduce inventory levels and avoid even greater devaluation. With customers, however, the trend is toward fence-sitting until the decision is announced when they have had a chance to observe how the market reacts before making the deci- sion to purchase – possibly with negative effects. A closer look at the possible scenarios reveals why this is the case:

If import restrictions are lifted, suppliers of inexpensive Chinese goods will very quickly enter the European market, as demand in Asia is currently declining and warehouses are increasingly filling up with available goods. The resulting price slide will inevitably lead to a devaluation of existing inventories in Germany. Even a sharp rise in domestic demand will no lon- ger be able to accommodate the immense quantities of modules. Module prices in the low to mid-20 euro cent range are entirely conceivable for the rest of the year. This would be a highly posi- tive development for investors and builders, as the lower prices would naturally lead to higher returns. The only limiting factor will then be the scarcity of installation capacity.

If the import restrictions remain, however, cell and module prices are likely to stagnate. There are even rumblings of pos- sible price increases triggered by a bottleneck in MIP-free cells and modules. Supposedly, developers in Germany and through- out southern Europe have built up a project pipeline so large that there are not enough non-Chinese modules available to cover it completely and on schedule. The result would be a brawl over delivery capacities and deadlines, as well as a gradual price adjustment to the barely acceptable level, as has often been observed in such situations. Those who find themselves in this situation may regret that they did not take better precautions and avail themselves of one of the module offers currently available. The market is currently a game of chance, with all of the play- ers deciding for themselves which card to bet on, what risks they are willing to take in the game of module price poker, and what they stand to win or lose. Martin Schachinger, pvXchange.com

Table: pvXchange.com

August 2018: Greetings from the madhouse…

Module price index: So ended a recent e-mail from a good friend in the PV industry, a pioneer with over 30 years of experience. It was regarding an exchange about current market developments and the sharp price declines over the past few weeks and months – not a bad analogy!

But the influence on global brand development has never been as great as in this case. All of the forecasts of the past few months have already become obsolete. Instead of predicting a decline in installation figures, the European industry association SolarPower Europe, in its recently published global market outlook, now anticipates a small but very real increase of 3 to 4% in 2018, and 5 to 6% in 2019. Only then will there be a return to healthy growth of 12 to 15% annually, as we have already seen on average over many years. For Europe, however, the forecasts for the coming years are somewhat more optimistic, with an average increase of 15%. Within Europe, Germany should again become one of the strongest markets, with an increase of 20%, even without further political support.

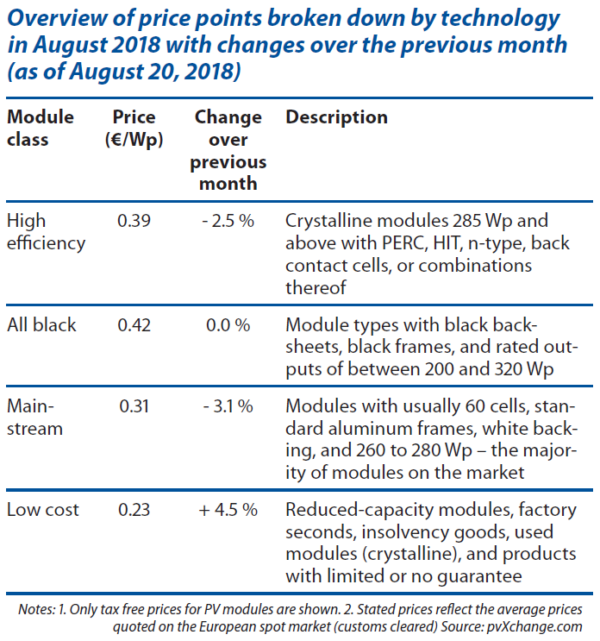

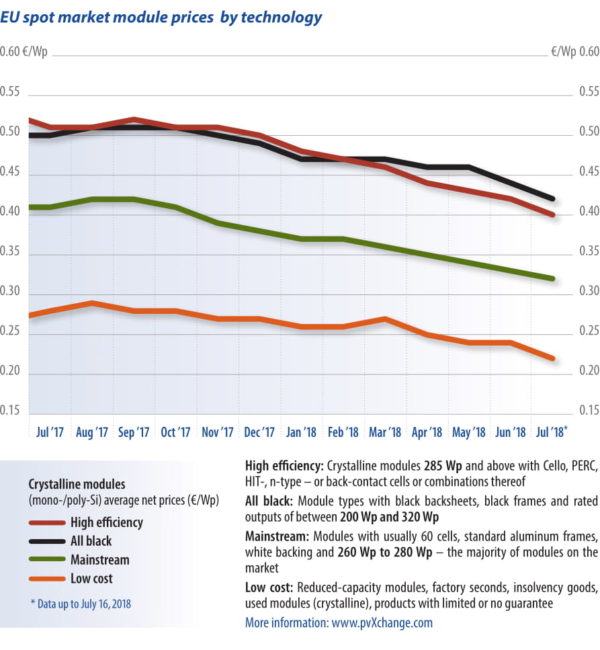

Initially, prices for multicrystalline products in particular were expected to continue their precipitous slide due to imminent or current oversupplies. Buyers were hoping for a drop to the €0.25 mark, at least for megawatt-scale volumes. However, the major Asian manufacturers at all levels of the value chain apparently knew how to take quick corrective action. Through artificial shortages, such as production shutdowns, companies are now trying to counteract oversupply and the associated price free fall. Although the effect is not yet immediately apparent, as is evident from the continuing decline in prices, a major crash could probably be prevented in the long term. However, it is doubtful that this strategy will work out in the medium to long term and that prices will stabilize at the current level or just below it.

Europe’s MIP

Module and cell manufacturers with large production capacities in China are waiting for the EU’s minimum import price to be eliminated in September so that they can then offer their modules even more cheaply in Europe. If this actually happens, outlook for the remaining European manufacturers would likely be grim. Their survival would then depend heavily on general market growth, their international business orientation, and strong support from customers. Yet, even if there is a review of the dumping case against Chinese producers and the minimum import prices are kept in place for the next three to six months, it will only be a short reprieve for domestic producers.

I myself expect a general price dip of a maximum of €0.02 per watt peak across all technologies in the fourth quarter. The drop in prices for high-efficiency modules is currently already somewhat more pronounced than for other products, as high performance is itself becoming increasingly “mainstream.”

This is why I raised the lower limit for “high-efficiency” modules to 285 watts peak in May, but these products have become disproportionately cheaper over the course of the year. Nevertheless, the price spread to the mostly multicrystalline “mainstream” modules is still 8 to 10 cents per watt – at the current price level, a difference of 25 to 30%. This price spread cannot actually reflect the difference in the manufacturing costs between monocrystalline or multicrystalline cells, but rather indicates that many modules with lower performance classes are already being sold off close to the production cost to reduce inventories.

Strap on the straitjacket and off into the rubber cell would be the right course of action for some politicians who repeatedly manage to stop generally positive market development through erratic, ill-considered actions and tear down what they have already created.

The best strategy in this roller coaster market is probably to rely on one’s own experience and also a little on one’s own gut. So far, every downturn has been followed by an upturn – usually relatively quickly – because we in the industry have learned to adapt to adversity and make the most of it. In the medium term, the world market for renewables has still grown and system prices have fallen. The motto is to stick to your own vision, and the way ahead is to stay the course in an unsteady market gone mad.

|

Overview of the price points in July 2018, broken down by technology, including the changes over the previous month |

||||

|

Module class |

Price |

Change over |

Trend since January 2018 |

Description |

|

High efficiency |

0.40 |

-4.8% |

-16.7% |

Crystalline modules 285 Wp and above with Cello, PERC, HIT, n-type, or back contact cells or combinations thereof |

|

All black |

0.42 |

-4.5% |

-10.6% |

Module types with black backsheets, black frames, and rated outputs of between 200 and 320 Wp |

|

Mainstream |

0.32 |

-3.0% |

-13.5% |

Modules with usually 60 cells, standard aluminum frames, white backing, and 260 to 280 Wp – the majority of modules on the market |

|

Low cost |

0.22 |

-8.3% |

-15.4% |

Reduced-capacity modules, factory seconds, insolvency goods, used modules (crystalline), products with limited or no guarantee |

|

The prices shown reflect the average asking prices for goods cleared through customs on the European spot market, as of 16 July 2018. |

||||

Martin Schachinger, pvXchange.com

July 2018: Bad for the industry – but unfortunately, awesome

Module price index: Taken from a song by beloved German group Deichkind, the phrase ‘leider geil’, roughly translated as ‘unfortunately awesome’, applies quite nicely, in my view at least, to the current downward spiral of module and cell prices. Of course, it is clear that some companies – especially module producers – will again fall by the wayside. We wholesalers will also have to contend with the uncertainty of potential customers who cannot decide whether to buy now or rather in a few weeks or even months. But if we are honest and serious about restructuring the global energy system then falling prices are, unfortunately, awesome.

What is behind the continuing downward trend despite a general increase in demand? First and foremost, it is the somewhat surprising announcement made by the Chinese government in May, to make major cuts to subsidies and incentive programs for the further expansion of renewables. Analysts expect PV installation figures in China to fall by 20 to 30 gigawatts compared with last year, which is quite dramatic given the rapid increase in production capacities, particularly in Asia. The reasons given for capping renewables development include the high costs of the enormous build-out in recent years, as well as problems with grid expansion and the connection of new plants. It may be that the decline in China will only have a minor impact on global demand over the long term, being offset by other rapidly growing markets, but the pressure on manufacturers is already mounting due to the overcapacity already present in the market.

Delays in project implementation on the one hand, and uncertainty about future module price developments on the other, have led to large-scale cancellations by a number of major manufacturers in recent weeks. Some of the key players in the industry simply no longer feel bound by their perhaps too loosely worded purchase agreements, which has become a serious problem for suppliers. In times of oversupply the customer is suddenly king; and takes revenge for having been left in the lurch too often in the past. Gone are the days when module manufacturers could pull out of agreements with flimsy arguments to earn a few cents more in another market, and still manage to keep their buyers. Now the tables are turned! Bad for companies, good for market prices, good for customers – unfortunately, awesome.

Following a shortage of inexpensive modules due to artificial bottlenecks caused by market regulations in the U.S. and Europe, and the resulting stagnation in prices, we are now facing a glut of modules which will inevitably cause prices to fall. What seemed cheap yesterday is already too expensive for today's market. Of course, this causes buyers of PV systems to hesitate, and stocks which currently have to be devalued almost weekly, are growing. “I love this business – it never gets boring,” a wholesaler friend recently said to me, not without a touch of cynicism. Planning security? Not a chance! But the old hands of the PV industry have long since come to terms with this. The newcomers, on the other hand, are wide-eyed and wonder why their business models, which have proven so successful in other sectors, do not seem to gain traction in the solar industry. At best, they can quickly adapt to the volatile market situation. In most cases, however, this ends in bankruptcy or withdrawal from the market – and not without serious financial losses.

Does survival in the solar industry or in the entire energy sector really have to be so unpleasant and unpredictable; and if so, why? As long as the solar business – worldwide, by the way – continues to be at the mercy of policies driven by the purely economic interests of the old and large industrial sectors, we will remain a pawn of the forces that cannot be influenced by the environment-conscious citizens and voters of supposedly democratic governments. At the banquet of high politics the stakeholders in the renewable energy industry do not even have a seat at the children's table yet; at best they are permitted to lurk at the back door for a few leftovers to be tossed their way once the business dinner is finished. Good for the economy, bad for the citizen, bad for the environment – unfortunately, not very awesome.

In his recently published outlook for the next ten years, Kalle Remmers expects, “… for Germany […] little political will to implement core projects that serve the further development of our society. In a market as highly regulated as the energy industry, innovations are doomed to failure due to outdated rules.” I can only fully endorse that view! However, ever more rays of hope are coming from Brussels, where the influence of the industry lobby on EU policy is perhaps not quite as strong as on politics at the national level. Following the complaint I raised in my last commentary about excessive pollution in cities, binding targets have now been formulated for the Europe-wide expansion of renewable energies – not to 35 percent, as requested by parliament, but to 32 percent by 2030. Germany has shown itself to be an obstacle to meeting the targets, according to informed sources.

What has become of this country, which only a few years ago emerged on the international stage as an absolute pioneer in environmental issues and as the architect of the Paris climate protection agreement? Soon the requirements will be coming from Brussels and must then be transposed into national law by the EU member states within 18 months. Failure to do so could result in new lawsuits and severe penalties.

Overview of the price points broken down by technology in June 2018 with changes compared to the previous month:

| Module class | Price (€/Wp) | Change over previous month |

Description |

| High efficiency | 0.42 | – 2.3 % | Crystalline modules 285 Wp and above with Cello, PERC, HIT -, n-type – or back-contact cells or combinations thereof |

| All black | 0.44 | – 4.3 % | Module types with black backsheets, black frames and rated outputs of between 200 Wp and 320 Wp |

| Mainstream | 0.33 | – 2.9 % | Modules with usually 60 cells, standard aluminum frames, white backing and 260 Wp to 280 Wp – the majority of modules on the market |

| Low cost | 0.24 | 0.0 % | Reduced-capacity modules, factory seconds, insolvency goods, used modules (crystalline), products with limited or no guarantee |

(The prices shown reflect the average asking prices for goods cleared through customs on the European spot market, as of 13 June 2018.)

Martin Schachinger, pvXchange.com

May 2018: He's gone again…

Module price index: … But is he gone for good? We are talking about Frank Asbeck and his company SolarWorld. It was only last August that I reported on the comeback of Mr. Asbeck as an investor and the new/old CEO of the PV module production and sales company that had risen from the ashes of insolvency. Now, the company has been shuttered once again – a new bankruptcy petition has been filed; employees fear for their futures, and the remaining customers for the value of their promised warranties. There do not seem to be many customers left, however; otherwise the story may have turned out differently. Trust in this formerly great German brand seems to have been permanently undermined.

Module price index: … But is he gone for good? We are talking about Frank Asbeck and his company SolarWorld. It was only last August that I reported on the comeback of Mr. Asbeck as an investor and the new/old CEO of the PV module production and sales company that had risen from the ashes of insolvency. Now, the company has been shuttered once again – a new bankruptcy petition has been filed; employees fear for their futures, and the remaining customers for the value of their promised warranties. There do not seem to be many customers left, however; otherwise the story may have turned out differently. Trust in this formerly great German brand seems to have been permanently undermined.

Will the “Sun King” try to ascend to the throne once again? I think he should drop it and abdicate. He has nothing more to prove to himself or us, his place in the history of photovoltaics is assured and he has certainly set aside a tidy sum for his well-deserved pension. Unfortunately, during his last tenure, he managed to cause quite a stir again, at least in the USA, by loudly supporting Trump in his measures to restrict the market. Now, the child has fallen into the well.

In Europe, the voices in favor of punitive tariffs and other protective measures have become quieter in recent months. Even if Asbeck should take up the scepter again, I do not expect any more activity in this respect. The influence of foreign investors in SolarWorld is now too great and level heads seem to have prevailed. As long as European manufacturers lack the financial resources of their Asian competitors and are unable to scale up their production capacities to the same extent, they will be on the losing side – tilting against windmills.

And, while we're on the subject of fighting windmills, this seems to be far from futile – at least in the recent open-technology tenders in Germany. To the contrary, all of the contracts were awarded to photovoltaic projects this time. This has demonstrated once again the technology that is most economical to implement in large projects, even if it only seems feasible using products from the all-powerful Asian competition. It is inconceivable that there could have been a similar result in the tender process if only German or European products had been permitted.

Unfortunately, another German module manufacturer has recently fallen: Calyxo. The manufacturer of cadmium-telluride modules was a spin-off of Q-Cells and has been struggling hard since the latter’s insolvency in 2011. Following the sharp decline in prices for crystalline solar cells, there has been less and less demand for thin-film modules in recent years. First Solar has proven, however, that technology does not necessarily have to hobble a company. The US manufacturer is apparently able to hold its own quite well against the crystalline competition from Asia, not least because of its size. Here, too, economies of scale have paid off, along with an intelligent marketing concept that relies mainly on large-scale plants developed and built either in-house or by a handful of partners. On the open market, First Solar modules are virtually unavailable or, if so, only after a long wait.

First Solar is currently launching Series 6, which it says is a particularly economical module. Considering the power classes from 420 to 450 watt-peak and the module dimensions of two meters by one meter, is already an indication that this is a product purely intended for large-scale commercial plants. Nevertheless, the broad-based rollout of this product is expected to exert price pressure on suppliers of crystalline modules, but not this year. The availability and visibility of Series 6 on the market is far too low.

However, what could put pressure on module prices is the elimination of all market restrictions on Chinese solar cells and modules. Following the official announcement of a gradual lowering of the minimum import prices by 2 cents per watt per quarter, rumors have been circulating for several weeks that the restrictions will be done away with completely. My research did not confirm this, however. The relevant documents only deal with the elimination of anti-subsidy duties, a very small proportion of the total punitive tariffs imposed. There has been no mention of eliminating the anti-dumping component yet. Even if all restrictions were lifted, the price trend would probably not change. Prices are increasingly decoupling from the effects of the EU Commission's market regulation measures.

At present, module prices are again affected predominantly more by supply and demand than by political influence. Moreover, the first large-scale plants in Europe are being built entirely without any major subsidies – in Spain, for example. In Germany, demand is rising continuously with rising temperatures, albeit at a moderate rate. Crystalline solar panels are available in sufficient quantities to trigger across-the board price declines since last month. However, silicon and wafer prices are pointing in the opposite direction, which means that the expected further price reductions at mid-year may not materialize for most module manufacturers. Have we already reached the bottom for the year? Somehow, I cannot really imagine we are there yet.

Martin Schachinger, pvXchange.com

April 2018 : It is not hard to become a dealer, but very hard to be a dealer.

Module price index: Buying low, selling high, pocketing the difference – on the face of it, it does not sound complicated, and can also be quite lucrative if you do not have a large overhead. In the PV sector, too, there are still numerous small companies that operate like this without giving it much thought.

Many small wholesalers are not even aware of the risks they are taking. If something goes wrong, however, the personal damage in our economic system is also very small. Liability – except in cases of gross negligence – is limited to the company capital, which sometimes amounts to only a few hundred euros. In the worst case, the company is simply liquidated and then reopened under a different name. The real damage comes from the customers who made purchases in good faith from these irresponsible dealers because the price was a few cents cheaper there.

Many buyers probably think: “What could possibly go wrong if the brand behind the product is reasonably well-known? If there's a problem, I'll just contact the manufacturer.” That the buyer has been handed a bill of goods only becomes apparent when the manufacturer either ceases to exist or the customer is simply left twisting in the wind, “Not our responsibility, please contact the dealer!” The buck is passed back and forth until the injured party finally gives up. Lucky customers will have taken comprehensive risk insurance on their PV systems. In that case the insurance company is in charge and will somehow have to solve the problem.

It has to be made clear once again that the so-called distributor, i.e. the first entity that places a product on a closed market, is the party responsible before the law (importer's liability). What differs from case to case is whether a sovereign country or the economic community (e.g. the EU) is the determining factor in this respect. To be released from liability, the sales documents must clearly show that an upstream dealer was the actual distributor and can still be held liable if necessary. In the case of customs offences, however, it is possible to intervene right through to the end customer.

Within the framework of the European market restrictions for Asian modules, this is also the first hurdle to overcome when buying and selling such products. This practice raises a number of questions: Are the modules subject to the EU Directive for imports from Asia? Have duties been paid correctly and can this be proven plausibly? Has the manufacturer correctly identified the origin of the modules and the cells used to build them? Quite a few allegedly correctly declared modules have been withdrawn from the market in recent years due to forged documents, and the importers and manufacturers have faced steep penalties.

The next hurdle is the European Recycling Regulation, which contains the underlying idea of the polluter-pays principle but is implemented in very different ways in different countries. In this context, the national border defines the closed market, so that the obligations deriving from this regulation apply to the party offering a product for the first time in a local market. On a brand basis, the distributor has to register business involving PV modules, inverters, measuring technology and soon also cable material with the respective relevant authority. Only after a registration number has been issued, certain requirements are met, and financial securities deposited to guarantee subsequent disposal, may the products be put on the market.

Of course, in addition to all of these obligations it is important not to forget to regularly and conscientiously check the quality of the products traded. Unfortunately, it is not enough to have a handful of certificates issued by the manufacturer and trust that everything is correctly stated and that the documents are still valid. With the rapid pace of development and the short product cycles of today's PV modules, hardly any product available on the market is likely to match the version that passed an IEC certification. Due to the high costs, follow-up certifications tend to be sporadic. In principle, this is also no problem as long as no safety-relevant components are affected by the changes. A product-specific certification is always only a snapshot and not a guarantee of good product quality. But the current standard requires valid certificates to form the basis for the CE marking required in Europe. With these certificates, the manufacturer or distributor declares that the product meets the applicable requirements, also known as the EU Declaration of Conformity. Products that are not CE marked may not even be offered for sale!

The problems described here are only a small part of what a serious wholesaler who wants to act responsibly has to deal with in today's market. Since this involves financial and personnel expense, conscientious operators are naturally at a disadvantage over unscrupulous, or perhaps even ignorant competitors, the so-called free riders. But government checks are rare – people rely on reciprocal controls and reporting when irregularities are discovered. Many reputable trading companies are still wary of throwing the first stone, however, because they cannot be sure that this will not come back to haunt them. Many requirements are simply not feasible without changing the business model. There is an urgent need to correct this with legislation. Some obligations are reasonable and necessary, but often not known to those affected. There is an urgent need to remedy this situation, both through education and implementation.

Martin Schachinger, pvXchange.com

March 2018: Market up, prices flat

Module price index: The scarcity of low-cost multicrystalline modules in the “mainstream” class, evident since the beginning of the year, continues. The Trump decision in the USA has not yet had any visible impact, such as increasing module volumes for the European market due to lower demand on the other side of the pond.

Module price index: The scarcity of low-cost multicrystalline modules in the “mainstream” class, evident since the beginning of the year, continues. The Trump decision in the USA has not yet had any visible impact, such as increasing module volumes for the European market due to lower demand on the other side of the pond.

Apparently, many U.S. installers seem already to have taken higher module prices into account. The cost-saving potential of other components and services seems almost to compensate for module prices, which are up to 30% higher, and the high demand so far this year and for future deliveries seems to be holding steady.

For the domestic market this means that there will be no price changes, at least for modules in the mid-range performance classes. As demand picks up at the beginning of February, prices could even rise again in some cases if additional shipments for Europe do not become available. Although German and European manufacturers claim that they can supply products at full capacity, this is still a drop in the bucket, considering their limited production capacities. If cells and materials purchased in Asia become scarcer, the tide could turn rather quickly.

Interestingly, in contrast to other module categories, the price for high power modules has slipped by a few percentage points. This is mainly due to the fact that more manufacturers are pushing their multicrystalline 60 cell modules into the 280 W range without demanding significantly higher prices for these products. As a result, the average price for ‘high efficiency’ modules is slightly lower. I will continue to monitor this phenomenon over the next few months to correct the classification at the appropriate time.

Another conspicuous feature is the proliferation of half-cell modules on the market. The claim is that by doubling the number of cells and further optimizations, such as increasing the number of busbars while simultaneously reducing the cross-section of wires, up to 3% more power can be teased out of a module. This is probably due mainly to the lower amperage at the cell level and the resulting reduction in transition losses. The downside is an increase of the inactive area between the cells and, because this format has many more soldered joints, an increased risk of hot spots due to poor soldering. We can only hope that there has also been a commensurate improvement in production technology, so that complaints and recalls of 120 and 144 cell modules can either be avoided or limited. In terms of price, these products are still in the upper segment, which makes them unattractive for medium and large-scale projects.

In recent weeks, demand for photovoltaic systems has risen sharply not only in Germany, but also in neighboring countries, where operators and installers have woken up. Whereas the demand for replacements of faulty existing modules was particularly high during spring maintenance, the demand for standard components for new systems has now also risen sharply. Overall, we anticipate an exciting and successful year for solar in Europe. Austria, the Benelux countries, France, and Spain are just a few examples of countries where ambitious PV expansion targets have been announced for 2018 and where corresponding incentives have either been introduced already or will be introduced. In Denmark and Sweden, too, the market is poised for an upturn if the announcements of politicians and industry insiders can be believed.

We can only hope that manufacturers have started the new year well-prepared, that they can quickly follow through on commensurate or planned capacity increases, and that the supply of raw materials is able to keep pace with demand.

Investors are also in the starting blocks and, in addition to China, they are focusing on Germany and Europe, according to the business consulting firm KPMG. We are thus well positioned for global market growth of 25 to 30% this year. After all, at current module prices there are still so many projects that can be implemented economically. There is no more reason to wait, unless…

Martin Schachinger, pvXchange.com

February 2018: What the new year

will bring …

Module price index: Last year there was much speculation about what was coming in 2018. There were plenty of forecasts – and not just from me. Based on factors known to influence the market, such as module price development and other less distinct aspects – factors like the political and regulatory situation in high-volume markets or expected technological breakthroughs – the course appears to be more or less clearly mapped out.

Module price index: Last year there was much speculation about what was coming in 2018. There were plenty of forecasts – and not just from me. Based on factors known to influence the market, such as module price development and other less distinct aspects – factors like the political and regulatory situation in high-volume markets or expected technological breakthroughs – the course appears to be more or less clearly mapped out.

The year is still too young to lend certainty to expectations, or to spring any big surprises. Nevertheless, the past few years have shown time and again that as sure as the sun will rise, bumps in the road will come when they are least expected.

First, we were caught off guard in Central Europe with unusually early and severe winter storms and flooding. With the abundance of PV systems today, it goes without saying that buildings without photovoltaics were not the only ones affected. The maintenance and repair business has the capricious weather to thank for its first orders this year. However, it is not advisable to combine reconstruction with a planned repowering. It is important to be on the safe side of the law, in this case to ensure that the feed-in tariffs are not lost in a backfired attempt to boost profits.

Minimum import price

As reported last month, the gradual reduction of minimum import prices across all module groups is having an effect. An average reduction of €0.02/W at the beginning of the year can be observed, at least for higher-priced products, whereas prices for standard polycrystalline modules and special lots have fallen only moderately so far – on the order of €0.01/W. This was to be expected, however there is still insufficient availability of these sought-after reasonably priced products. Many installers are still biding their time to see whether the prices nudge down a bit before they buy any modules or sign contracts.

The absolute prices for modules with high efficiency by area (“high efficiency” and “all black” products) appear, at €0.48 or €0.47/W, somewhat too high compared to the general market sentiment. However, it should be noted that figures in the index are not weighted by supply volume. The prices for small lots of mono-PERC cells or other efficiency enhancing cell and module technologies are on an equal footing with project and wholesale prices for high performance multi-PERC modules. Products from manufacturers such as Panasonic, Sunpower, and LG are known to be traded at prices significantly higher than the average.

What advice can we offer project developers, installers, or contractors regarding their purchasing strategy? Well, it depends largely on the options available to them, which can vary considerably from project to project. If a high level of commitment is required – that is, on-schedule construction and a fixed purchase price – a contract model with more certainty is advisable. In this case, suppliers offer the reliable provision of the goods required on a monthly or quarterly basis. With appropriate security, such as a deposit on the next consignment or even the entire contract amount up-front, the modules or even all the other components are held in reserve exclusively for the contractual partner. Of course, these goods then have to be retrieved by the respective deadline, at the latest – a delay due to disruptions during the project is usually not an option.

Enhanced flexibility

Other suppliers are embracing a more flexible model. In this case, certain quantities, dates, and prices are also defined, but without a definite obligation to purchase. Bonuses are sometimes added to the agreement to increase the incentive to reach or exceed mutually agreed volumes. With this type of arrangement, there are generally no restrictions in place if the purchase target is not met. However, the non-binding obligation on the purchaser’s side comes at the cost of a certain non-binding obligation on the supplier side. Should the goods become scarce again, buyers may have to wait for the goods and may not be able to retrieve the desired quantities, or they may have to dig a bit more deeply into their pockets.

Irrespective of the contractual model, it is always advisable to discuss module quality with your supplier at an early stage, to announce spot checks and include relevant provisions in the agreement. These should regulate with legal certainty which measures are to be taken if the products supplied do not meet expectations. Trust is good – control is better! In his recent blog post, Karl-Heinz Remmers illustrated for us – in rather forceful terms – that this general wisdom can be applied in particular to the photovoltaics business. Even the biggest manufacturers sometimes make mistakes but are not always willing to admit them and provide an immediate fix. It is important to be vigilant and not to cut corners in the wrong places. It will be interesting to see what other ripples Remmers’s latest statement makes in the industry.

Martin Schachinger, pvXchange.com

January 2018: Always downwards – never up!

Module price index: This slogan will set the tone for developments in the first quarter of next year. What was already hinted at in the last quarter is becoming increasingly certain. On module orders for delivery in the coming year, there will be a discount of at least 10% compared to contract prices charged in 2017.

Module price index: This slogan will set the tone for developments in the first quarter of next year. What was already hinted at in the last quarter is becoming increasingly certain. On module orders for delivery in the coming year, there will be a discount of at least 10% compared to contract prices charged in 2017.

The coming price drop corresponds to a price for bulk purchases of €0.33 to €0.35 for multicrystalline and €0.39 to €0.42 for more efficient monocrystalline products. This price level is already reflected in the spot market, but only in the case of absolute fire sales, i.e. surplus lots or the resale of contract quotas, which have to be liquidated this year.