In Europe, there are still large stocks of modules produced in 2023, or earlier with distributors and installers themselves. If these have the smaller dimensions commonly used for rooftop systems in Germany, they are selling poorly due to low power output classes. Building owners usually want to see a high wattage and the latest technology installed in their systems, which makes it much more difficult to sell existing inventory.

Despite the supposed reduction in module production, and European import volumes, it appears that more Asian panels are still reaching the European market than are currently in demand. This, in turn, is causing inventories to grow, even in high-performance classes, exerting additional pressure on module prices, especially on old modules that were produced and purchased at significantly higher prices.

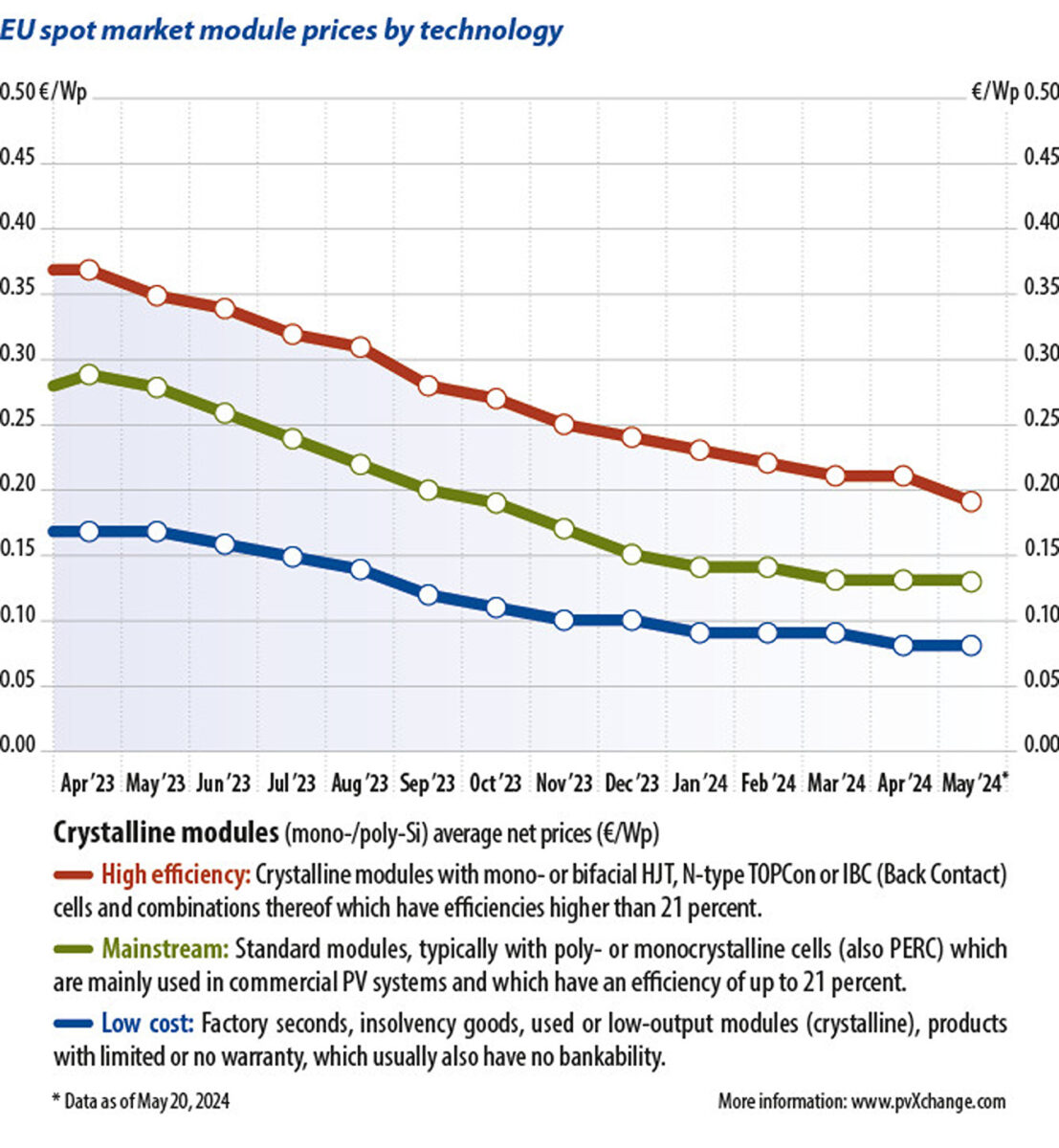

The ability to devalue old stock varies greatly from company to company, resulting in vastly different prices for modules with passivated emitter rear contact (PERC) cell technology. The overall price differences between model categories is shrinking.

Shelf warmers

It is very difficult to get rid of these older modules in markets outside Europe without accepting a massive loss in value. Africa and Southeast Asia are also likely to be oversaturated with modules and Chinese-made products cannot easily be sold to the US market. One strategy that is becoming increasingly established is to enable concessions in the soft factors of the trade business. There can be some room to move in payment and delivery terms. Instead of offering the modules at a lower price, a credit line is granted – often without requiring collateral – and delivery can be offered for free. That said, it is doubtful that this tactic will work over the long term. Many smaller companies are on the brink of insolvency and the possibility of defaults cannot be ruled out. The pressure to sell should, therefore, not override common sense and tempt providers to take incalculable risks.

Some suppliers are also attempting to take refuge in online marketplaces where they hope to sell quickly to international customers without incurring sales and marketing costs. However, the competitive pressure there is also high and the goods can often only be sold at dumping prices.

Online business models come with further risk. They seldom provide solid opportunities to get to know the potential business partner in advance – sellers just take what they can get. Misunderstandings can arise in business transactions, especially across national borders and the platform operator is not always available to provide support and advice. The effort involved in an online transaction can quickly become greater than buying or selling within an established business relationship. Everything can go smoothly but that does not necessarily mean that it will.

| Module class | €/Wp | Trend since April 2024 | Trend since January 2024 | Description |

|---|---|---|---|---|

| Crystalline modules | ||||

| High efficiency | 0.19 | -9.5% | -17.4% | Crystalline panels at 340 Wp and above, with PERC, heterojunction, n-type, or back-contact cells, or combinations thereof |

| Mainstream | 0.13 | 0.0% | -7.1% | Modules typically featuring 60 cells, standard aluminum frames, white backsheets, and 275 Wp to 335 Wp |

| Low cost | 0.08 | 0.0% | -11.1% | Factory seconds, insolvency goods, used or low-output modules, and products with limited or no warranty |

Notes: Only tax-free prices for PV modules are shown, with stated prices reflecting average customs-cleared prices on the European spot market. Source: pvXchange.com

Popular content

One possibility for making good use of surplus old solar modules is to install them in larger open-space projects or rooftop systems. Smaller formats may not be a bad choice in areas with higher wind or snow loads. Although the material and installation costs increase slightly, easier handling during installation makes up for this disadvantage. There is another undeniable advantage here – that the modules are already in stock. This guaranteed availability means there can be no delivery problems and therefore no delays in the construction process. Add in a few unsold inverters and cable reels and the components are in place for a working PV system.

Once a system has been installed and connected to the grid, nobody will care whether the solar modules belong to the very latest generation or not. The resulting asset can then be marketed better than the 400 W PERC modules in the current market situation. This can also be done via an online brokerage portal, for companies not yet properly set up for project sales.

About the author: Martin Schachinger has a degree in electrical engineering and has been active in PV and other renewables for almost 30 years. In 2004, he founded online trading platform pvXchange.com, enabling wholesalers, installers, and service companies to buy solar panels, standard components, and inverters that are no longer manufactured but which may be urgently needed to repair defective PV plants.

About the author: Martin Schachinger has a degree in electrical engineering and has been active in PV and other renewables for almost 30 years. In 2004, he founded online trading platform pvXchange.com, enabling wholesalers, installers, and service companies to buy solar panels, standard components, and inverters that are no longer manufactured but which may be urgently needed to repair defective PV plants.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.