From pv magazine 11/2021

Five of China’s largest module manufacturers – namely, Longi, JinkoSolar, Trina Solar, JA Solar and Risen – recently issued a joint statement apologizing for supply chain disruptions, as well as delays and other negative impacts on customers. In the statement they invoke force majeure; that is, external circumstances not under their control, such as government regulations or natural disasters. This was likely done as a precautionary measure to justify and pave the way for gradual adjustments to existing supply contracts. This is of little help to an EPC provider or distributor. The rest of the value chain is in turn dependent on them – from planners to installers to end customers. In most cases, commitments to these downstream stakeholders cannot simply be tossed out the window.

Five of China’s largest module manufacturers – namely, Longi, JinkoSolar, Trina Solar, JA Solar and Risen – recently issued a joint statement apologizing for supply chain disruptions, as well as delays and other negative impacts on customers. In the statement they invoke force majeure; that is, external circumstances not under their control, such as government regulations or natural disasters. This was likely done as a precautionary measure to justify and pave the way for gradual adjustments to existing supply contracts. This is of little help to an EPC provider or distributor. The rest of the value chain is in turn dependent on them – from planners to installers to end customers. In most cases, commitments to these downstream stakeholders cannot simply be tossed out the window.

If delivery dates and purchasing conditions that were presumed to be the secure start to waver, it will push many PV projects to the brink. In the event of a cancellation, contractors could find themselves between the bleak alternatives of taking a loss – in the worst case, a contractual penalty – or postponing the installation date indefinitely and possibly having to reapply for grid access and plant certification. Recalculation and renegotiation with the client is not always possible or reasonable. But how long can plant builders wait?

Managing the increase

In the letters invoking force majeure, the manufacturers list measures taken by China’s central government in response to the impending energy shortage this winter, which is expected to lead to production cuts of up to 90%, depending on the sector. This means that for some suppliers, these requirements – and in the case of module producers, the added woe of raw materials that are either unavailable or overpriced – could soon bring production to a complete standstill, putting additional pressure on overall capacities still available. With such an outlook, the laws of the market immediately kick in. Only those who are prepared to pay a premium will still be supplied.

In addition, global shipping prices are still through the roof and the problem won’t be solved anytime soon. The current shortage of truck drivers in the U.K. and elsewhere further exacerbates the situation. Empty containers – and no small number of full ones – are sitting in temporary storage facilities and can neither be unloaded nor sent on their way; and are thus effectively removed from the international logistics chain.

In this precarious situation, module producers are going all in to minimize impending losses and renegotiate older supply contracts. They do not want to find themselves in a predicament similar to the one they faced at the beginning of the year, when there was an unexpected increase in the price of raw materials and a shortage of shipping capacity so that conditions negotiated last year could only be maintained this spring by eating their entire sales margin. This fall, all contracts signed before March or April 2021 will apparently be up for review. Small to medium-volume customers are generally going to be the ones holding the short end of the stick. Larger, strategically important customers will probably be spared for the time being.

Options for buyers

Once again, this is a case where good advice is expensive. First of all, the installer or EPC should talk to the client again and determine whether a price adjustment is possible for the project. Of course, the financier or investor should also be involved so as not to jeopardize the release of funds. Sometimes there is a buffer in the budget that can be tapped without crushing profitability or sacrificing the company’s own earnings. After all, prices on the electricity exchange have also crept up a bit, increasing the value of a solar-generated kilowatt-hour accordingly.

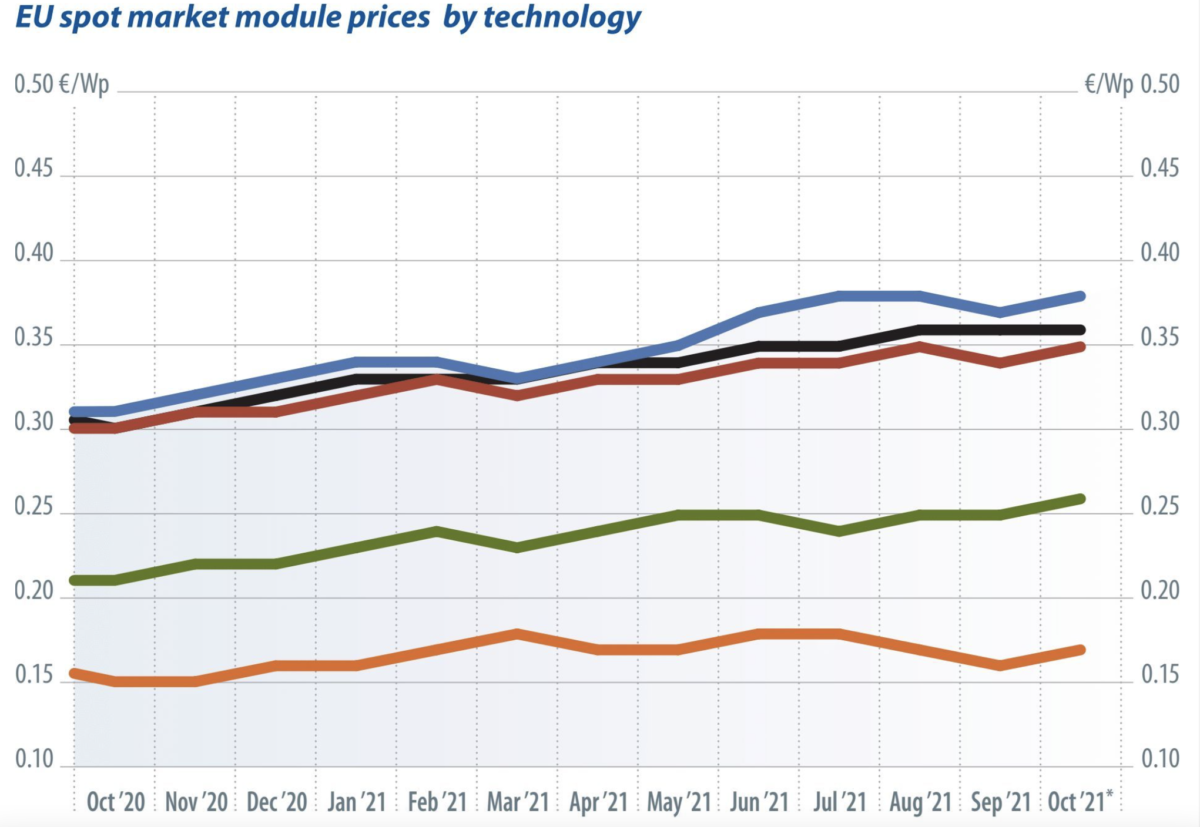

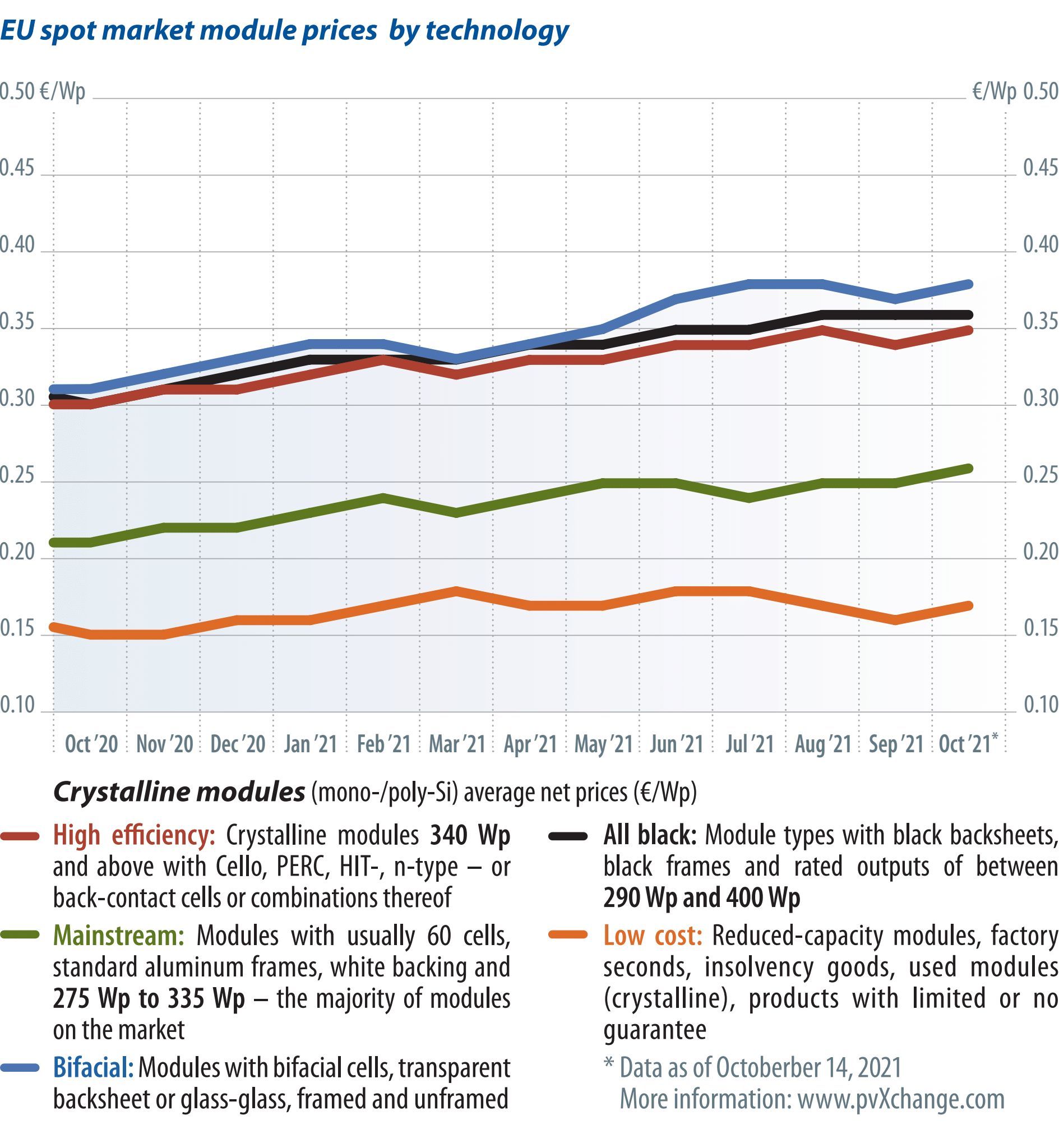

The second option – namely, to wait until prices fall again – requires something of a gambler’s mentality. Certainly, at the end of the fourth quarter, there will again be the odd remaining lot of existing modules, which will be offered at special prices. However, whether it is suitable for the project at hand, and whether the interested party is fast enough, is largely left to chance. Unfortunately, a steady price decline for crystalline modules is nowhere in the foreseeable future.

About the author

Martin Schachinger has been active in renewable energy for more than 20 years. In 2004, he founded pvXchange.com. Wholesalers, installers, and service companies use the online trading platform to purchase standard components, solar modules, and inverters that are no longer manufactured, but are still urgently needed to repair defective PV systems.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.